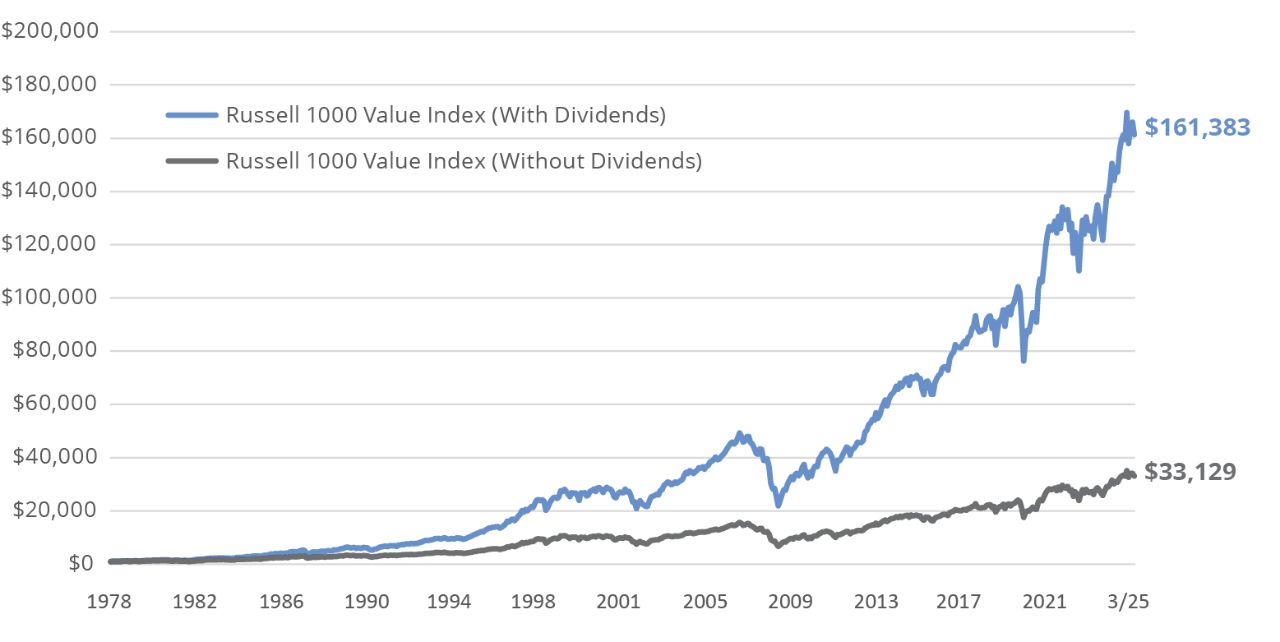

1 Russell 1000 Growth Index has returned 54.48% over the 3-year period ending 4/30/25 vs. 24.61% for the Russell 1000 Value Index. Past performance does not guarantee future results.

2 The Russell 1000 Value Index returned -0.98% year to date through 4/30/25 vs. -8.37% for the Russell 1000 Growth Index. Past performance does not guarantee future results.

3 The price-to-earnings ratio measures a company’s share price relative to its earnings-per-share and helps assess the relative value of a company’s stock.

Index Definitions

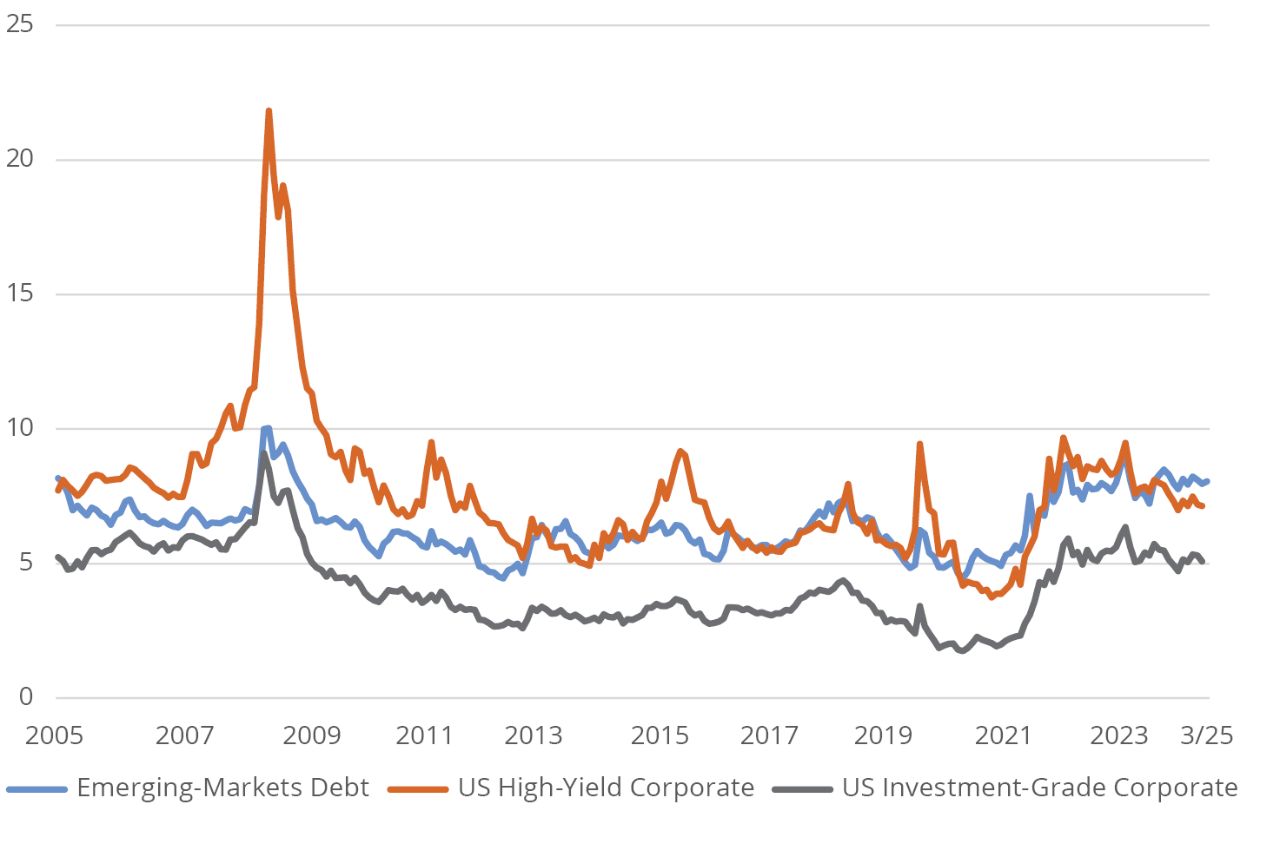

Bloomberg US High Yield 2% Issuer Cap Index is a market capitalization-weighted index that tracks the performance of US dollar-denominated, non-investment-grade, fixed-rate corporate bonds.

Bloomberg US Corporate Index is a market-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more.

JPMorgan Emerging Markets Bond Index Plus is a broad-based, unmanaged index which tracks total return for external currency denominated debt (Brady bonds, loans, Eurobonds and US dollar-denominated local market instruments) in emerging markets.

Russell 1000 Growth Index is an unmanaged index which measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Value Index is an unmanaged index measuring the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. Indices are unmanaged and not available for direct investment.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Important Risks: Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The portfolio managers may allocate a portion of the Fund’s assets to specialist portfolio managers, and among different asset classes, each of which may not work as intended. • Fixed income security risks include credit, liquidity, call, duration, event and interest-rate risk. As interest rates rise, bond prices generally fall. • For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. • Value investing style may go in and out of favor, which may cause the Fund to underperform other funds that use different investing styles. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. • Restricted securities may be more difficult to sell and price than other securities. • Derivatives are generally more volatile and sensitive to changes in market or economic conditions than other securities; their risks include currency, leverage, liquidity, index, pricing, valuation, and counterparty risk.

Diversification does not ensure a profit or protect against a loss.