- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

Investment Options

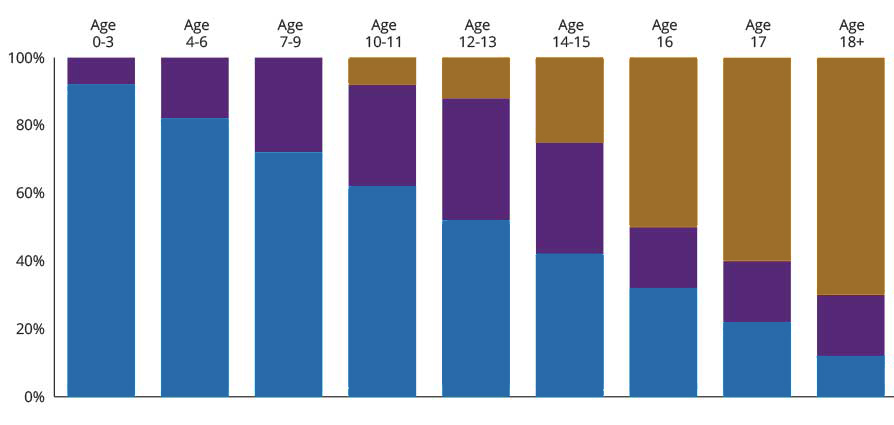

With age-based portfolios, deciding how to invest is easy. The asset allocation within each of our nine age-based portfolios is tailored for children in a particular age group. Assets are automatically adjusted from a more aggressive portfolio to a more conservative one as the child grows older and nears college age.

| Target Allocations of the Underlying Funds | Age | ||||||||

| 0-3 | 4-6 | 7-9 | 10-11 | 12-13 | 14-15 | 16 | 17 | 18+ | |

| Hartford Growth Opportunities Fund | 11.50% | 10.00% | 9.00% | 7.50% | 6.50% | 5.25% | 4.00% | 2.50% | 1.50% |

| Hartford Small Cap Growth Fund | 5.25% | 4.75% | 4.25% | 3.50% | 3.00% | 2.25% | 1.75% | 1.25% | 0.00% |

| Hartford International Growth Fund | 4.50% | 4.00% | 3.50% | 3.00% | 2.25% | 2.00% | 1.50% | 1.00% | 0.50% |

| Schwab® S&P 500 Index Fund | 9.00% | 7.75% | 6.50% | 5.50% | 4.50% | 3.75% | 2.75% | 1.75% | 1.25% |

| Hartford Multifactor US Equity ETF | 8.50% | 7.50% | 6.50% | 5.75% | 4.75% | 3.75% | 3.00% | 2.00% | 1.25% |

| Hartford Schroders International Multi-Cap Value Fund | 7.25% | 6.50% | 5.75% | 5.00% | 4.00% | 3.50% | 2.50% | 1.75% | 1.00% |

| Hartford Core Equity Fund | 20.00% | 18.50% | 16.25% | 14.25% | 12.00% | 9.50% | 7.25% | 5.50% | 3.00% |

| Hartford Schroders Emerging Markets Equity Fund | 3.00% | 2.50% | 2.25% | 2.00% | 1.75% | 1.25% | 1.00% | 0.75% | 0.50% |

| Hartford International Opportunities Fund | 7.25% | 6.50% | 5.75% | 5.00% | 4.25% | 3.50% | 2.75% | 1.75% | 0.75% |

| Hartford Multifactor Developed Markets (ex-US) ETF | 7.25% | 6.50% | 5.75% | 4.75% | 4.25% | 3.25% | 2.50% | 1.75% | 1.00% |

| Hartford Equity Income Fund | 8.50% | 7.50% | 6.50% | 5.75% | 4.75% | 4.00% | 3.00% | 2.00% | 1.25% |

| Hartford Strategic Income Fund | 5.00% | 5.25% | 5.75% | 6.00% | 7.25% | 6.50% | 4.00% | 4.00% | 4.00% |

| Hartford Core Bond ETF | 3.00% | 6.00% | 10.50% | 11.25% | 13.25% | 12.25% | 7.00% | 7.00% | 7.00% |

| Hartford Inflation Plus Fund | 0.00% | 5.50% | 9.00% | 9.50% | 11.50% | 10.50% | 7.00% | 7.00% | 7.00% |

| Hartford World Bond Fund | 0.00% | 1.25% | 2.75% | 3.25% | 4.00% | 3.75% | 0.00% | 0.00% | 0.00% |

| The SMART 529 Stable Value Portfolio | 0.00% | 0.00% | 0.00% | 8.00% | 12.00% | 25.00% | 50.00% | 60.00% | 70.00% |

| Total | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

The actual allocations among the Underlying Funds will fluctuate from time to time.

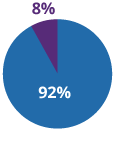

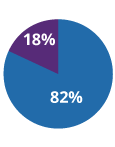

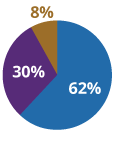

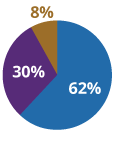

Aggressive

Growth  |

Growth  |

Balanced  |

Conservative Balanced  |

Checks & Balances  |

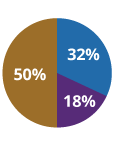

Aggressive Growth |

Growth |

Balanced |

Conservative Balanced |

Checks & Balances |

| Target Allocations of the Underlying Funds | Aggressive Growth | Growth | Balanced | Conservative Balanced | Checks & Balances |

| Hartford Growth Opportunities Fund | 11.50% | 10.00% | 7.50% | 4.00% | 0.00% |

| Hartford Small Cap Growth Fund | 5.25% | 4.75% | 3.50% | 1.75% | 0.00% |

| Hartford International Growth Fund | 4.50% | 4.00% | 3.00% | 1.50% | 0.00% |

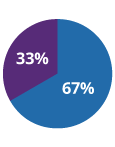

| Hartford Capital Appreciation Fund | 0.00% | 0.00% | 0.00% | 0.00% | 33.33% |

| Schwab® S&P 500 Index Fund | 9.00% | 7.75% | 5.50% | 2.75% | 0.00% |

| Hartford Multifactor US Equity ETF | 8.50% | 7.50% | 5.75% | 3.00% | 0.00% |

| Hartford Schroders International Multi-Cap Value Fund | 7.25% | 6.50% | 5.00% | 2.50% | 0.00% |

| Hartford Core Equity Fund | 20.00% | 18.50% | 14.25% | 7.25% | 0.00% |

| Hartford Schroders Emerging Markets Equity Fund | 3.00% | 2.50% | 2.00% | 1.00% | 0.00% |

| Hartford International Opportunities Fund | 7.25% | 6.50% | 5.00% | 2.75% | 0.00% |

| Hartford Dividend and Growth Fund | 0.00% | 0.00% | 0.00% | 0.00% | 33.33% |

| Hartford Multifactor Developed Markets (ex-US) ETF | 7.25% | 6.50% | 4.75% | 2.50% | 0.00% |

| Hartford Equity Income Fund | 8.50% | 7.50% | 5.75% | 3.00% | 0.00% |

| Hartford Strategic Income Fund | 5.00% | 5.25% | 6.00% | 4.00% | 0.00% |

| Hartford Total Return Bond ETF | 0.00% | 0.00% | 0.00% | 0.00% | 33.33% |

| Hartford Core Bond ETF | 3.00% | 6.00% | 11.25% | 7.00% | 0.00% |

| Hartford Inflation Plus Fund | 0.00% | 5.50% | 9.50% | 7.00% | 0.00% |

| Hartford World Bond Fund | 0.00% | 1.25% | 3.25% | 0.00% | 0.00% |

| The SMART 529 Stable Value Portfolio | 0.00% | 0.00% | 8.00% | 50.00% | 0.00% |

| Total | 100% | 100% | 100% | 100% | 100% |

The actual allocations among the Underlying Funds will fluctuate from time to time.

Individual 529 portfolio options may be used to customize a Hartford SMART529 account with one or more portfolios. The Hartford SMART529 offers 13 individual 529 portfolio options from which to choose.

| SMART529 Individual 529 Portfolio Options |

Underlying Fund |

|---|---|

| Hartford Small Company 529 Fund | Hartford Small Company Fund |

| Hartford MidCap Value 529 Fund | Hartford MidCap Value Fund |

| Hartford Growth Opportunities 529 Fund | Hartford Growth Opportunities Fund |

| Hartford International Opportunities 529 Fund | Hartford International Opportunities Fund |

| Hartford MidCap 529 Fund | Hartford MidCap Fund |

| MFS Global Equity 529 Fund | MFS® Global Equity Fund |

| Hartford Dividend and Growth 529 Fund | Hartford Dividend and Growth Fund |

| Hartford Equity Income 529 Fund | Hartford Equity Income Fund |

| Hartford Balanced Income 529 Fund | Hartford Balanced Income Fund |

| Hartford High Yield 529 Fund | Hartford High Yield Fund |

| Hartford Inflation Plus 529 Fund | Hartford Inflation Plus Fund |

| Hartford Total Return Bond 529 Fund | Hartford Total Return Bond Fund |

| SMART529 Stable Value Fund |

SMART529 Stable Value Portfolio* |

*This is a Separate Account and not a mutual fund.

SMART529 is a college savings plan offered by the Board of Trustees of the West Virginia College and Jumpstart Savings Programs and administered by Hartford Funds Management Company, LLC ("HFMC").

Investments in SMART529 are not guaranteed or insured by the State of West Virginia, the Board of Trustees of the West Virginia College and Jumpstart Savings Programs, the West Virginia State Treasurer's Office, HFMC, The Hartford Insurance Group, Inc., the investment sub-advisors for the Underlying Funds or any depository institution and are subject to investment risks, including the loss of the principal amount invested, and may not be appropriate for all investors.

The Hartford SMART529 is available to all investors. West Virginia (WV) provides certain tax advantages to WV taxpayers that invest in The Hartford SMART529. Before investing, an investor should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s 529 plan.

This information is written in connection with the promotion or marketing of the matter(s) addressed in this material. The information cannot be used or relied upon for the purpose of avoiding IRS penalties. These materials are not intended to provide tax, accounting or legal advice. As with all matters of a tax or legal nature, your clients should consult their own tax or legal counsel for advice.

Investors should carefully consider the investment objectives, risks and charges and expenses of SMART529 and its Underlying Funds before investing. This and other information can be found in the Offering Statement for SMART529 and the prospectuses or other disclosure documents for the Underlying Funds. Please read them carefully before investing or sending money. For a copy of the Board of Trustees of the West Virginia College and Jumpstart Savings Programs privacy policy, please click here. SMART529 college savings plans are distributed by Hartford Funds Distributors, LLC. Member SIPC

For a copy of the West Virginia College and Jumpstart Savings Programs’ most recent Annual Comprehensive Financial Report, please click here.

"The Hartford" is a registered trademark of Hartford Fire Insurance Company.

"SMART529" is a registered trademark of the Board of Trustees of the West Virginia College and Jumpstart Savings Programs.

"The Hartford" is The Hartford Insurance Group, Inc. and its subsidiaries.