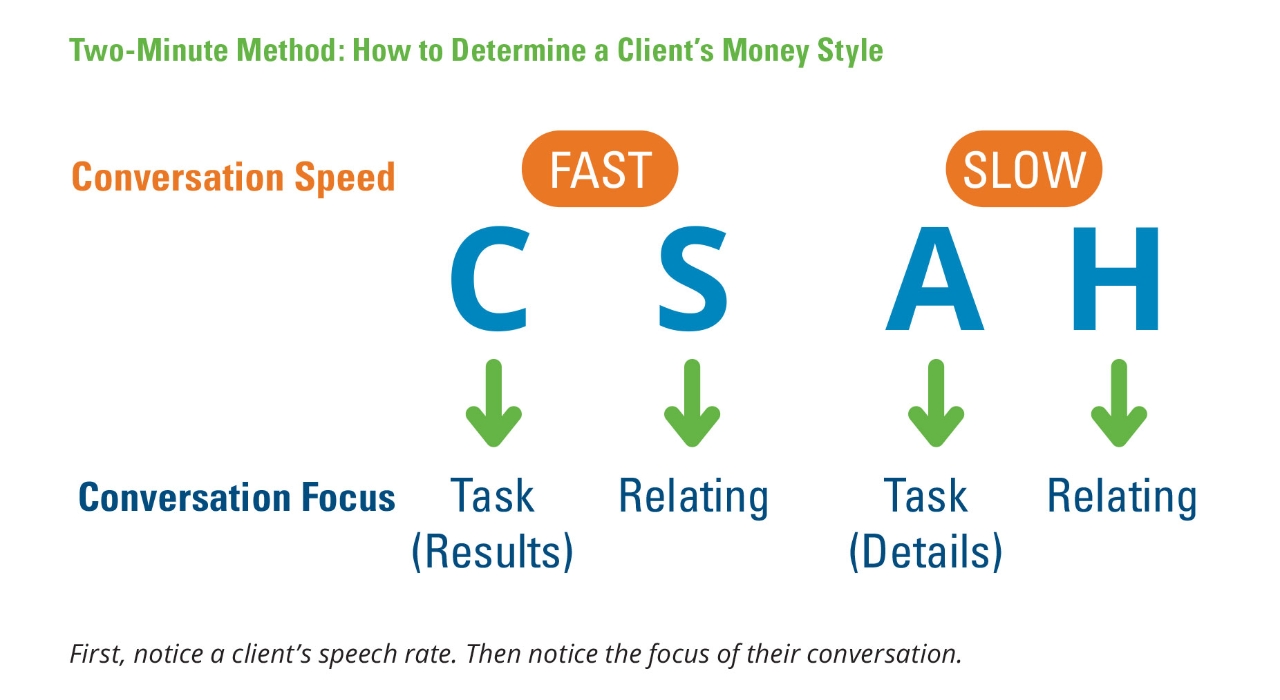

Once you’ve identified a client’s rate of speaking, next, try to notice the focus of their conversation. Sociable and Harmonious clients focus on relating. They’ll happily engage in friendly small talk.

Confident and Analytical clients will focus on the tasks at hand; small talk will be brief because they want to get down to business. Confident clients will be direct and get right to the point. Analytical clients will quickly begin engaging on all the details.

Now that you can identify your clients’ styles, we’ll explain how to best connect with each style.

Tips for Communicating With Each Style

Tailoring your conversations to a client’s style can increase their satisfaction and decrease the likelihood of misunderstanding.

Confident

- Do’s: The Confident style appreciates clear and concise messages. Come to any conversation ready to deliver a results-focused summary of opportunities, risks, benefits,and recommendations. Stay on topic and provide well thought-out solutions.

- Don’ts: Due to their desire for directness, the worst way to communicate with a Confident style is to stray from a discussion that’s focused on actions and results. These clients will likely have direct questions to ask and won’t want you to shy around the point. Be prepared for your ideas to be challenged.

Analytical

- Do’s: Analytical clients want quality, accuracy, and order. They need to see how your plan delivers quality, and they usually ask a lot of questions, so make sure you do a thorough job of addressing all their questions and concerns.

- Don’ts: Coming to a meeting with an Analytical client unprepared will result in an unproductive and frustrating meeting. Highly resistant to pressure, Analytical clients don’t make immediate decisions, so give them plenty of time to ponder. It’s helpful to ask how much time they need to make a decision and schedule a follow-up conversation.

Sociable

- Do’s: Your Sociable clients want to feel good, be inspired,and socialize. Work on building a positive relationship with them as an individual and as a client. When it comes to their money, paint a picture of how your recommendations will help them achieve their ideal future vision.

- Don’ts: Try to avoid overloading Sociable clients with administrative tasks. If a client must do the task, make it as easy as possible. Focusing solely on facts and figures and ignoring their personal stories will lead to an unhappy client.

Harmonious

- Do’s: It’s important for your Harmonious client to feel as though you’re both working toward the same goal. Harmonious clients seek calm, stability, and collaboration. They want to have a partner in achieving their money goals.

- Don’ts: The least independent of all the money styles, they want to feel supported through the process. Rushing through a meeting and focusing too much on risks will discourage these clients.

“My Clients Seem Like They Shift Styles Sometimes”

Some may resist sorting their clients into four simplistic categories. People are more complicated than that. I agree. Most people gravitate to two of the four styles. It’s common for clients to exhibit various combinations and have one style show up more prominently at various times.

Being aware of their primary styles, and how they shift, can improve communication and deepen your relationship. Clients do shift styles, especially during challenging markets. Clients who were happy with the positive returns generated by markets in years past may show a different money style in volatile markets. Be aware of money style shifts and adapt your conversations accordingly.

To Summarize

First, clients tend to fall into four different money styles. These styles impact how they evaluate recommendations, how concerned they are about risk, and how they make decisions. Second, you can identify a client’s money style using a two-minute method. Third, increase client satisfaction and decrease the likelihood of conflict by learning the tips to best communicate with each style.

Applying Money Styles to Trent’s Client

Adapting to a client’s money style in the moment is an important tool for avoiding unnecessary conflict. In Trent’s case, the client was initially being Harmonious by quietly accommodating. Later, the client’s Analytical style surfaced, and Trent was confronted with multiple questions on the details. Trent was confused and derailed by the abrupt shift.

If Trent had used my two-minute test during the phone call, he would’ve immediately noticed the Analytical money style and been better prepared to adapt to the client’s needs in the moment. Even better, had Trent been clued into the client’s Harmonious style in the earlier meeting, he would have been aware that being too quiet is a warning sign. He might have gently probed rather than mistaking quiet capitulation for full agreement. After explaining the four money styles and how to accommodate them, Trent is much better prepared for all the styles and how they may shift over time.