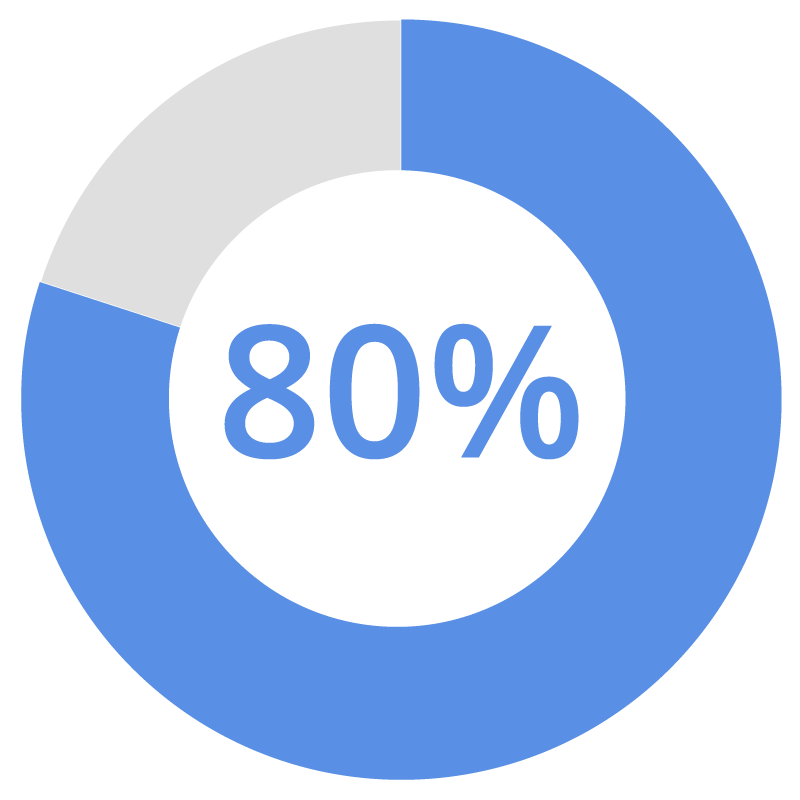

80% of clients would change financial professionals if theirs couldn’t help them maximize their Social Security benefits1

80% of clients would change financial professionals if theirs couldn’t help them maximize their Social Security benefits1

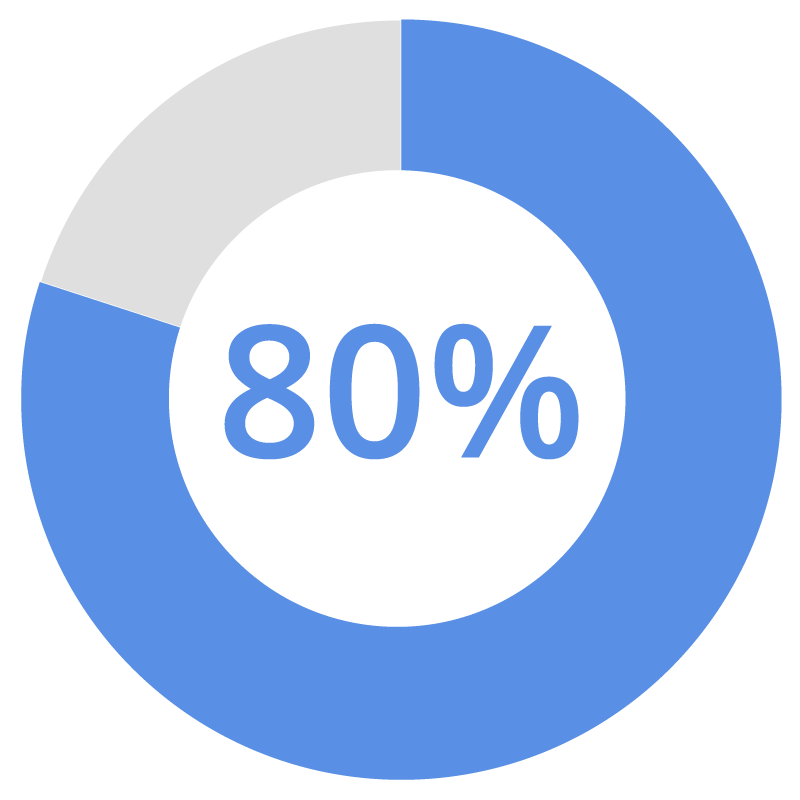

36%

are unsure how much their monthly Social Security benefit will be2

36%

of retirees are receiving a lower-than-expected Social Security benefit2

Currently the average retirement benefit is

$1,907

monthly or

$22,884

annually*

*Frequently Asked Questions, January 2024, ssa.gov

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable.

The preceding is not intended to be a recommendation or advice.

This information does not take into account the specific investment objectives, tax and financial condition of any specific person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice. This material may not be copied, photocopied or duplicated in any form or distributed in whole or in part, for any purpose, without the express written consent of Hartford Funds.

¹ The Nationwide Retirement Institute® 2024 Social Security Survey, nationwidefinancial.com, 7/24.

2 Nationwide Peak Retirement Survey Insights Report, 12/23.

3 How Much Do I Need to Retire Comfortably? fool.com, 9/24.

4 The True Cost of Forgotten 401(k) Accounts, hicapitalize.com, 6/23.

The MIT AgeLab is not an affiliate or Subsidiary of Hartford Funds.