| 1 | Get it in writing – In order to qualify for severance packages and unemployment compensation, your company must either lay you off or fire you, so you might want to resist any lingering temptation to quit ahead of a layoff. Better yet, get your HR department to provide you with your termination status in writing. Read the letter carefully for any possible errors or omissions. |

| 2 | Read your severance agreement carefully – A typical agreement may include nondisclosure language, clauses that strip the company of any wrongdoing, or even provisions that would bar a worker from suing. It never hurts to try to negotiate a better deal, but be careful—in some cases, severance benefits can affect how much unemployment insurance you can collect. If the agreement doesn’t include outplacement services, ask that they be included. If necessary, obtain legal advice before you sign.1 |

| 3 | Be certain you received sufficient notice – The Worker Adjustment and Retraining Notification (WARN) Act is a federal law that protects workers by requiring employers to give adequate notice—typically at least 60 days—when closing or selling a facility that employs 50 or more workers.2 Each state has a website with state-specific details on how to file for a suspected WARN Act violation (Google “WARN Act”). |

| 4 | Verify your final paycheck amount – Find out when you'll be getting your final check—and make sure it includes everything you're owed. While there's no federal law that requires unused vacation to be paid at termination, many companies will pay accrued unused vacation days—or even sick leave, bonus, and commission payouts—as a matter of policy.3 Confirm the policy with HR. |

| 5 | Make a plan for health insurance – Companies with 20 or more employees generally offer COBRA4 continuation coverage that covers you and your family for up to 18 months. But COBRA isn’t cheap, and it may require you to pay the entire premium, up to 102% of the plan costs.5 If your spouse is employed, piggybacking on their policy for a while may be a less expensive option. In some cases, a reasonably priced package may be available under the Affordable Care Act. |

| 6 | Decide what to do with your 401(k) – Roll it over? Stand pat? Cash out? You’ll have a lot of options to consider. As with all matters of a tax or legal nature, please consult with your tax or legal counsel for advice. |

| 7 | Apply for unemployment insurance immediately – Once you start receiving aid, most states will send you checks for up to 26 weeks. Some states allow you to apply (and re-apply every two weeks) online. You also may have to register with a related job-listing site to demonstrate to your state that you’re making a good-faith effort to become re-employed. |

| 8 | Contact your creditors – Contacting your mortgage lender, auto lender, and credit-card issuers is essential to explore more forgiving payment schedules for your outstanding debts. Some lenders may offer you a “hardship postponement” that allows you to stop payments until you land a new gig. If you have credit-card debt, consider asking the card issuers to lower your interest rate. |

| 9 | Set up a budget – Once you’ve finalized the amount of your monthly unemployment benefits and debt reductions, make a plan to reduce discretionary expenses to the bone. Cut back on those nice-to-have extra items—premium cable, nightly takeout dinners, $40-a-bottle vintage wines, etc. Your financial professional can help you set up a budget. |

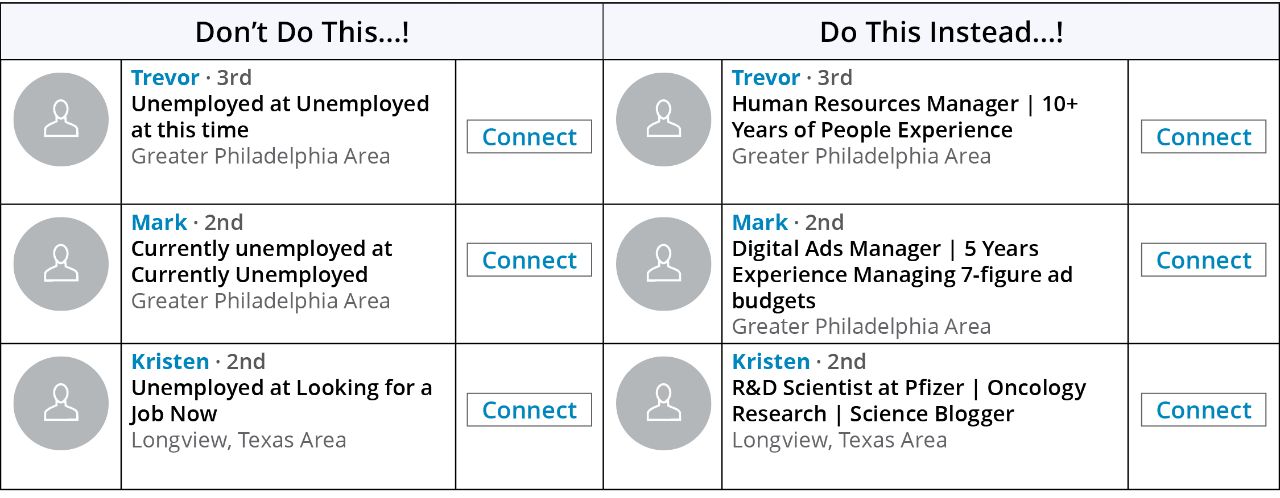

| 10 | Update your resume and LinkedIn profile – Let your friends and social media contacts know you’re in the market for your next opportunity. A serious professional resume makeover may give you the best chance for success. Make sure your LinkedIn title and skills summary fields reflect what you want potential employers to know about you. By default, LinkedIn creates your headline based on your current job title and company, giving you 220 characters to describe yourself. But if you’ve left your title as simply “Unemployed,” your profile could undersell your skills (see Do's and Don'ts below). |

Update Your LinkedIn Headline to Show Employers What You Can Actually Do

For illustrative purposes only. Source: Careersidekick.com, 12 Best LinkedIn Headline Examples for Job Seekers, 11/13/23.

For help with decision-making on household budgets, healthcare, or retirement plans, talk to your financial professional.

1 Investopedia, 7 Effective Ways to Prepare for a Layoff, 11/4/22. Most recent data available.

2 US Dept. of Labor, WARN Act: Worker’s Guide to Advance Notice of Closings and Layoffs.

3 How to Prepare for a Layoff: 14 Tips, Flexjobs.com, 2024.

4 COBRA is an acronym for the Consolidated Omnibus Budget Reconciliation Act, a landmark federal law passed in 1985 that provides for continuing group health insurance coverage for some employees and their families after a job loss or other qualifying event.

5 Centers for Medicare & Medicaid Services, COBRA Continuation Coverage, 9/10/24.

The views expressed here should not be construed as investment advice. They are based on available information and are subject to change without notice. The information above is intended as general information and is not intended to provide, nor may it be construed as providing, tax, accounting or legal advice. As with all matters of a tax or legal nature, please consult with your tax or legal counsel for advice. This material and/or its contents are current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Hartford Funds.