Birthday cards? Nice, but low impact, low difficulty. Would clients miss them?

Annual reviews felt like Groundhog Day—same old portfolio updates, no spark. So, I focused on high-impact actions. We revamped meetings to emphasize education—like explaining why we chose specific funds, how REITs work, or what drives our portfolio decisions.

I also hosted legacy letter events, where top clients wrote heartfelt notes to their kids about love and wisdom. Low effort, huge impact—clients felt amazing, told friends, and referrals skyrocketed. We spaced out tasks like beneficiary audits, typically reviewing them every few years unless life events required changes. I validated this by asking top clients, “Would you miss this if we stopped?” Their feedback shaped my priorities.

The result? By using this subjective Impact Score to prioritize high-value activities, I boosted engagement and efficiency. Clients left meetings energized, cancellations dropped, and I worked smarter, focusing on what truly moves the needle without extra hours.

While Impact Score helped me maximize client value, I also needed to work smarter, not harder. That led to my second KPI: Revenue Per Hour.

KPI #2: Revenue Per Hour

I wanted a better work-life balance, not just more revenue. Traditional metrics like total revenue don’t show true productivity—if you work 30% more to earn 30% more, you’re just busier. So, I tracked Revenue Per Hour, dividing annual revenue by hours worked.

This revealed how efficiently we generated income by prioritizing high-value clients. By focusing on this, I cut my working time by two-thirds, doubling or tripling revenue per hour—from $100 to $300 per hour—even though total revenue grew only 5-10% annually. The result? Less burnout, more time for family.

This KPI also transformed client management. One “A” client demanded 40 hours a year but paid the same as two “B” clients who took 10 hours each. By calculating revenue per hour, I saw this client dragged down efficiency. We transferred the “A” client to another trusted financial professional who could better serve them, freeing time to serve four “B” clients, doubling revenue for the same effort—and enjoying the work more.

This metric justified extra time for top clients, like lunches or personalized gifts, boosting satisfaction. The result? Referrals surged as clients felt valued. Revenue Per Hour optimized capacity and delivered better experiences without sacrificing my life.

With Revenue Per Hour optimizing my work-life balance, I wanted to ensure more time went to what I do best: serving clients face-to-face. That led to my third KPI: Percentage of Time Spent with Clients.

KPI #3: Percentage of Time Spent with Clients

To boost productivity and impact, I started tracking what percentage of my workweek was spent directly with clients—meetings, calls, or personal interactions—vs. behind-the-scenes tasks. Unlike subjective KPIs like Impact Score, this is a hard-number metric: hours with clients divided by total hours worked. The goal? Increase that percentage year-over-year, even if working fewer hours overall.

In my experience coaching financial professionals, most spend just 18-25% of their time with clients, bogged down by emails, paperwork, or tracking for tracking’s sake. I was no different, wasting hours on non-essential tasks. Measuring this KPI helped me get real about what was eating up my time—like getting buried in emails or doing the same data entry over and over. I used AI for workflows and delegated administrative tasks, pushing my client-facing time toward 50%.

The result? More time for high-impact activities like client lunches or year-end tax planning calls. My capacity grew, client satisfaction soared, and referrals poured in because clients felt prioritized. This KPI freed me from busywork, letting me focus on what truly drives value.

Maximizing client-facing time boosted satisfaction, but I wanted that time to spark organic growth. That led to my fourth KPI: Number of Referrals to Ideal Clients, an extension of tracking client time.

KPI #4: Number of Referrals to Ideal Clients

This KPI tracked not just total referrals, but those to ideal clients—ones who fit my niche and expertise. It was a hard-number metric that showed whether I was deepening impact, building strong relationships, and reducing friction to create an exceptional, share-worthy client experience. It also showed that I had clearly communicated who I served best.

By spending more time with clients (KPI #3), I focused on concierge-level, experiential service—reducing friction with seamless processes like streamlined onboarding. I also clarified my niche, say, serving business owners, not recent college grads who needed basic plans.

This ensured referrals matched my expertise. I never asked for referrals; they flowed naturally when clients were thrilled. A frictionless experience and clear messaging about who I served best drove referrals to ideal clients through the roof, deepening relationships and growing my practice without extra effort. Tracking referrals to ideal clients showed me the power of a frictionless, niche-focused experience. But how do you put all four KPIs to work? Here’s how I started.

Third, How to Start Using Them Yourself

Track these KPIs weekly for one quarter to build the habit, but plan for a year to see transformative results. Use dedicated strategy hours to log and reflect:

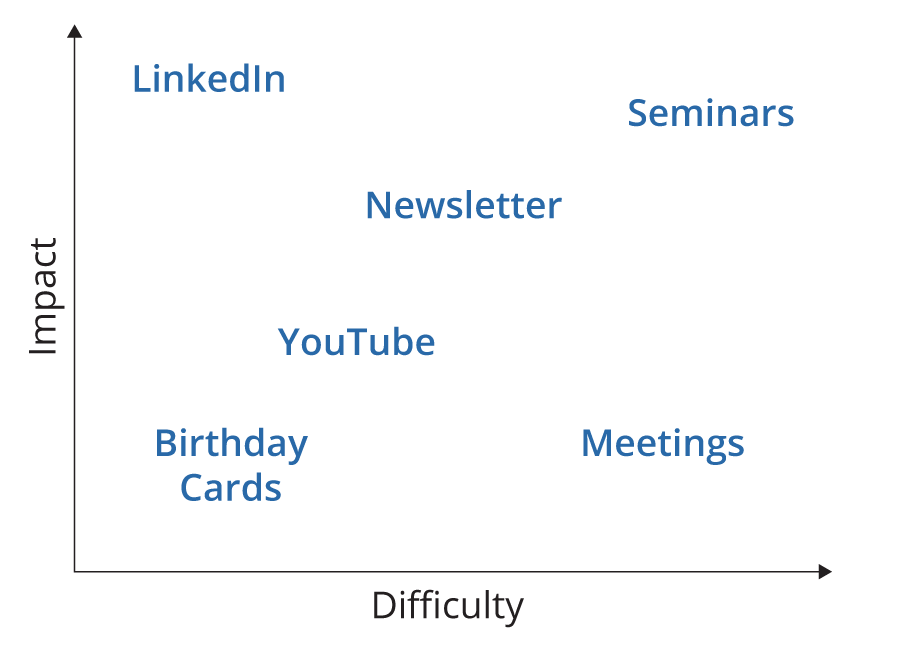

- Impact Score: Rate all activities (e.g., meetings, newsletters, birthday cards, YouTube videos, value-adds) on a 1–4 scale for impact and difficulty to prioritize high-value tasks.

- Revenue Per Hour: Divide total revenue by hours worked to identify clients who maximize efficiency

- Percentage of Time Spent with Clients: Divide client-facing hours (meetings, calls) by total hours, aiming for 50% by delegating busywork

- Number of Referrals to Ideal Clients: Count total referrals and qualify how many fit your niche (i.e., business owners, not mismatches)

These KPIs can drive results, but you might still question traditional metrics’ role.

“Aren’t Traditional KPIs Still Important?”

Absolutely, but they often track activity, not outcomes. These KPIs enhance metrics like leads or revenue by focusing on client impact and efficiency, driving referrals. Start small, review weekly, and watch your practice become a referral magnet, delivering value and balance without burnout.

To Summarize

First, traditional KPIs track activity but miss impact, productivity, and client experience. Second, my four KPIs—Impact Score, Revenue Per Hour, Time with Clients, and Ideal Referrals—target what matters to me. Third, weekly CEO time tracking, with a year-long plan, drives sustainable, client-focused growth.

These Unconventional KPIs Transformed My Practice and My Life

As a young financial professional, I chased traditional metrics, only to end up overworked and yearning for time with my family. By focusing on client impact, working smarter, and creating seamless experiences, I sent referrals soaring and reclaimed my time for those I love. Now, as a coach, I guide financial professionals to help build thriving practices without burnout.

Next Step

Start tracking them in your CEO time this week. You’ll see what’s truly moving the needle—more engaged clients, a healthier business, and a life you love.