Social Security was never intended to be the sole source of income for older Americans. Originally developed in the 1930s to supplement employer-sponsored plans and other personal savings, it’s now become the primary income source for many retirees.

Nearly 9 out of 10 people age 65 and older received Social Security benefits in 2024. By the end of 2025, almost 69 million Americans will have received over $1.6 trillion in monthly benefits during the year.1 However, the gap between what we receive from Social Security and the income many of us will need in the years to come may be wide.

That’s why it’s crucial to consider how timing, income, and taxes impact your Social Security benefits. Understanding more about these factors can help you plan accordingly, avoid surprises, and prepare for what you may need to find other sources of income to fill any gaps.

When Should I Begin Taking Social Security?

Let’s start with your biggest priority—knowing the amount of your Social Security benefits. The age you start taking benefits may affect that amount more than you realize. To have a successful retirement, it’s important to think about how much income you’ll actually need versus when you should file. When you figure that out, choosing when to file becomes a whole lot easier.

Today, 67 is full retirement age for anyone born in 1960 and later. Your benefits grow by 8% every year that you delay claiming them. The longer you hold off, the greater your benefits will be.

Amount of Full Social Security

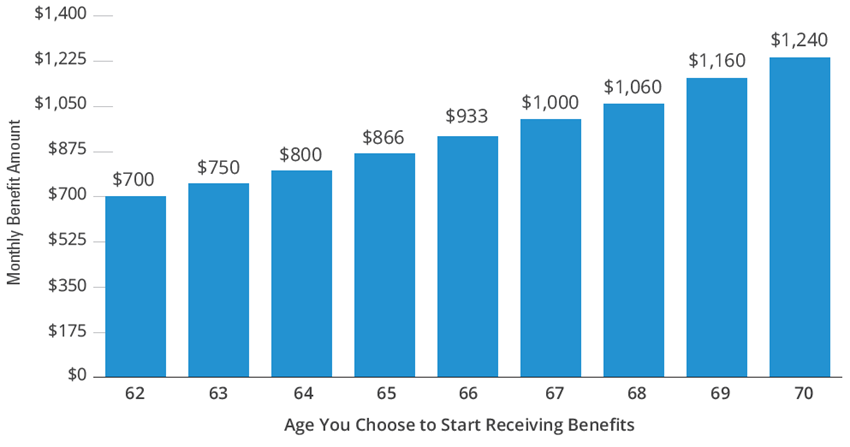

Monthly Benefit Amounts Differ Based on the Age You Decide to Start Receiving Benefits

This example assumes a benefit of $1,000 at a full retirement age of 67

You can receive retirement benefits starting as early as age 62 or as late as age 70. In the example above, age 67 is full retirement age. Taking full retirement before age 67 could reduce your benefits by 25%–30%. Conversely, deferring until age 70 could result in benefits that are 30% higher. Source: ssa.gov.

There are certainly pros and cons to taking them early or waiting. You can actually delay taking them all the way to age 70 before you stop seeing incremental increases in the benefit amount. If you can delay taking benefits until at least 70, you’ll have increased your annual Social Security income by 77% relative to someone who began taking benefits early at 62.

What Happens If I Continue To Work?

If you’re thinking about working while receiving Social Security benefits, your benefits may be reduced depending on when you file.

- Before full retirement age, benefits are reduced $1 for every $2 above $23,400 in earned income (the 2025 limit).

- At full-retirement age, benefits are reduced $1 for every $3 above $62,160 in earned income (the 2025 limit).

- After full retirement age, there’s no limit on earnings. Withheld earnings are returned.

Suppose you’re 63 and have work earnings of $30,000. You’ve exceeded your limit by $6,600 ($30,000 in earnings minus $23,400). Because of that, $3,300 (which is 50% of the overage) is going to be subtracted from your Social Security benefit. If your Social Security benefit is supposed to be $750 a month, or $9,000 a year, your benefit is going to be reduced dramatically. Instead, the benefit amount you’d receive will only be $5,700 ($9,000 minus $3,300), or $475 per month. In other words, your monthly benefit will be reduced by 37%, or $275 a month ($750 minus $475), because you’ve chosen to continue working.

For those winding down work or working part-time, taking benefits may make sense. For those who are remaining at the same compensation level, you should consider delaying receiving benefits. The good news is you’d get that $275 a month back, but not until full-retirement age. It would gradually be paid back after you reach full-retirement age, even if you continue to work.

Will My Benefits Be Taxed?

Your benefits may be taxed. The question is if they are, at what percentage? That depends on a combination of your “combined income” and your tax bracket. The Internal Revenue Service defines “combined income” as a combination of your adjusted gross income, nontaxable interest income, and one-half of your Social Security benefits.

If you file as an individual and your combined income is between $25,000 and $34,000, up to 50% of your benefits are taxable. If your combined income is equal to $34,001 or more, up to 85% could be subject to taxation.

If you’re married, file a joint return, and you and your spouse have a combined income between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If you and your spouse have combined income of $44,001 or greater, 85% could be taxable.

Under the newly enacted One Big Beautiful Bill Act, qualifying taxpayers age 65 and older may benefit from a temporary $6,000 “senior deduction” ($12,000 for joint filers), available through 2028. While this additional deduction could reduce taxable income, its impact on Social Security taxation may be limited. Lower-income retirees often already fall below the thresholds at which Social Security benefits become taxable, meaning the deduction may not change their tax liability. Conversely, higher-income filers may exceed the income limits to qualify for the deduction altogether.

Speak with your tax advisor for guidance concerning the calculation of taxes.

Who Can Help Me?

It would be easy if there was a simple manual for collecting Social Security benefits, a magic age, or exact income amount that worked for everyone. But, that’s not the case. Your situation and needs are unique. So, too, is the amount you’ll need to generate in order to live the way you want to in retirement. Social Security alone most likely won’t get you there. With potential funding issues down the road, it might get even tougher.

So, work with your financial professional and tax professional to put together your own personal plan for yourself and your loved ones. Visit the Social Security Administration website (ssa.gov) to access your Social Security statement or call 800-772-1213. Educating yourself today on the ins and outs of Social Security and its place in your retirement can help you make the most of your tomorrow.

1 Social Security Fact Sheet, ssa.gov, 2025

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable.

The preceding is not intended to be a recommendation or advice.

This information does not take into account the specific investment objectives, tax and financial condition of any specific person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.