Over 2,000 Years Ago, Aristotle Defined Categories of Friends

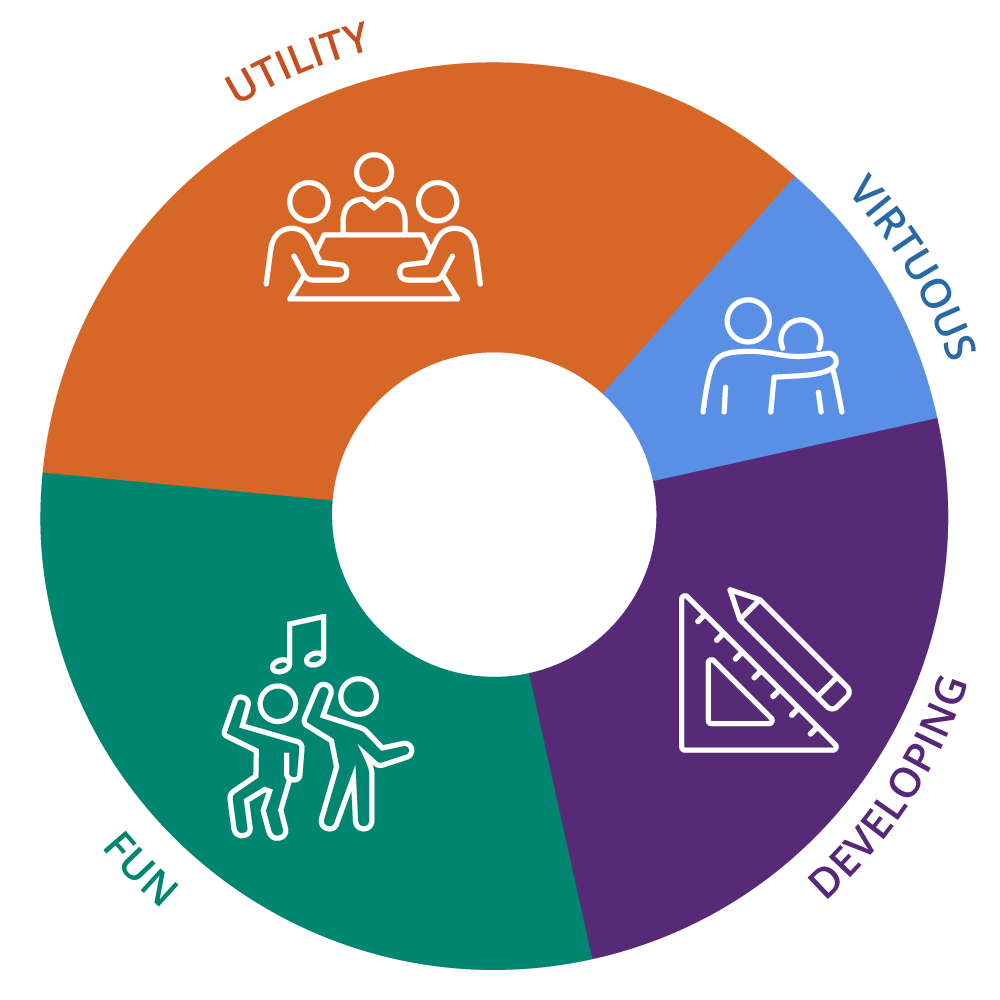

Even the ancient Greeks recognized the importance of friends. The great philosopher Aristotle categorized our friends into what might be described as the first portfolio approach to friends—utility, fun, and virtuous friends.

Utility

Utility friends are the people you see during routine activities, sometimes daily. The people with whom you share a smile, exchange a few good words, or may even have an occasional coffee with. They might be a coworker, the receptionist you say hello to each morning, or a local barista, who already knows your order before you step up to the counter.

Fun

Fun friends, as the name might suggest, are those you “just wanna have fun” with, e.g., you’re not looking for advice, consolation, etc. Fun friends are the people that we plan activities together to go out to eat, a hike, or a cruise. In short, they’re often the people that keep you going and doing.

Virtuous

Virtuous friends are our closest friends. They understand where we’ve been and where we are in our lives. They’re the ones who have our permission to nudge us in the right direction or provide support when it’s needed most (e.g., through a medical crisis or the loss of a family member).

Developing

While Aristotle named the three types of friends above, there’s another category of friends in our modern lives—developing. They’re acquaintances with whom you think there’s potential for a closer relationship. They’re the endless number of people that we see, cross paths with, and may even share a few words with in-person and online.

Evaluate Your Social Portfolio

Similar to how a well-diversified investment portfolio includes different types of investments, your social portfolio should include different types of friends. Do you think you’re lacking friends in any of the categories? There aren’t hard-and-fast rules about exactly how many friends you should have in each category. It’s good to have at least a few friends in each category.

Methods of Developing Friendships

Making new friends can be tough, but the methods below may help you make friends with people in your “Developing” category.

Rekindle

Reconnecting with old friends can be easier than making new friends, because you may already have some sort of existing relationship. This provides the chance to revisit good memories and make new ones. Example: Reach out to an old college roommate or get coffee with an old co-worker.

Repot

As with a live plant, you may want some friendships to grow beyond their initial containers. In other words, if you have a relationship with someone in one environment, how can you take the relationship outside of that? If you had a coworker who liked the outdoors, consider asking them to join you for a hike on the weekend.

Ritual

Consistency is important when it comes to connection, especially friendship. If you meet someone you’d like to befriend, or even maintain a friendship with someone you used to see regularly (like a former coworker), try getting together on a weekly basis. Activities might include attending an exercise class, a book club, meeting for lunch, etc. The keys to building friendships through ritual are being intentional, available, and reliable.

For anyone thinking their social portfolio needs a boost, there’s good news. There are ways to strengthen it using principles from financial investing: systematic investing, diversification, and monitoring.

Systematic Investing

In finance, systematic investing means investing small amounts on a regular basis over a long period of time. Why does it work? Without a consistent habit, investing is an easy thing to procrastinate.

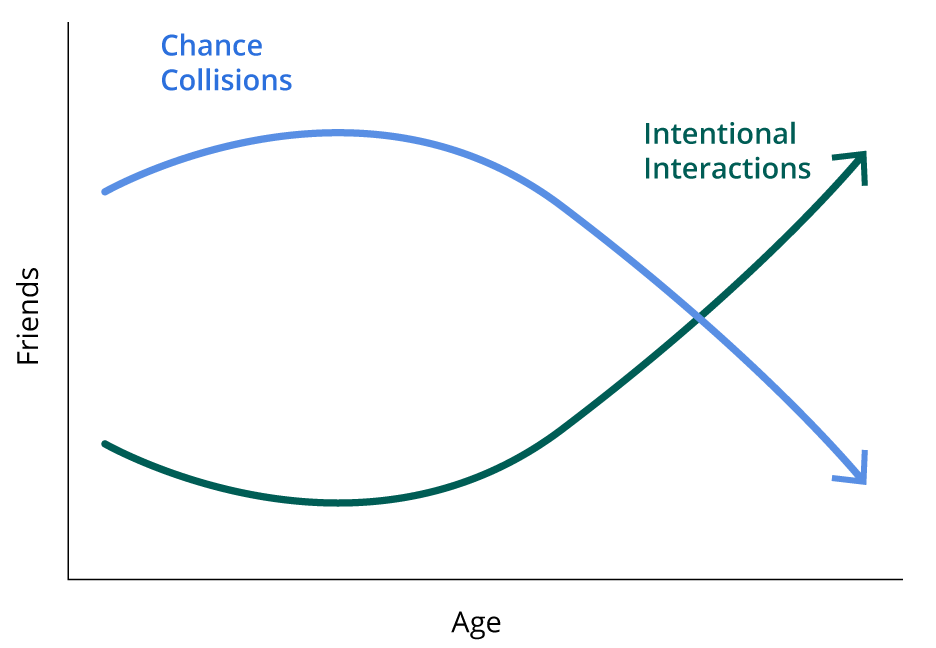

The same approach can be applied to your social portfolio by investing time in your friendships over time. As we age, especially in retirement, it’s important to invest more time to renew connections with old friends and spend more time meeting new people. Consistency and ritual can help bridge the gap between acquaintances and friends.

Diversification

Diversification means including a wide variety of investments within a portfolio. “Don’t put all your eggs in one basket” is sage guidance when it comes to investing. Investing in only one company or fund can be risky if that investment loses value.

Diversification can apply to your social portfolio too—it’s likely to be stronger if you have a variety of friends. Start by taking an inventory: Can you identify 3-5 friends in each category? If you feel like you’re lacking friends in any of the categories, focus on places and activities where you may have more opportunities to develop friendships.

Monitoring

It’s important to review results in your financial portfolio on a regular basis, at least annually. Why? Reviewing gains and losses can help us decide if any portfolio adjustments should be made.

We should monitor our social portfolio too: Last year, did I gain or lose friends? Did my friendships get stronger or weaker? Am I making enough effort to maintain and make new friends? The answer to these questions can help us determine if our social portfolio needs a little more work or if there are any areas we can tweak.

Remember Three Things About Your Social Portfolio

First, the quality of our friendships is vital to our wellbeing as we age. A strong social portfolio can provide more satisfaction, less isolation, and better health. Second, a social portfolio consists of friends in all four categories: utility, fun, virtuous, and developing. Third, building and maintaining a strong social portfolio requires investing in it using systematic investing, diversification, and monitoring.

To Age Successfully, Don’t Forget to Invest In Your Social Portfolio

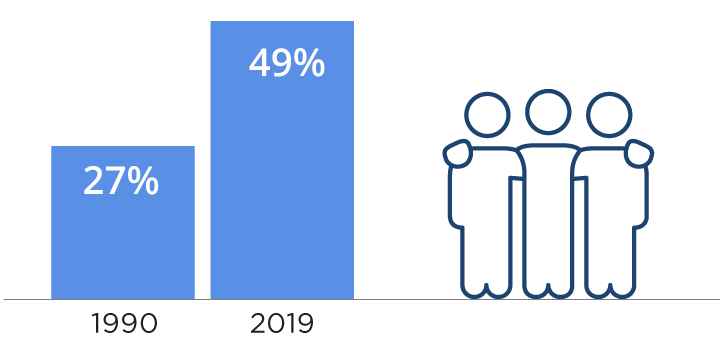

What do you think will bring happiness and satisfaction in retirement? Many believe the answer lies in having enough money and time to do the things you want. However, the Harvard Study of Adult Development found otherwise. Their research found that among aging adults surveyed, having healthy relationships was the single most important trait of happiness.6 The quality of our friendships is vital to our wellbeing as we age. A strong social portfolio can provide more satisfaction, less isolation, and better health.

Next Steps:

- Take an inventory of your friends. List a few friends you have in each of the categories: utility, fun, virtuous, and developing.

- Determine if you’re lacking friends in any of the categories

- If you are, try to repot, rekindle, or create rituals to build them up