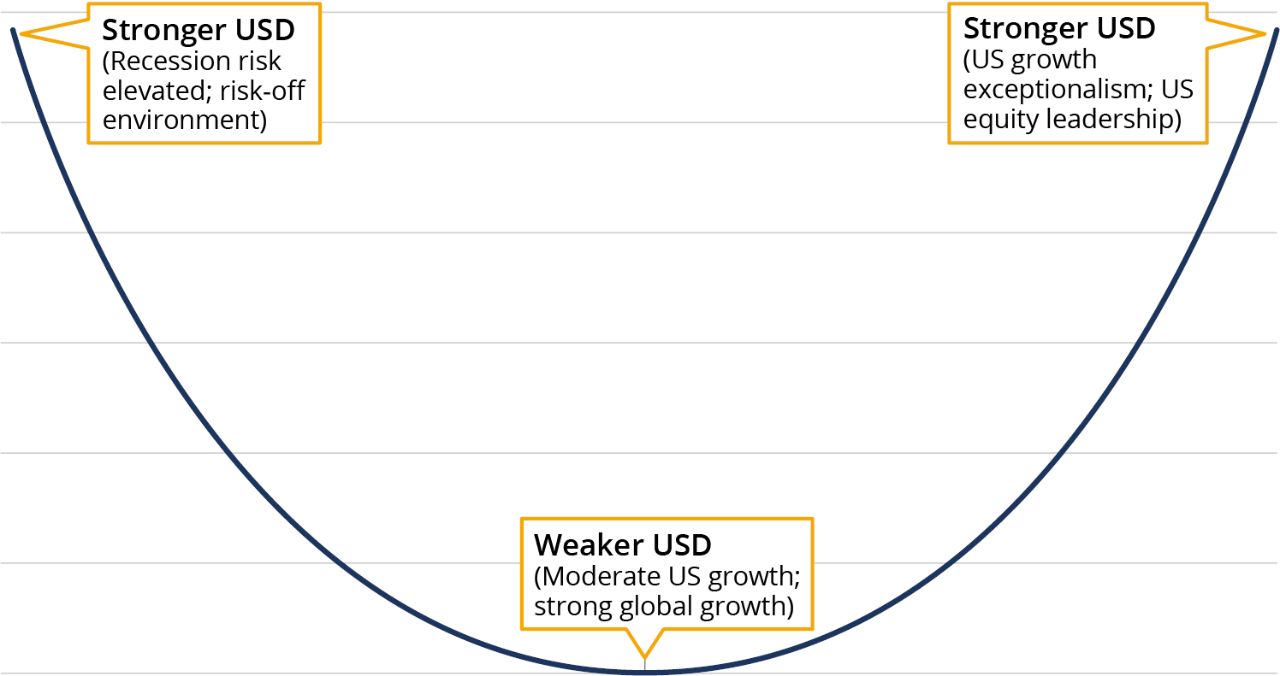

The Dollar Smile Theory posits that the world’s reserve currency tends to appreciate both when the US economy is weak (as investors take flight to quality) and when it’s strong (as investors become optimistic about US growth). The theory also holds that the dollar weakens in the middle part of the distribution (the bottom of the smile) when US growth moderates relative to the rest of the world (FIGURE 1). During April, when volatility gripped markets amid tariff concerns, the dollar sold off even as stocks plunged and odds of a US recession rose. To understand why the theory did not hold and what it could mean for markets from here, it’s worth considering the perspective of foreign (ex-US) asset allocators.

FIGURE 1

The Dollar Smile Theory

Source: Wellington Management.

Why Foreign Allocators Sold Dollars—Not US Stocks or Bonds

During the past 15 years, foreign ownership of US assets has increased dramatically to around $26 trillion, or 88% of GDP.1 This is largely due to US asset-price performance dwarfing the performance of most other nations, coupled with very strong dollar appreciation. Foreign investors have become conditioned to leave sizable portions of their US assets unhedged, meaning they lose money if their home currency appreciates against the US dollar. Foreign allocators tend to hedge their US bond holdings more than their stock holdings, because fixed-income volatility is typically lower, and bondholders can substitute a variety of credit instruments to offset the cost of currency hedging.

Throughout April, bond yields rose due to fears of foreign selling. But since positions were largely currency hedged, it didn’t happen. There was, however, persistent foreign selling of US dollars, even after the Trump administration slashed its previously announced tariffs for most countries. This makes sense. These investors were experiencing losses on their unhedged stock portfolios at the same time their currencies were appreciating against the dollar. When a position goes against you, you can either hedge or sell the asset. Not surprisingly, most foreign investors chose to hedge their currency risk first, given President Donald Trump’s seeming preference for a weaker dollar and investors’ reluctance to realize big losses on their stock portfolios.

There’s been a bear market in international diversification since 2010, but the dollar’s crooked smile might reverse this trend.

Implications for US Equity Markets

The stock market has recovered, and I think it’s now much more likely that foreigners will use this strength to reduce their US stock allocations and remove some of their unhedged currency risk. Since early April, the currencies that have appreciated the most are countries with the largest positive net international positions (i.e., they own assets abroad). These include Switzerland, Japan, Korea, and Taiwan. At the same time, Norway, Canada, and Australia (among others) have multi-trillion-dollar US-equity-markets holdings—many of which are unhedged—through their pension systems. If these countries start taking profits on their US holdings and/or further hedge their currency risk by selling USD and buying domestic currencies, then a dampening effect on the upside potential for US equity prices is very possible.

In 2022, when the negative correlation between bond and stock returns became dislocated, many asset allocators sought new sources of diversification, moving into gold or Bitcoin and out of bonds to hedge their portfolios. Following the dollar’s recent decline during an intense risk-off episode, I believe that many non-US allocators will do something similar, diversifying their US equity exposure by turning toward their home markets and other global assets.

Since 2010, there’s been a bear market in international diversification, with US stocks outperforming the rest of the world by close to 300%.2 The dollar’s crooked smile might reverse this trend and reshape the flow of international investment capital.

To learn more about how the US dollar could impact your portfolio, please talk to your financial professional.

1 Source: Bureau of Economic Analysis

2 Source: Bloomberg

Important Risks: Investing involves risk, including the possible loss of principal • Foreign investments may be more volatile and less liquid than US investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets.

The views expressed herein are those of Wellington Management, are for informational purposes only, and are subject to change based on prevailing market, economic, and other conditions. The views expressed may not reflect the opinions of Hartford Funds or any other sub-adviser to our funds. They should not be construed as research or investment advice nor should they be considered an offer or solicitation to buy or sell any security. This information is current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management or Hartford Funds.