If $50,000 showed up tomorrow, would you live large—or build lasting wealth?

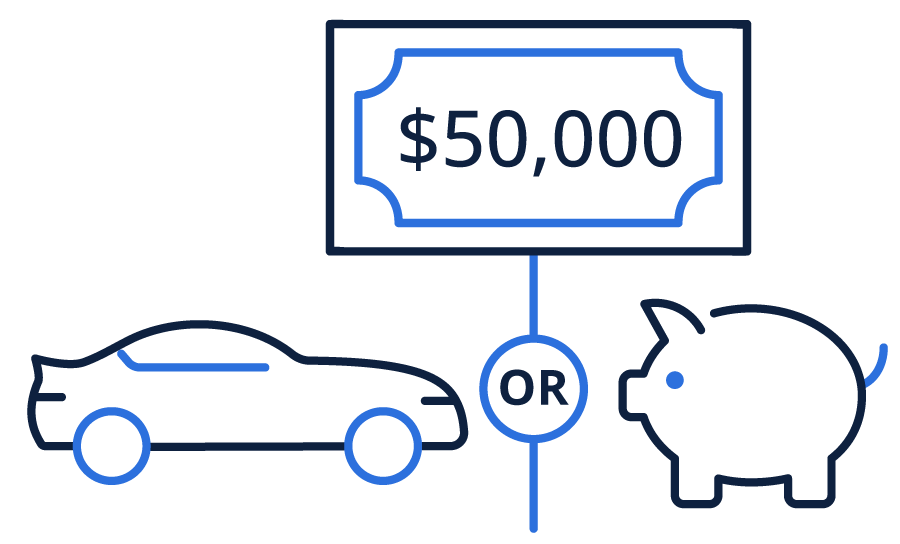

Picture this: An unexpected $50,000 windfall lands in your lap. What do you do next?

Do you start luxury-car shopping—leaning toward living large—or quietly slip the money into savings, leaning toward being wealthy? How we interact with money isn’t just about dollars and cents—it’s about the choices and reactions that shape our lives. Some people crave the thrill of living large in the moment: the dream vacation, the home upgrade, the visible wins.

Others prefer the security of being wealthy: building assets, creating freedom, and savoring meaningful moments at any income level.

The challenge? Lean too far one way, and you risk regret—either from overspending and putting your future at risk, or from holding back so much that you miss out on experiences you value.

This article will help you understand the difference, weigh the trade-offs, and find a balance that lets you enjoy today without sacrificing tomorrow.

First, What It Means to Live Large

When many people think about “living large,” they picture the visible markers of success—the things others can see: the luxury SUV in the driveway, the designer wardrobe, the golf club membership, the big, memorable vacations.

For many of my clients, these choices reflect years of hard work, and they can feel exciting and well-earned. And yes, there’s often a quiet satisfaction that comes from knowing others notice and admire that success.

But Living Large Often Relies on a Steady Income

For many of my clients, that can create pressure to keep earning at the same level to sustain the lifestyle they enjoy. For those who are retired, it may raise questions about whether their portfolio can support that pace for the long haul.

Without a solid foundation, living large can become more about what others see than what’s truly sustainable for your household.

Second, What It Means to Be Wealthy

Wealth isn’t defined by the car you drive or the logo on your clothes. It’s about what money enables, not just what it buys. When I ask clients what a wealthy life means to them, money rarely tops the list.

Instead, they talk about the immaterial, such as their health, time with the people they love, and the freedom to spend their days in ways that feel meaningful. Wealth can look like sipping coffee on your favorite porch with your favorite person—a moment that feels rich because of its significance, not its price tag.

Wealth Means Your Money Works Even When You’re Not

It’s the difference between relying on a paycheck and having investments, real estate, or other resources that generate income on their own. That’s why I often say: wealth buys freedom; living large buys bills. If you stopped earning tomorrow, how long could you maintain your current lifestyle? The answer often reveals whether you’re income-dependent or truly wealthy.

So, does the pursuit of being wealthy come with risk? My clients who strive for it often tend to underspend. When they hold back too tightly, it can mean postponing experiences they value or denying themselves comforts they can easily afford.

Over time, that restraint can turn into a habit that limits their enjoyment of today—even when their finances fully support it. Without balance, underspending becomes less about security and more about shrinking the life they’ve worked hard to build.

Third, Which Side Do You Lean Toward?

Think back to that $50,000 windfall from the intro. Your very first instinct—indulge or save—isn’t just a financial choice. It’s a glimpse into what you hope for, what you worry about, and what makes you feel secure.

If you lean toward living large, there’s often a genuine desire to make life feel a little richer right now. Maybe it’s the upgraded car you’ve dreamed about, or that once-in-a-lifetime trip you’ll talk about for years.

These choices feel exciting because they are—they deliver a burst of joy and a sense of “I deserve this.”

Psychologically, it taps into the brain’s reward response: that quick, satisfying lift that comes from visible wins. But the flip side is subtle. When each upgrade makes life feel better, spending can quietly stretch, and keeping up the lifestyle that fuels those highs becomes difficult.

If you lean toward being wealthy, your instinct tends to come from a deeper place—wanting freedom, stability, and the ability to show up for the people you care about.

You may feel wealthiest when you’re able to spend unhurried time with friends, support someone you love, or simply make choices without financial stress. This is tied to the brain’s safety response and the comfort that comes from knowing the future is protected.

But there’s a quiet challenge here, too: It can become so natural to prioritize “later” that you miss chances to enjoy “now,” even when you have more than enough to do so comfortably.

Neither leaning is right or wrong—they’re both rooted in what you value. The key is to understand the emotion that’s driving your instinctive choice. When you know why you lean the way you do, and the pros and cons that come with it, you can make choices that feel more intentional and balanced.

The Best News

You don’t have to choose. Keep the parts of living large that genuinely excite you—and anchor them in a wealth plan that lasts. A financial professional can help translate that intention into a plan: protecting wealth (e.g., assets, risk management, cash reserves) while making room for the “live large” moments you care about—and pacing them so your future stays intact.

To Summarize

First, living large delivers visible wins and tangible rewards—but it often relies on income, so make sure the lifestyle doesn’t outpace your resources. Second, being wealthy means building assets that work for you, creating freedom and security even when you’re not earning. Third, assessing your priorities helps you see what matters most and strike a balance between today’s joys and tomorrow’s resilience.

Making It Work: Enjoy Today, Protect Tomorrow

We started with a tension: enjoying your money now or building security for later. That tension doesn’t vanish. Living large and being wealthy both have real upsides—and real drawbacks.

The point isn’t choosing one forever but understanding where you lean and what that means for your life and finances. A financial professional can help you sort through that tension and figure out how to honor both sides in a way that works for you.

Next Step

Schedule time with your financial professional to design a plan that balances living well now with building lasting security—without sacrificing either.