| Percentage of Caregivers of Adults Who Are in Each Generation, 20201 | |

|---|---|

| Generation Z (born 1997 or after) |

6% |

| Millennial (born 1981 to 1996) |

23% |

| Generation X (born 1965 to 1980) |

29% |

| Baby Boomers (born 1946 to 1964) |

34% |

| Silent/Greatest (born 1945 or prior) |

7% |

Source: Caregiving in the US, AARP and National Alliance for Caregiving, 2020. Most recent data available.

Aging is not just about the old. Families are typically the primary source of care and support as we age. While doctors, nurses, social workers, and other professionals may call it caregiving, most people simply consider providing help to an older loved one being a loving spouse or a good adult child.

Caregiving is a catchall phrase that encompasses an important and extensive set of activities that evolve (sometimes slowly, other times rapidly) with the needs of the care recipient. This paper provides financial professionals and investors with an overview of caregiving—what it is, who is most likely to provide it, what the associated costs are, and where those who are providing care to an older adult can turn for help.

What Is Caregiving?

Caregiving, or informal care, is when a family member or friend provides unpaid help with a wide range of tasks to assist an older adult in his or her daily life. These activities can be as simple as giving a ride to the grocery store and cleaning out the refrigerator, or as complex as managing multiple medications and administering care to a wound.

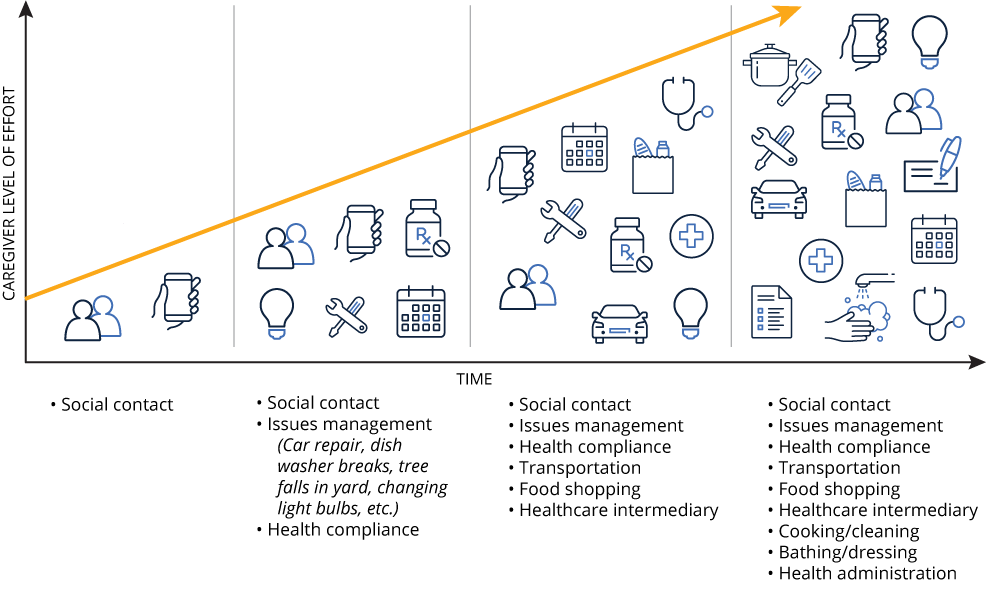

The nature of caregiving and associated tasks change as the care recipient’s condition evolves. The figure below provides an overview of the ‘caregiver career.’ Over time, the demands of providing care are likely to increase in their diversity and intensity, placing a commensurate increase of physical and emotional burden on the caregiver.

However, there is no set schedule for any one set of tasks. Rather, change can happen gradually or dramatically with a health event such as a stroke or an accident in the home.

At first, caregiving may look like periodic, simple phone calls or check-ins to maintain social contact. While still independent, an older loved one may need to be reminded to refill prescriptions, or take medications on time, in the correct dose, with the appropriate meal.

Over time, other tasks may emerge, such as providing transportation to the doctor’s office or routine home maintenance, such as changing a light bulb. In many instances, a caregiver may serve as a healthcare advocate or intermediary, speaking with physicians, pharmacists, and others.

Caregivers may also provide assistance with financial responsibilities such as paying bills or balancing the household checkbook, especially in situations with cognitive decline. Increasing physical frailty or limitations may require the caregiver to help with daily activities, such as washing, dressing, and toileting, adding significant physical and emotional demand to the caregiver.