- Individual Investor? Learn More Individual Investor? LEARN MORE >

-

ACCOUNT ACCESS

- FOR FINANCIAL PROFESSIONALS

- Mutual Fund Accounts

- Smart529 Accounts

- FOR INDIVIDUAL INVESTORS

- Mutual Fund Accounts

- Smart529 Accounts

-

CONTACT US

Pre-Sales Support

Mutual Funds and ETFs - 800-456-7526

Monday-Thursday: 8:00 a.m. – 6:00 p.m. ET

Friday: 8:00 a.m. – 5:00 p.m. ETPost-Sales and Website Support

888-843-7824

Monday-Friday: 9:00 a.m. - 6:00 p.m. ET- PHONE US MAIL US

- ADVISOR LOG IN

-

Products

- INVESTMENT RESOURCES

- Systematic ETFs

- Model-Delivery SMAs

- The Hartford SMART529 College Savings Plan

- VIEW FUNDS BY ASSET CLASS

- Taxable Bond

- Domestic Equity

- International/Global Equity

- Tax Advantaged Bond

- Multi Strategy

-

Insights

- Market Perspectives

- Equity

- Fixed Income

- Global Macro Analysis

- Strategic Beta & ETFs

- Investor Insight

- The Future of Advice

- Navigating Longevity

- Investor Behavior

- See all Investor Insights

- Investment Strategy

- Global Investment Strategist

- Fixed-Income Strategist

- Informed Investor

- Practice Management

- Resources

- About Us

-

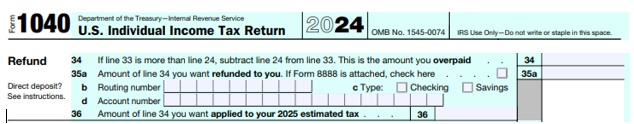

Direct Deposit Your IRS Refund

For direct shareholders with the IRS refund direct deposit, you can instruct the IRS to deposit your tax refund directly into your existing Hartford Funds account by following a few simple steps on your federal income tax form 1040.

How To Directly Deposit Your Refund

IRS Form 1040 includes a refund section that lets the IRS and Hartford Funds know into which specific account you want your refund deposited.

- 35b–Routing number: This line designates which financial institution is to receive your check. Hartford Fund's routing number is 011000028.

- 35c–Type: This line designates to which type of account your refund should be deposited. Because there is no "mutual fund" option on the form, please mark "Checking."

- 35d–Account Number: All account numbers must begin with a prefix HTF. Next, please write in your fund number (you can find this on your account statement, along with your account number). Finally, fill in your account number, preceded by as many zeros as necessary to fill all 17 boxes. Example HTF01230000123456

Avoiding Problems

Here are a few tips to help ensure that your direct deposit is completed smoothly:

- Please print clearly. If the information is illegible or incorrect, the deposit will be returned to the IRS, which will then issue a check to the address on the front of your Form 1040.

- Deposits cannot be accepted into employer sponsored retirement accounts.

- Hartford Funds will send a confirmation statement that you should receive in five to ten business days of receiving your deposit.

- Deposits cannot be accepted into 529 college savings accounts.

Hartford Funds will not be liable if the IRS does not deposit your refund in accordance with your wishes.

Investing involves risk, including the possible loss of principal.

The information in the Tax Center is not intended to be legal or tax advice.