1 The Consumer Price Index (CPI) in the United States is defined by the Bureau of Labor Statistics as a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

2 The real return on an investment is its annual growth rate after adjusting for the effects of inflation. It represents the actual increase in purchasing power an investor gains from an investment, reflecting the change in the value of money over time.

3 Real GDP is the value of a country’s total output of goods and services adjusted for inflation or deflation. It allows economists, policymakers, and analysts to assess the underlying growth of an economy without the distortion caused by changes in prices. Nominal GDP, also called “current dollar” GDP, is the total in dollars (or any other currency) of goods and services consumed, plus government expenditures, investments, and exports, minus total imports. In the context of equities, the nominal value of a company’s stock is a value assigned when it is issuing share capital. It is the lowest limit set to the value of a share of stock and has nothing to do with the real value, which is the price at which the shares are traded.

4 Market capitalization, or market cap, is the current market value of all of a company’s outstanding stock shares. Market cap is often used to indicate a company’s size and worth in comparison to its peers.

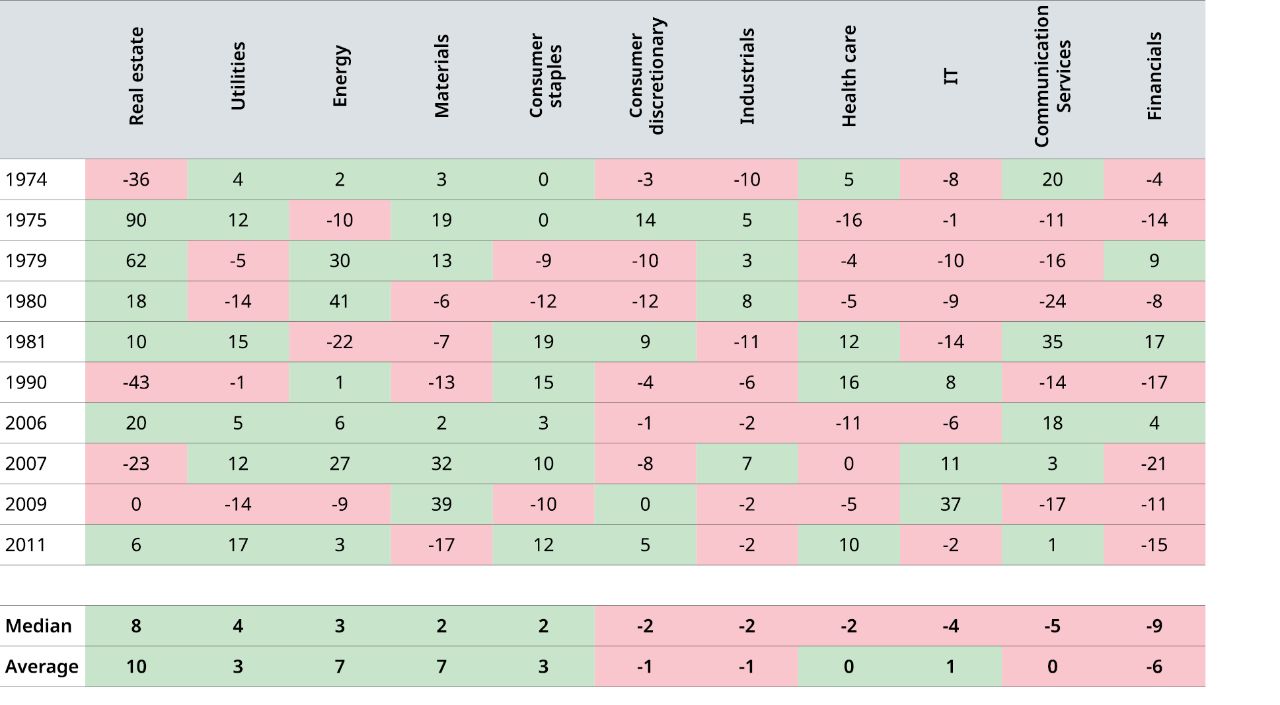

5 LSEG DataStream provides sector indices that are based on the TRBC (The Reference Data Business Classification) industry classification. These indices allow for the analysis and comparison of developed, emerging, and select frontier markets across various levels of granularity. They are highly correlated with popular global benchmarks and cover over 99.5% of the investable market capitalization for each market.

6 Source: Kenneth French data library available at: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

7 The price-to-earnings (P/E) ratio measures a company’s share price relative to its earnings-per-share and helps assess the relative value of a company’s stock.

8 Present value is based on the concept that a sum of money in hand today is probably worth more than the same sum in the future because it can be invested and earn a return in the meantime. Calculating present value allows an investor to compare the potential performance of various investments by determining the current worth of the number of dollars that each investment will return by a future date.

9 The yield curve is a line that plots interest rates of bonds having equal credit quality but differing maturity dates; its slope is used to forecast the state of the economy and interest-rate changes.

10 EM refers to emerging markets, defined as markets that are transitioning from a developing to a developed stated, characterized by rapid growth, increasing industrialization, and growing integration with the global economy. EMU refers to the MSCI EMU Index (European Economic and Monetary Union), which captures large and mid-cap representation across the developed market counties in the European Economic and Monetary Union. ACWI refers to the MSCI ACWI Index, which captures large and mid-cap representation across developed-market and emerging-market countries.

11 GICS, or the Global Industry Classification Standard, is a hierarchical system used to categorize companies by industry, developed by MSCI and S&P Dow Jones Indices. It provides a common framework for investors, analysts, and other market participants to understand and compare companies based on their business activities. The GICS structure includes four levels: Sectors, Industry Groups, Industries, and Sub-Industries.

The IA SBBI US Large Stock Index is an index that measures the performance of the U.S. large-cap equity market. It is part of the Ibbotson Associates Stocks, Bonds, Bills and Inflation (SBBI) series and is used to provide historical data and insights into the performance of this market segment.

The IA SBBI US 30 Day T-Bill USD Index measures the performance of a single issue of outstanding Treasury bill which matures closest to, but not beyond, one month from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month that issue is sold and rolled into a newly selected issue.

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. The index covers approximately 85% of the free float-adjusted market capitalization in the US.

The MSCI United Kingdom Index is designed to measure the performance of the large and mid cap segments of the UK market. The index covers approximately 85% of the free float-adjusted market capitalization in the UK.

The MSCI EMU Index (European Economic and Monetary Union) captures large and mid cap representation across the 10 Developed Markets countries in the EMU. With 219 constituents, the index covers approximately 85% of the free float-adjusted market capitalization of the EMU.

The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market. The index covers approximately 85% of the free float-adjusted market capitalization in Japan.

The MSCI ACWI Index captures large and mid cap representation across Developed Markets (DM) and Emerging Markets (EM) countries. The index covers approximately 85% of the global investable equity opportunity set.

Important Risks: Investing involves risk, including the possible loss of principal. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets. • Focusing on one or more sectors, may subject inventors to increased volatility and risk of loss if adverse developments occur. • Risks of focusing investments on the healthcare related sector include regulatory and legal developments, changes in funding or subsidies, patent and intellectual property considerations, intense competitive pressures, rapid technological changes, long and costly process for obtaining product approval by government agencies, potential product obsolescence, rising cost of medical products and services, and price volatility risk. • Investments in the commodities market may increase the Fund’s liquidity risk, volatility and risk of loss if adverse developments occur. Investments linked to prices of commodities may be considered speculative. • The value of the underlying real estate of real estate related securities may go down due to various factors, including but not limited to, strength of the economy, amount of new construction, laws and regulations, costs of real estate, availability of mortgages and changes in interest rates.

The views expressed herein are those of Schroders Investment Management, are for informational purposes only, and are subject to change based on prevailing market, economic, and other conditions. The views expressed may not reflect the opinions of Hartford Funds or any other sub-adviser to our funds. They should not be construed as research or investment advice nor should they be considered an offer or solicitation to buy or sell any security. This information is current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Schroders Investment Management or Hartford Funds.