We Really Don’t Like Discussing Eldercare with Our Parents

53%

of adult children anticipate that talking through senior care options with their loved ones will be difficult

Source: When mom or dad wants move in with you: How to decide and what to say if the answer is no, Care.com, 7/20/23

Remember when you were assigned a book report back in school? Did you plan out your progress and diligently make strides toward its completion? Many of us waited until the night before and got it done in a panicked frenzy.

Procrastination in discussing elder care options with parents later in life can lead to avoiding crucial conversations. Failing to plan for potential serious illness or incapacity may result in unforeseen emotional and financial consequences. Initiate discussions now to prevent these challenges.

What’s Elder Care?

Elder care refers to the support and assistance given to elderly or infirm individuals, which can be provided through residential institutions, paid daily help at home, or by family members.

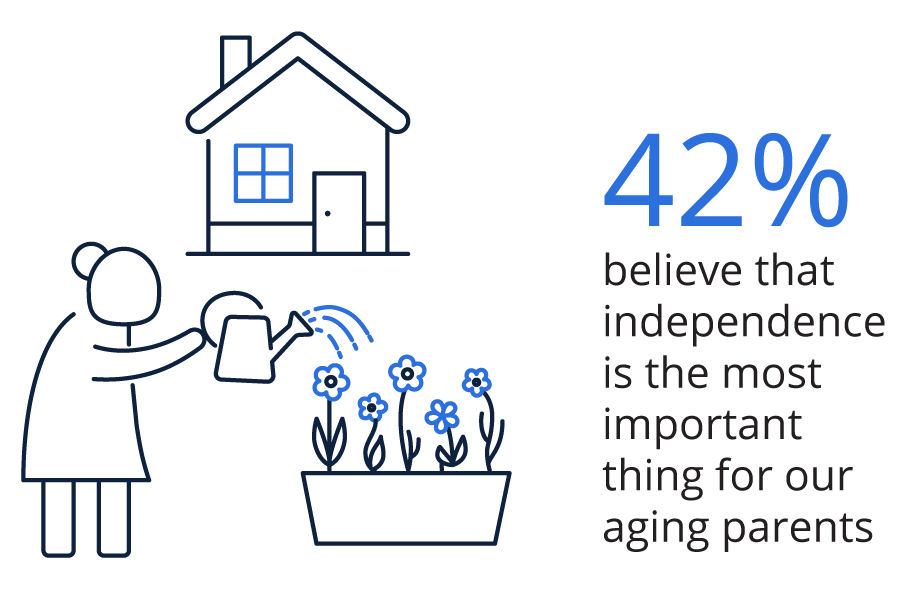

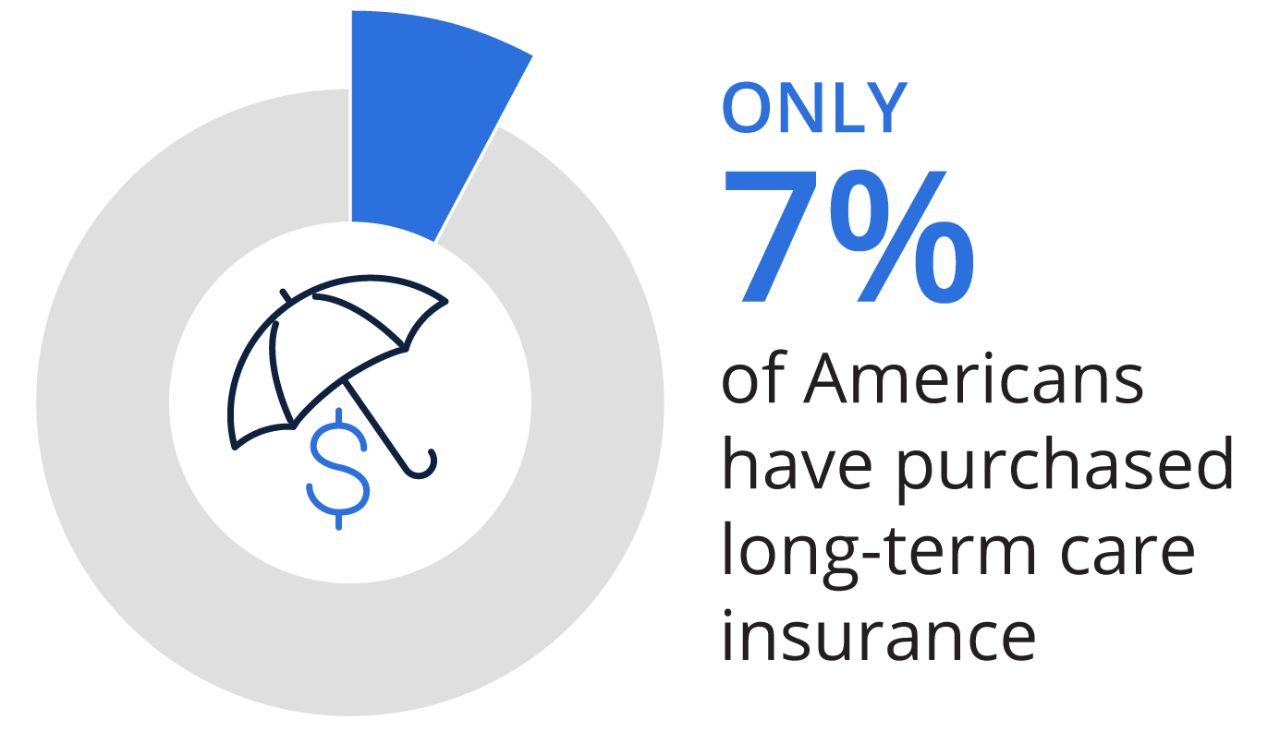

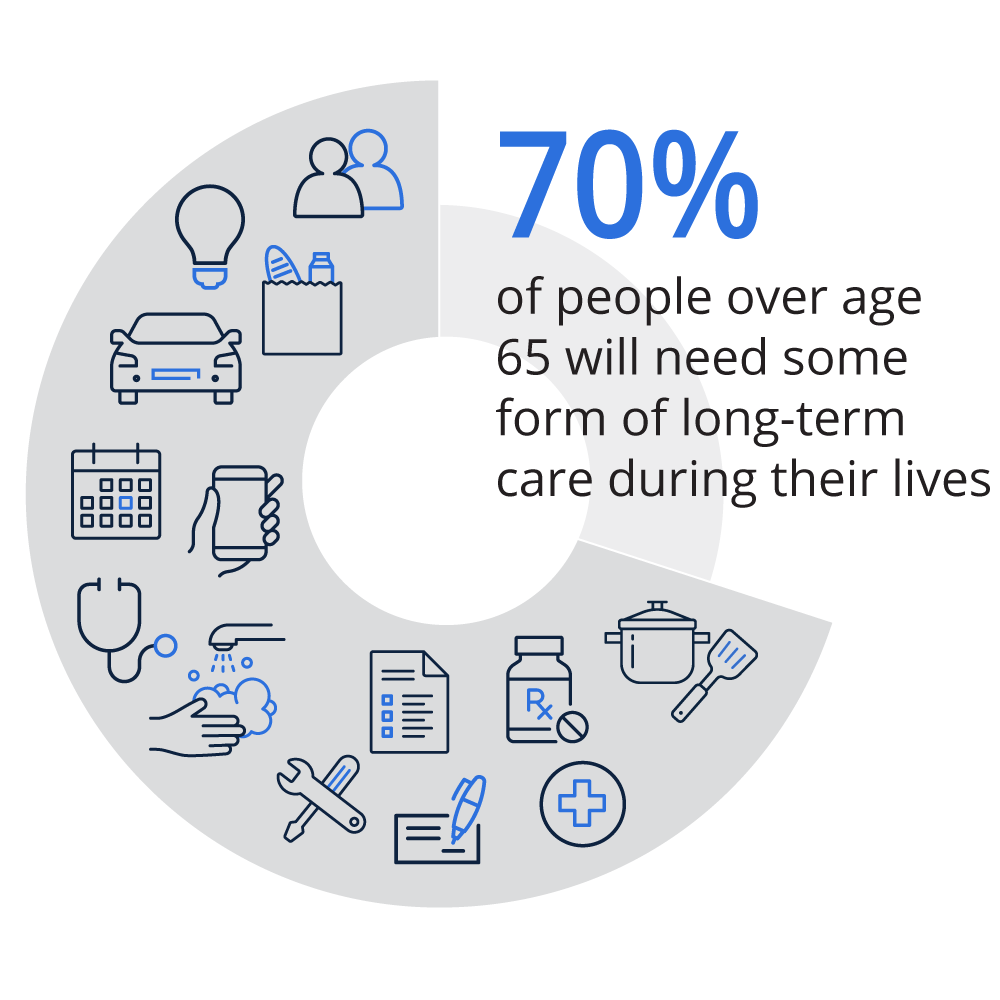

We all want to maintain our independence as we age. A 2019 study found that 78% of people over 50 worry about losing their independence.1 We want to make our own decisions about where we live, where we go, and who we spend time with. But aging, and its effect on our bodies, can take away that independence. We never know when that will happen. It could happen quickly as a result of a fall or illness or it could happen gradually over time. At that point, we’ll need help, and the probability of us, and our parents, needing help is high. About 70% of people over the age of 65 are expected to need some long-term care services at some point in their lives.2

We Avoid Discussing Elder Care With Our Parents

Fifty-three percent of adult children surveyed anticipate that talking through senior care options with their loved ones will be difficult.3 It’s human nature to not want to discuss things we fear, don’t understand, or anticipate will result in conflict. Elder care discussions could cover all three. It’s so scary that over 50% of aging adults would rather die than go to a nursing home.4 No wonder we don’t want to discuss the topic with our parents.

We may be concerned about how an elder care discussion could affect our relationships with our parents. We want to respect our parents’ privacy. Will our parents think we’re trying to put them away in a nursing home? Fifty-five percent of people in a 2016 survey said they don’t plan on discussing senior care options until there’s a need.5

We Don’t Like to Discuss the Cost of Elder Care

Most of us have no idea what elder care costs. Sixty-seven percent of people surveyed didn’t know the cost of a nursing home, and 57% didn’t know the cost of non-medical home care.5 Finding costs for senior housing options isn’t easy because most communities don’t publish their prices online. These facilities may be afraid of scaring off prospective residents and their families with sticker shock. As a result, many people have misperceptions about the costs of elder care.

For example, when people were asked how much they thought it would cost to cover assistance with activities of daily living (walking, grooming, toileting, dressing, and eating) for a year, the average guess was $25,000.6 The actual cost of a year in a nursing home in 2025 was $127,750.7