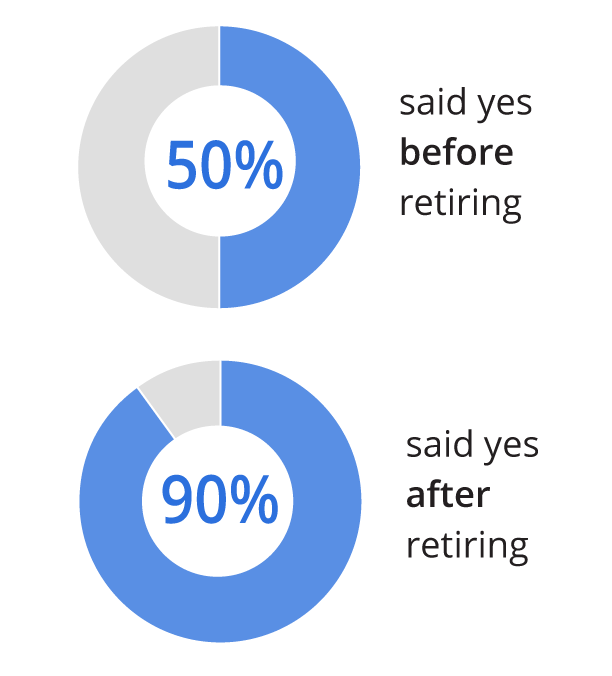

It’s a classic case of “Don’t know what ya got till it’s gone,” as retirees didn’t realize the importance of work’s built-in advantages. Too often, these advantages are overshadowed by things they didn’t like about working. Unsure how to get back the positive aspects of work, they can feel stuck. Worse, the inability to find life satisfaction in this stage has been associated with increased anxiety, depression, and physical health challenges.3

In other words, work can satisfy needs that are critical to our wellbeing. When your clients retire, how will those needs continue to be met? I recommend creating a letdown-proof retirement plan to complement your client’s financial plan for retirement. It may not eliminate all disappointment but should make the adjustment easier.

Third, How to Avoid a Retirement Letdown

Avoiding a retirement letdown begins with raising awareness about the challenges retirement can present. Then, thinking of ways to effectively fill in the gaps that work once did. Start with three questions to gauge clients’ risk of a retirement letdown and begin highlighting what they need to continue leading a satisfying, productive, and happy life.

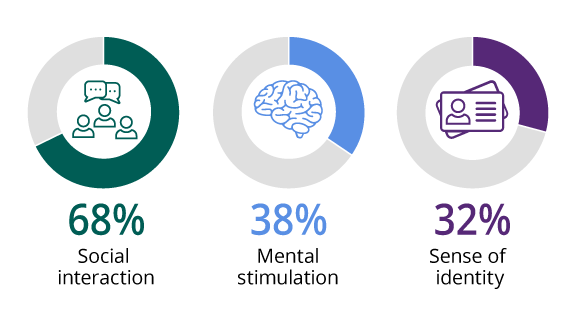

Social Interaction

Ask your client:

When you retire, how will you replace the social interaction that work provides?

At work, we chat at the coffee machine or over cubicle walls, collaborate on projects, or have lunch with coworkers. Without the buzz of work conversation and banter, clients of mine have been surprised at how quiet retirement can be.

Potential solutions:

Recommend that clients place themselves in situations where they’re more likely to interact with others—ranging from deep discussions to just shooting the breeze—and possibly build new connections.

- Plan activities or regular meet-ups to stay connected with friends and family

- Join social clubs and organizations that support your interests

- Explore a new hobby to network with others who share your passion

Your clients might already be doing these things. But they may need to be more intentional about creating a routine and frequency when they retire.

Mental Stimulation

Ask your client:

When you retire, how will you continue to use your brain power and challenge yourself intellectually?

Breaking away from the drudgery of work may sound liberating. But the intellectual stimulation and sense of accomplishment that work provides, e.g., learning new skills and information, using our creativity and problem-solving skills, and even meeting deadlines, can go unnoticed.

Potential solutions:

- Enroll in a class (a fitness class counts)

- Attend lectures or join a discussion group to learn about new subjects

- Take on a different work role, e.g., part-time work, consulting, or teaching

Identity and Purpose

Ask your client:

Who are you when you’re not working?

Identity loss poses a significant challenge for retirees, particularly when their self-concept is strongly linked to their work role. Consider how we tend to introduce ourselves using our professions: “I’m a [insert your profession here].”4 Although the concept of retirement has changed, the word “retired” still carries a stigma. People may be retired from their paid professions but not from life. But the fear of being perceived as no longer useful, irrelevant, or old can reinforce a lost sense of identity.

Potential solutions:

- Get involved in causes that are personally meaningful

- Apply or volunteer for roles that are compatible with interests and skills

- Engage in energizing projects, individually or with a group

These questions can get your clients’ wheels turning to help them build a bridge from work to the next chapter and avoid the common non-financial pitfalls that unsuspecting retirees have faced. Chances are the solutions will have multiple benefits and satisfy their needs in more than one area.

“I Never Talked About This With My Retired Clients. Is It Too Late?”

Don’t worry, it isn’t too late. You can say something such as, “A great retirement isn’t only about funding it. Many retirees go through an adjustment period, and I hear some say they miss the social and intellectual stimulation that came from working. Others are trying to rediscover who they are.

I’m interested in hearing how you feel about your transition—what’s going well and what you’re enjoying, and what you might have done differently. And if you’re having any challenges, I’m happy to discuss them with you and offer some recommendations.”

When It Comes to Creating a Avoiding a Retirement Letdown, Remember These Three Things

First, retirement is often idealized, misleading workers to believe it will be trouble free with no preparation required. Second, retirees who didn’t recognize the non-financial benefits of work can experience a retirement letdown. Third, a retirement letdown can be avoided when clients create a non-financial retirement plan to complement their financial one.

Fortunately, Geraldo Had the Last Laugh

Geraldo refused to let the empty-vault debacle sink his career. Even though the silly, high-concept stunt failed to deliver, the show got phenomenal ratings. One year later, he kicked off his syndicated talk show, Geraldo, which ran for 11 seasons. While he didn’t avoid being let down, he was able to find his purpose after all.

Next Steps

- Ask clients who aren’t yet retired one of the questions in the third section above

- Encourage them to brainstorm ideas to fill any gaps

- Begin drafting a non-financial plan with your client. It can serve as a flexible guide to be fine-tuned as retirement nears.