Global currencies, especially the US dollar (USD), play a key role in shaping investment outcomes. While currency shifts often happen behind the scenes, their impact on portfolios can be significant and sometimes surprising. With recent swings in the dollar catching many investors off guard, it’s worth taking a closer look at what drives these changes and what it means for investments.

The Dollar’s Recent Trends

For much of the past decade, the USD was on a steady winning streak. Investors got used to seeing the dollar grow stronger compared to other currencies, which made international investments look less attractive when those gains were converted back to dollars. Many professionals even used strategies to “hedge” against currency swings, and for a while, those moves paid off.

But in early 2025, things changed quickly. The dollar dropped about 10%—a sharp reversal driven by shifting US interest rates, changing global growth patterns, and evolving trade dynamics. As a result, the old playbook didn’t seem to work anymore, and investors began asking new questions: What’s next for the dollar? How will future currency moves influence portfolios?

Factors That Shape the USD (and Make it Unpredictable)

The USD doesn’t move in a vacuum—it’s shaped by a mix of factors. There are the by-the-numbers influences, such as differences in interest rates between countries, how fast economies are growing, and how much nations are trading with each other. Economists and market analysts track these closely, and they’re often referenced in financial news to predict how currencies will react.

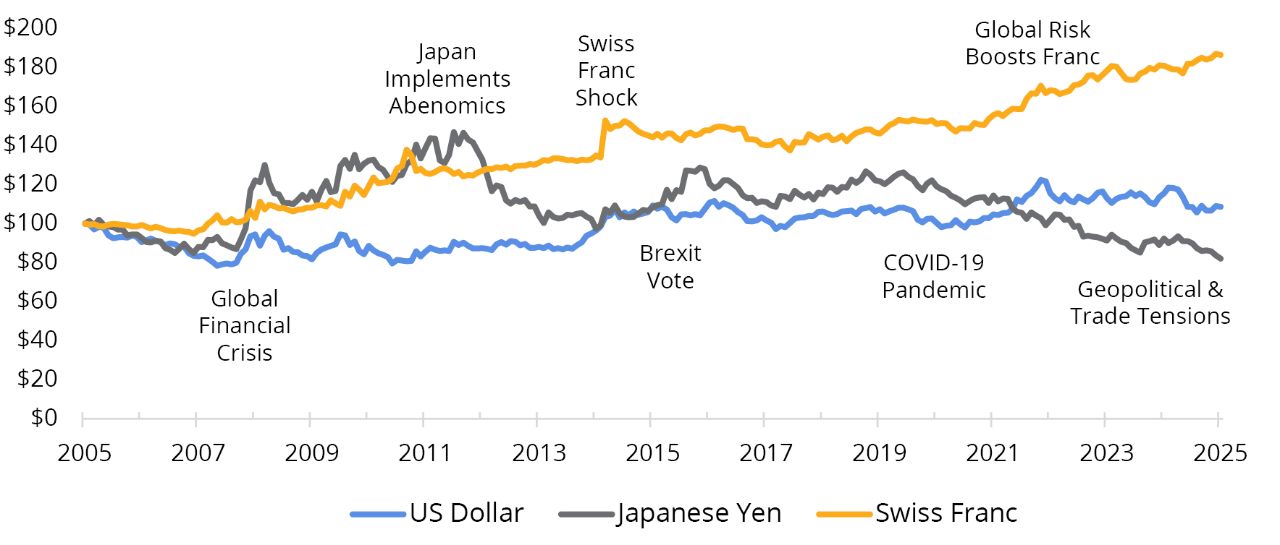

Other factors are harder to measure; wars, natural disasters, or shifts in trade policies can shake up currency markets in unpredictable ways. And when uncertainty rises, investors often flock to “safe-haven” currencies such as the USD, Japanese yen, or Swiss franc, driving up their value—but not always in sync (FIGURE 1).