Reporters often prepare obituaries in advance for ailing celebrities so that when the end comes, they can publish instantaneously. Occasionally, someone hits “publish” prematurely, posting tributes for public figures who are very much alive.

In the same way, much ink has been hastily spilled recently in obituaries for active management. Most of the negativity has focused on the rise of passive investing, which has enjoyed strong performance in recent years. But simply because one style of investing has come into favor does not mean others are going the way of the dodo.

So why are so many pundits ready to write off active management? And what makes us so sure that investing actively is not only a viable but essential part of investor portfolios?

What Have You Done For Me Lately?

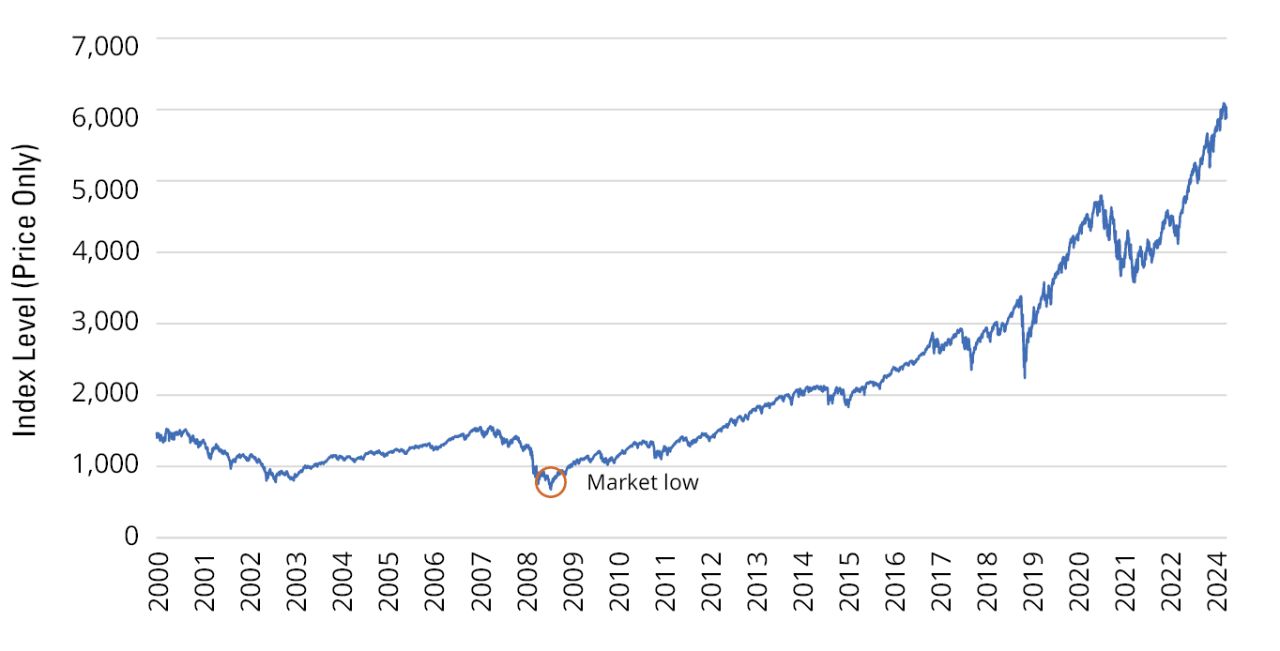

Recency bias is the tendency to believe that recently observed patterns will continue into the future, and it’s a powerful force that can influence investor decisions. But investors who only take recent performance into account are missing the forest for the trees. After all, yesterday’s events shouldn’t determine how tomorrow’s investment decisions are made.

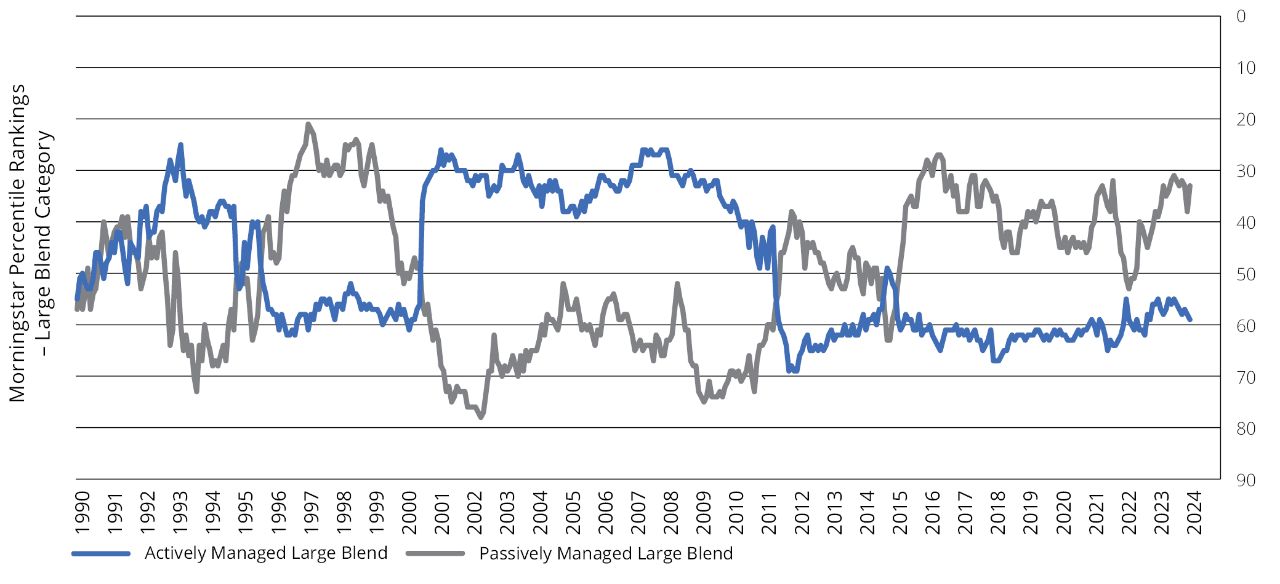

Morningstar Large Blend is the largest Morningstar category with $8.42 trillion in net assets, and it constitutes 28% of the US mutual fund and ETF market.1 We selected this category because it’s widely believed to be the most efficient—the one in which active investing supposedly makes the least sense.