|

Crypto what? – Cryptocurrency is a relatively new digital currency that’s an alternative to the US dollar and other traditional currencies. Bitcoin was created in 2009 and is the largest and oldest cryptocurrency. |

|

|

Mystery man – Bitcoin was the brainchild of Satoshi Nakamoto, a pseudonym used by the author of a white paper written in 2008. Several people have claimed to be Nakamoto, but his or her true identity remains a mystery. |

|

|

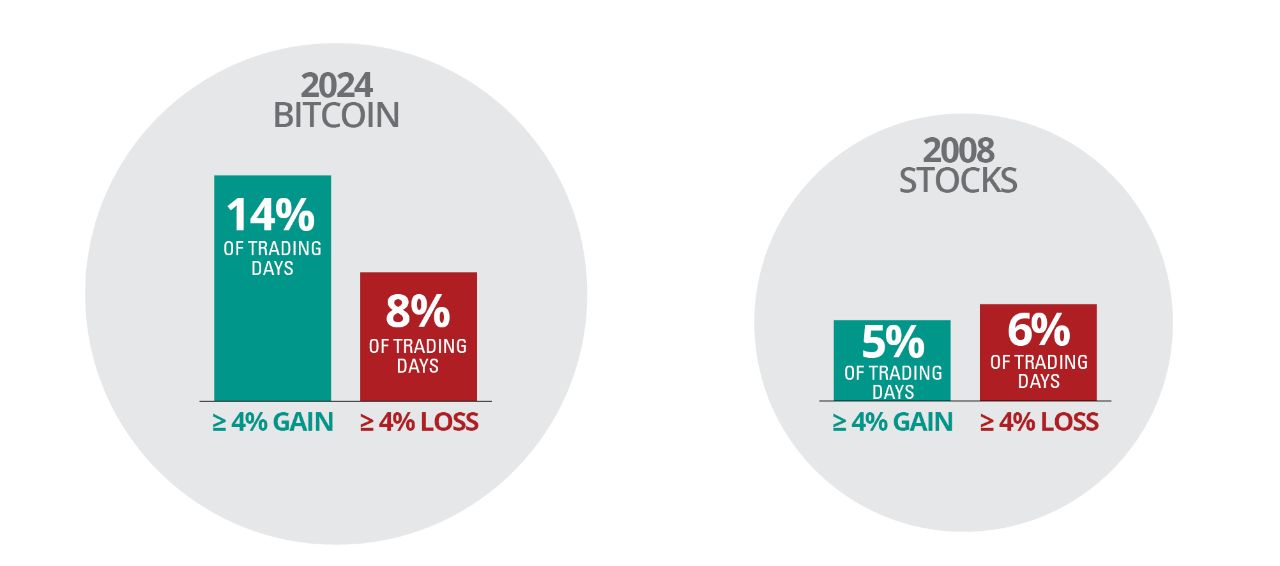

Fasten your seatbelts – Bitcoin had more dramatic price drops in 2024 than stocks had in 2008—the most volatile year for stocks on record due to the Global Financial Crisis (FIGURE 1). |

|

|

Put on your thinking cap – Bitcoin is created when programmers solve complex computations that are added to the blockchain—the public ledger that records all Bitcoin transactions. This process, known as mining, requires a lot of time and significant computing power. |

|

|

Finite supply creates scarcity – The maximum number of Bitcoins that will be created through mining is 21 million. As of December 31, 2024, there were about 1.1 million Bitcoins left to be mined.1 This finite supply is one reason why some people believe Bitcoin will increase in value over time. |

|

|

What's in your digital wallet? – Bitcoins are purely digital and stored electronically in programs called wallets that are secured by passwords. Once you transfer Bitcoin to someone else, there’s no way to retrieve it or dispute the transaction. |

|

|

Save some gains for Uncle Sam – The IRS treats Bitcoin as property rather than currency. If you receive Bitcoin as compensation, it’s considered taxable income. You also need to calculate your gain or loss every time you spend Bitcoin. Short-term gains (<1 year) are taxed as ordinary income, and long-term gains (1 year or more) are taxed as capital gains. Tax losses are treated the same as stocks. |

|

|

Don't lose your password! – Around 20% of Bitcoin, valued at approximately $140 billion, is lost forever because people forgot their passwords.2 Download our free “Get It Together” worksheet available on hartfordfunds.com to organize all your financial records, including cryptocurrency passwords. |

|

|

Value is in the eye of the beholder – Unlike stocks and bonds, Bitcoin doesn’t have any intrinsic value based on corporate earnings or cash flows. Therefore, when risk assets3 such as stocks come under stress, Bitcoin’s price may fluctuate wildly. But as with traditional currency, Bitcoin has value as long as people accept it as currency. Platforms such as PayPal and Square accept payments in Bitcoin, but a conversion to a fiat currency is required before the payments settle. |

|

|

Digital gold? – Some institutions and wealthy investors are using Bitcoin as an alternative asset class similar to gold (some call it digital gold), though it remains to be seen if this trend will continue in light of large-scale crypto scandals and the lack of regulation. |

FIGURE 1

Bitcoin Had More Large Price Drops in 2024 Than Stocks Had in 2008

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Stocks are represented by the S&P 500 Index, a market capitalization-weighted price index composed of 500 widely held common stocks. Bitcoin is represented by the FTSE Bitcoin Index, which aims to represent the value of one Bitcoin in US dollars each weekday sourcing data from qualified exchanges. Data Sources: FactSet and FTSE Bitcoin Index, 1/25.

FIGURE 2

Bulls and Bears Weigh in on Bitcoin

| Bitcoin Bulls Say | Bitcoin Bears Say |

| Bitcoin belongs to the people; it can’t be manipulated by central banks that devalue their currencies by printing more money |

Bitcoin has no intrinsic value; it could potentially lose all its value and become worthless |

| The limited supply of Bitcoin could result in higher demand once the final supply of Bitcoin is mined | A better cryptocurrency could come along, which would decrease the value of Bitcoin |

| President Donald Trump has suggested creating a strategic Bitcoin reserve; this would boost demand, especially if other countries follow suit | Bitcoin’s price is highly volatile, so creating a Bitcoin reserve could create significant economic instability, both domestically and globally |

| If wealthy individuals and institutions allocate 2-3% of their portfolios to Bitcoin for diversification, the demand will soar | A handful of people currently own a large portion of Bitcoin; they could quickly devalue it if they decide to unwind their positions |

| Exchange-traded funds and other investments focused on cryptocurrencies could provide demand and liquidity to Bitcoin | The UK banned sales of certain crypto-derivative products to retail investors; this highlights the regulatory risks that could put downward pressure on Bitcoin’s price |

Your financial professional can help you decide if cryptocurrency is right for you.

1 Source: Investopedia,“What Happens to Bitcoin After All 21 Million Are Mined?,” 12/22/24.

2 Source: New York Times, “Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes,” 1/12/21. Most recent data available.

3 Risk assets refer to assets that have historically exhibited a significant degree of price volatility, such as global equities, commodities, high-yield bonds, real estate, and currencies.

Important Risks: Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit or protect against a loss in a declining market.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities, or to adopt any investment strategy.