Rising and falling interest rates can have a significant impact on US Treasuries, which are issued by the US government. Other bond types, such as corporate bonds and mortgage-backed bonds, could be impacted differently due to credit risk (i.e., concerns about the issuer’s ability to make timely bond payments) and other factors.

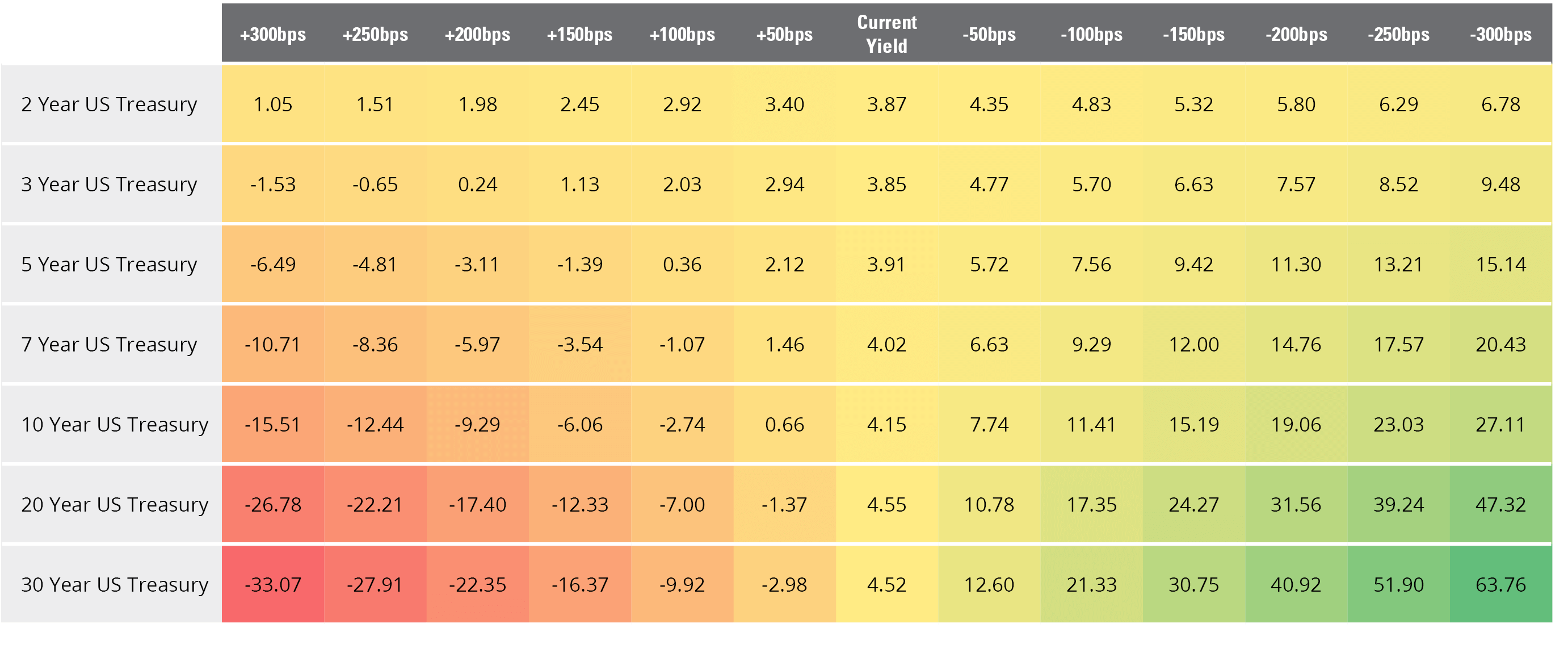

The Hypothetical Impact of Rising and Falling Rates on Treasuries (%, as of 12/31/25)

A basis point (bps) is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. For example, +100 bps is the equivalent of a 1% increase in interest rates. Changes to hypothetical return based on a security’s duration and convexity affect return. Duration is a measure of the sensitivity of an investment’s price to changes in interest rates. Convexity is a measure of how a bond’s duration can change based on the magnitude of an interest-rate change. Data Sources: Bloomberg and Hartford Funds, 1/26.

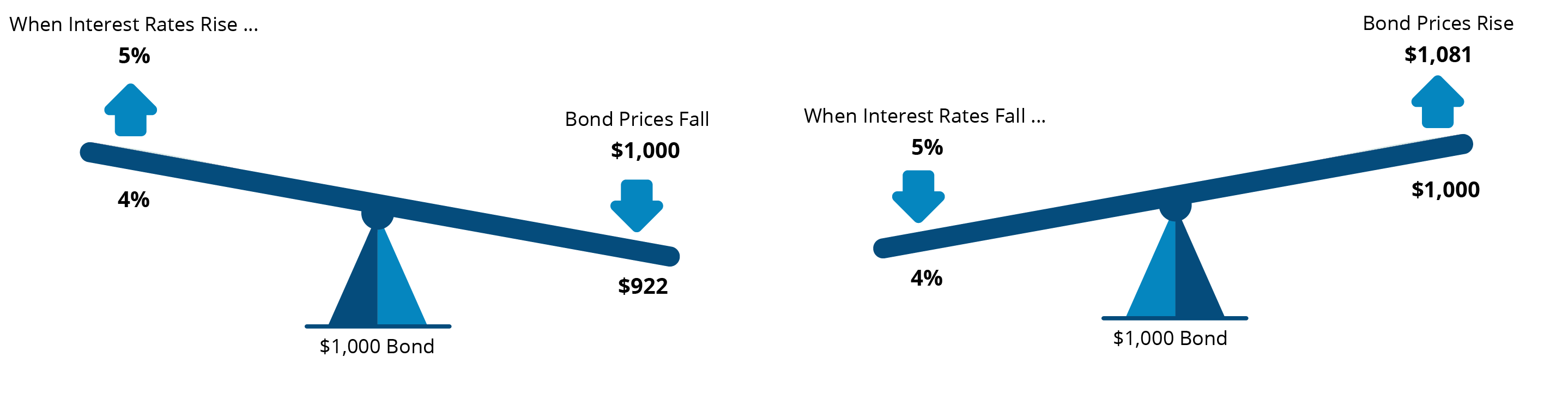

The Interest-Rate See Saw

Bond prices and interest rates have an inverse relationship: When interest rates rise, bond prices fall and vice versa—just like a see saw.

Higher interest rates allow bond investors to collect more interest on new bond purchases, but the principal value of their existing bonds will drop in value. When interest rates increase at a slow and steady pace over several years, bond investors may not feel the impact too much because the higher interest payments help offset the decline in bond principal. When rates rise rapidly, however, it can be painful because the drop in a bond’s principal value is greater than the additional interest income.

Bonds and Interest Rates Have an Inverse Relationship

For illustrative purposes only. Assumes a bond with a fixed semi-annual coupon and 10-year maturity. Source: Hartford Funds.

Purchasing bonds when interest rates are at or close to their peak could be a prudent strategy for capital appreciation since the principal value of bonds will likely increase as interest rates fall. You could also consider purchasing an actively managed bond fund or ETF to let professional money managers decide how to navigate changing interest rates.

Talk to your financial professional for help with managing interest-rate risk in your fixed-income portfolio.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed-income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting, or legal advice. As with all matters of an investment, tax, or legal nature, you should consult with a qualified tax or legal professional regarding your specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice. Tax laws and regulations are complex and subject to change.