1 Source: Yale Budget Lab

2 The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System. The FOMC is responsible for directing the nation's monetary policy by influencing the money supply and credit conditions to promote maximum employment, stable prices, and moderate long-term interest rates.

3 The Consumer Price Index (CPI) in the United States is defined by the Bureau of Labor Statistics as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” The Personal Consumption Expenditures (PCE) price index is a measure of the prices that people living in the US, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

4 The "long end of the yield curve" refers to the segment of the yield curve that represents long-term bonds, typically those with maturities of 10 years or greater.

5 A bull flattener occurs when long-term interest rates fall faster than short-term rates, leading to a flatter yield curve, while a bear flattener happens when short-term rates rise more quickly than long-term rates, also causing a flatter yield curve.

6 The yield curve is a graphical representation that plots the interest rates (or yields) of bonds with equal credit quality but different maturity dates at a specific point in time.

7 A "term premium" refers to the extra yield that investors demand for holding longer-term bonds compared to shorter-term ones, reflecting the compensation for bearing the risk that interest rates might change during the bond's lifespan.

8 Total return includes interest, capital gains, dividends, and distributions realized over a period. Total return accounts for two categories of return: income (including interest paid by fixed-income investments, distributions, or dividends) and capital appreciation, representing the change in the market price of an asset.

9 Go-anywhere strategies are typically benchmark-agnostic and not bound by limits on exposure by sector, quality, currency, or country. Whereas traditional core-bond-plus strategies generally have flexibility to invest across the fixed-income landscape, they generally have upper limits on the amount that can be invested in securities rated below-investment-grade, domiciled outside the US, non-US-dollar-denominated, or reside in a particular sector (e.g., emerging markets).

10 Duration is a measure of the sensitivity of an investment’s price to nominal interest-rate movement.

11 With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future. The agreement specifies the repayment and conversion terms which include the timeframe and the price per share for the conversion as well as the interest rate that will be paid until either conversion or maturity.

12 Core/core plus strategies typically invest in a baseline of investment-grade bonds such as government, corporate, and securitized debt. Core-plus funds can take that baseline and add additional sectors such as corporate high-yield, emerging-market debt, or non-US currency exposures to enhance returns.

13 Asset-backed securities (ABS) is a type of financial investment that is collateralized by an underlying pool of assets—usually assets that generate a cash flow from debt, such as loans, leases, credit card balances, or receivables.

14 Investment-grade credit refers to bonds or other debt securities deemed to have a low risk of default by credit rating agencies like Moody's, S&P, and Fitch. In essence, these are considered high-quality bonds issued by entities (corporations, municipalities, governments, etc.) with a strong capacity to meet their financial commitments.

15 Securitized credit involves pooling a large number of loans into an investable asset. Examples include mortgage-backed or asset-backed securities.

16 "Carry" generally refers to the return or cost associated with holding an asset, often used in the context of currency or asset trades, where investors borrow in a low-interest currency and invest in a higher-yielding one.

17 Subordination refers to a lower priority level of debt or securities. Subordinated debt ranks below senior debt in terms of claims on assets and earnings. This means that in the event of a default or liquidation, subordinated debt holders are paid after senior debt holders. Subordinated debt is often considered riskier because it has a lower claim on assets, but it typically offers higher interest rates to compensate for this increased risk.

18 A collateralized loan obligation (CLO) is a type of security that allows investors to purchase an interest in a diversified portfolio of company loans. There are two types of CLO tranches: debt tranches and equity tranches. Debt tranches are treated like bonds and have credit ratings and coupon payments. These debt tranches come first in terms of repayment, and there is also a pecking order within the debt tranches. Equity tranches do not have credit ratings and are paid out after all debt tranches. Equity tranches are rarely paid a cash flow but do offer ownership in the CLO itself in the event of a sale. Because equity tranche investors usually face higher risks, they often receive higher returns than debt tranche investors.

19 Commercial mortgage-backed securities (CMBS) are fixed-income investments backed by mortgages on commercial properties rather than residential real estate. Residential mortgage-backed securities (RMBS) are a type of mortgage-backed security backed by residential real estate mortgages.

20 High-yield securities, or "junk bonds," are rated below-investment-grade because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities.

21 Yield to worst is the minimum yield that can be received on a bond assuming the issuer doesn’t default on any of its payments.

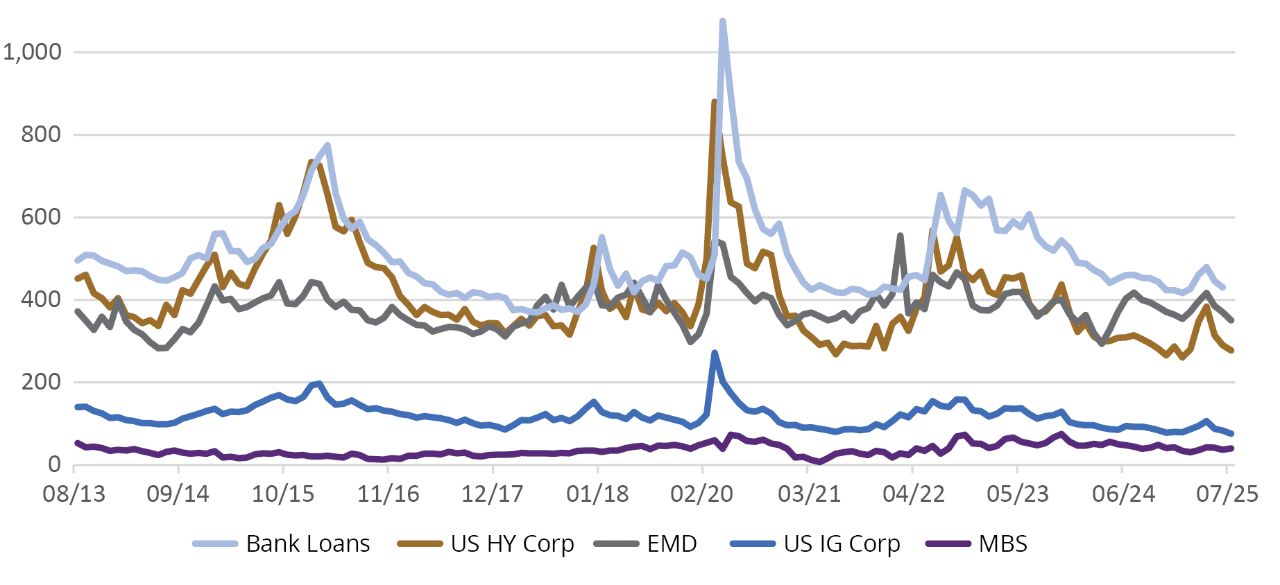

22 Spreads are the difference in yields between two fixed-income securities with the same maturity but originating from different investment sectors.

23 A leveraged loan is a type of loan provided to companies or individuals that already have a significant amount of debt or a low credit rating. These loans are considered high-risk by lenders due to the increased possibility of the borrower defaulting. To compensate for this higher risk, leveraged loans typically come with higher interest rates compared to traditional loans.

24 Emerging-market debt (EMD) are debt instruments issued by developing countries. These bonds tend to offer higher yields than Treasuries or corporate bonds in the US. Emerging-market issues tend to carry higher risks than domestic debt instruments.

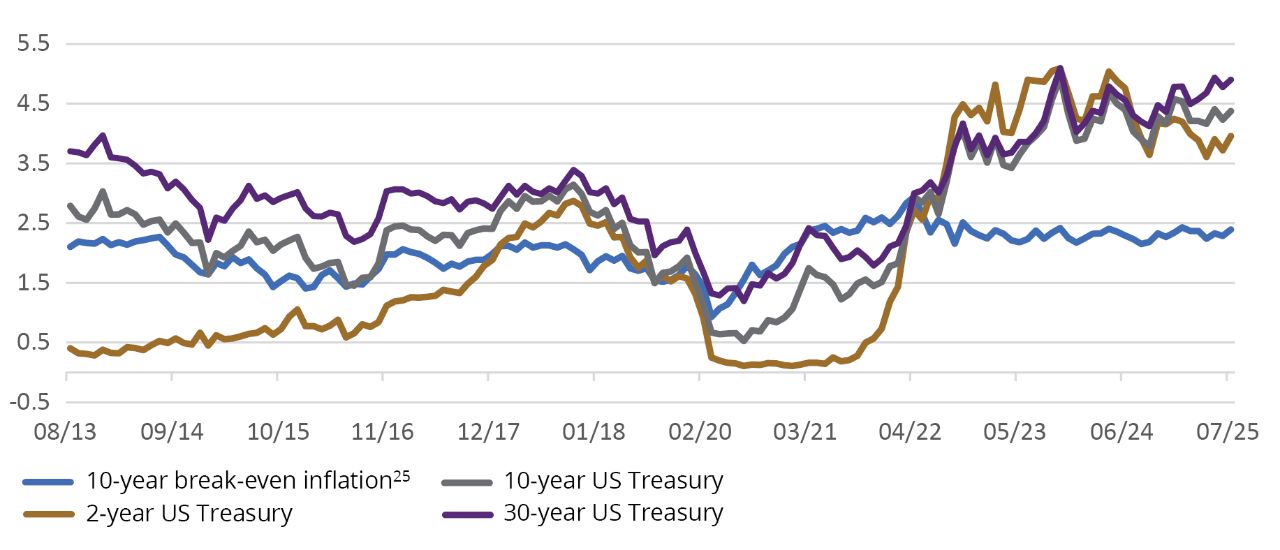

25 The break-even inflation rate is a measurement that aims to predict the effects of inflation on certain investments, by analyzing known market inflation rates from recent years. It can be calculated by comparing the yield of an inflation-based bond (such as Treasury Inflation-Protected Securities, or TIPS) with a nominal bond of the same maturity period. The difference represents the break-even inflation rate, or the rate that inflation would have to be for an investor to “break even”—or earn the same return—between purchasing TIPS or nominal Treasuries.

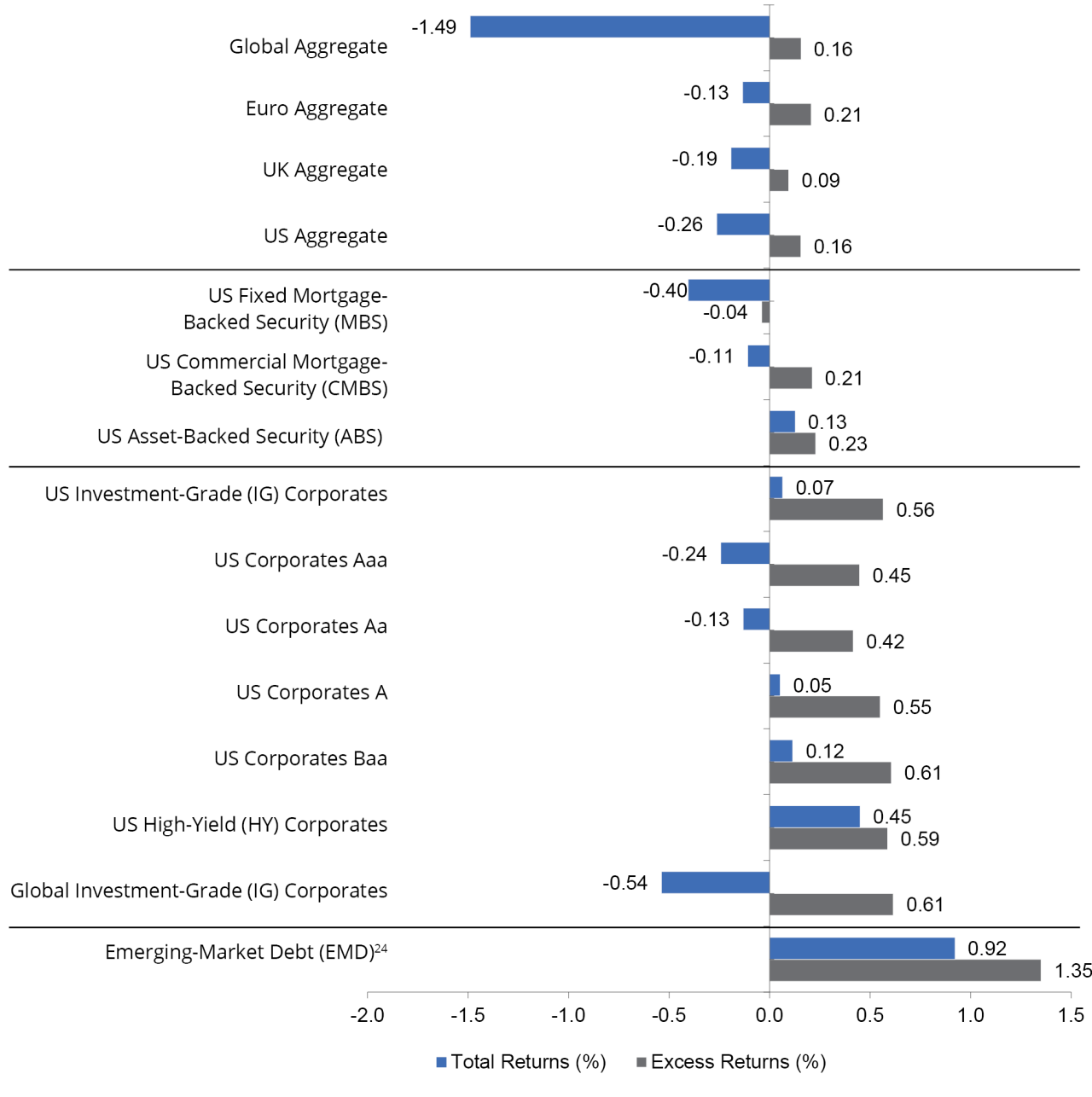

Representative Indices from Figure 4:

Global Aggregate: Bloomberg Global Aggregate Bond Index; Euro Aggregate: Bloomberg Global Aggregate Bond Index - European Euro; UK Aggregate: Bloomberg Global Aggregate Bond Index - United Kingdom; US Aggregate: Bloomberg US Aggregate Bond Index; US Fixed MBS: Bloomberg US MBS Index; US CMBS: Bloomberg CMBS ERISA Eligible Index; US ABS: Bloomberg Asset-Backed Securities Index; US IG Corporates: Bloomberg US Corporate Bond Index; US Corporates Aaa: Bloomberg Aaa Corporate Bond Index; US Corporates Aa: Bloomberg Aa Corporate Bond Index; US Corporates A: Bloomberg A Corporate Index; US Corporates Baa: Bloomberg Baa Corporate Bond Index; US High-Yield Corporates: Bloomberg US Corporate High Yield Bond Index; Global IG Corporates: Bloomberg Global Credit - Corporate Bond Index; Emerging-Markets Debt: Bloomberg Emerging Markets Hard Currency Bond Index.

Index Definitions:

Bloomberg Global Aggregate Index is a broad-based measure of the global investment-grade fixed-rate debt markets. Bloomberg Global Aggregate Bond Index - European Euro includes fixed-rate, investment-grade Euro denominated bonds. Bloomberg Global Aggregate Bond Index - United Kingdom includes fixed-rate, investment-grade sterling-denominated bonds. Bloomberg US Aggregate Bond Index is composed of securities from the Bloomberg Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index. Bloomberg US MBS Index tracks fixed-rate agency mortgage backed passthrough securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). Bloomberg CMBS ERISA Eligible Bond Index measures the performance of investment-grade commercial mortgage-backed securities, which are classes of securities that represent interests in pools of commercial mortgages. The index includes only CMBS that are Employee Retirement Income Security Act of 1974. Bloomberg Asset-Backed Securities Index, the ABS component of the Bloomberg US Aggregate Index, has three subsectors: credit and charge cards, autos, and utility. Bloomberg US Corporate Bond Index covers all publicly issued, fixed rate, nonconvertible, investment-grade debt. Bloomberg Aaa Corporate Bond Index is designed to measure the performance of investment-grade corporate bonds that have a credit rating of Aaa. Bloomberg Aa Corporate Bond Index is designed to measure the performance of investment-grade corporate bonds that have a credit rating of Aa. Bloomberg A Corporate Bond Index is designed to measure the performance of investment-grade corporate bonds that have a credit rating of A. Bloomberg Baa Corporate Bond Index is designed to measure the performance of investment-grade corporate bonds that have a credit rating of Baa. Bloomberg US Corporate High Yield Bond Index is an unmanaged broad-based market-value-weighted index that tracks the total return performance of non-investment grade, fixed-rate, publicly placed, dollar denominated and nonconvertible debt registered with the Securities and Exchange Commission. Bloomberg Global Credit - Corporate Bond Index is an unmanaged index considered representative of fixed rate, non-investment grade debt of companies in the US, developed markets, and emerging markets. Bloomberg Emerging Markets Hard Currency Bond Index includes USD-denominated debt from sovereign, quasi-sovereign, and corporate EM issuers. Morningstar/LSTA Leveraged Loan Index is a market-value-weighted index that is designed to measure the performance of the US leveraged loan market based upon market weightings, spreads, and interest payments. J.P. Morgan EMBI Global Diversified Index is a broad-based, unmanaged index which tracks liquid, US Dollar emerging-market fixed- and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. • Mortgage-related and asset-backed securities’ risks include credit, interest-rate, prepayment, and extension risk. The value of the underlying real estate of real estate related securities may go down due to various factors, including but not limited to strength of the economy, amount of new construction, laws and regulations, costs of real estate, availability of mortgages, and changes in interest rates. • Loans can be difficult to value and less liquid than other types of debt instruments; they are also subject to nonpayment, collateral, bankruptcy, default, extension, prepayment and insolvency risks. • Foreign investments may be more volatile and less liquid than US investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets. • The risks associated with mortgage-related and asset-backed securities as well as collateralized loan obligations (CLOs) include credit, interest-rate, prepayment, liquidity, default, and extension risk. • Diversification does not ensure a profit or protect against a loss in declining markets.

The views expressed herein are those of Wellington Management, are for informational purposes only, and are subject to change based on prevailing market, economic, and other conditions. The views expressed may not reflect the opinions of Hartford Funds or any other sub-adviser to our funds. They should not be construed as research or investment advice nor should they be considered an offer or solicitation to buy or sell any security. This information is current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management or Hartford Funds.