Healthcare costs continue to rise faster than inflation, which creates a conundrum for employers who offer healthcare to their employees. In recent years, most employers have sought to reduce their healthcare expenses by asking employees to shoulder a greater portion of these higher healthcare costs.

Shopping for Healthcare

High-deductible health plans (HDHPs) have become the vehicle of choice for many employers. For the 2026 calendar year, employees who have an HDHP are responsible for the first $1,700 in medical expenses ($3,400 for a family)1 before coinsurance kicks in (though some plans have higher deductibles). This encourages employees to shop for healthcare in an effort to reduce their out-of-pocket costs. Enrollment in HDHPs reached 51% in 2023, which illustrates how commonplace they’ve become.2

Health savings accounts (HSAs) were created to help employees pay some of their out-of-pocket healthcare expenses. HSAs can be used for dozens of qualified medical expenses ranging from diagnostic services such as x-rays to prescription medicine (see examples below).

Getting an HSA

You’re eligible for an HSA if you’re:

a) enrolled in a high-deductible health plan,

b) not eligible for Medicare, and

c) not eligible to be claimed as a dependent.

You and/or your employer can contribute to an HSA through payroll deductions. If your employer doesn’t offer an HSA, you can open one yourself. Either way, you’ll get a debit card that you can use for copays and prescriptions. Just be aware you’ll pay a 20% penalty if the money is spent on anything other than a qualified medical expense.3

How Do You Contribute?

An HSA generally has two separate functions:

- As an FDIC-insured personal savings account, or

- As an investment account for HSA assets

The IRS limits the amount of pre-tax dollars that can be contributed to an HSA each year. In 2026, the maximum is $4,400 for individuals and $8,750 for families.4

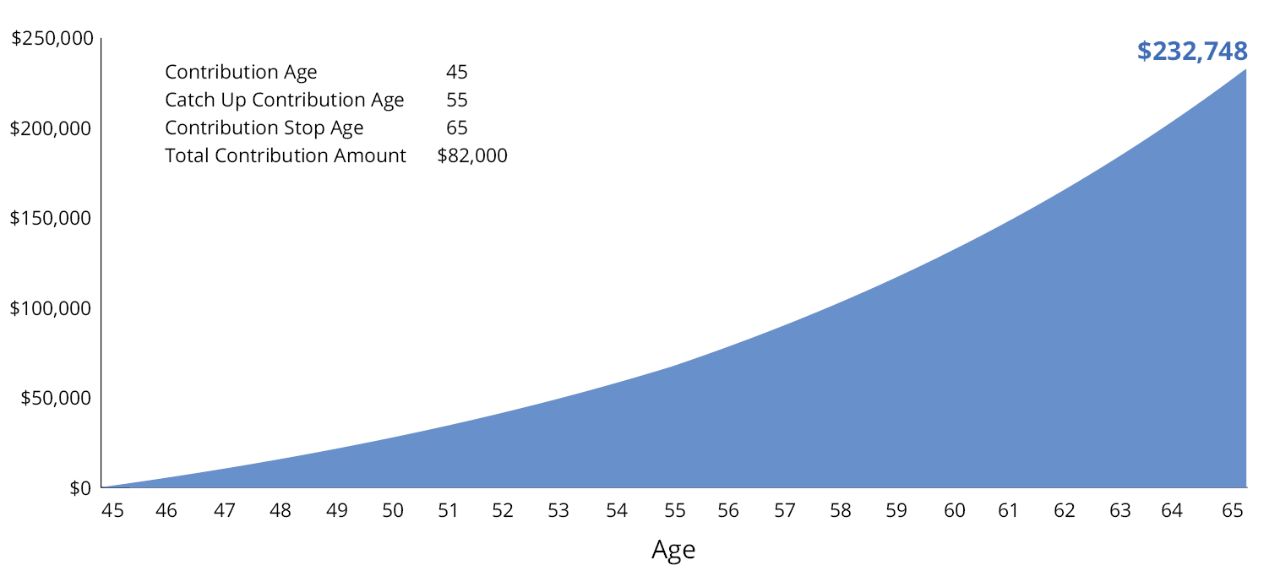

In addition, anyone 55 or older can contribute an additional $1,000 catch-up amount. Those approaching retirement can max out their contributions and then invest to build a health-expense nest egg (FIGURE 1).

FIGURE 1

Max Out Your HSA Contributions Before Retirement

Hypothetical of a 45-year old single woman who uses an investment account for growth potential instead of an FDIC-insured savings account. She contributes $4,400 for 10 years until age 55 and $5,400 for 10 years until age 65. Assumes monthly contributions, an 8% investment return, and no withdrawals. The hypothetical 8% annual rate is not guaranteed and does not reflect the performance of any particular investment. Actual results will vary. Source: Hartford Funds.

What Are the Benefits?

The main advantages of HSAs are the tax benefits:

- Salary deferrals and employer contributions to HSAs are pre-tax; after-tax contributions (not made via salary deferral) are tax deductible

- The investment earnings on HSAs accumulate tax-free

- Assets can be withdrawn tax-free for qualified medical expenses

If you know you have a big out-of-pocket medical expense on the horizon, you can add funds (up to your limit) into your HSA.

Some employers make contributions to HSAs on behalf of their employees. That amount varies from company to company. Other factors, including whether it’s solely for the employee or for the employee plus additional family members, can play a part, too.

It’s Not an FSA

An HSA is different than a flexible spending account (FSA). Both allow you to put aside money for healthcare costs, but there are no eligibility requirements for FSAs. The biggest difference is FSAs are “use it or lose it:" Contributions to a FSA must be spent by the end of the calendar year or they’re forfeited. HSAs, however, carry over year after year. If you have an HSA, you’re not permitted to have a FSA, in most instances.

You Own Your HSA Forever

If you leave your current job, you can take your HSA along with you. It’s your money, which is part of what makes HSAs an attractive way to save for healthcare expenses in retirement. Your HSA will always be there for you.

Going Deeper With HSAs

Understanding the ins and outs of this additional healthcare tool might help you more easily tackle your out-of-pocket spending. Visit HealthCare.gov and IRS.gov for more details on eligibility and limits today.

Examples of Qualified Medical Expenses

| Acupuncture | Insurance Premiums |

| Ambulance | Lab Fees |

| Artificial Teeth | Long-Term Care |

| Birth Control Pills | Nursing Home |

| Body Scans | Nursing Services |

| Braille Books/Magazines | Optometrist |

| Breast Pumps and Supplies | Oxygen |

| Breast Reconstruction Surgery | Physical Exams |

| Car | Pregnancy Test Kit |

| Chiropractor | Prosthetics |

| Contact Lenses | Psychiatric Care |

| Crutches | Special Education |

| Dental Treatments | Special Home for Intellectually and Developmentally Disabled |

| Diagnostic Devices | Surgery |

| Disabled Dependent Care Expenses | Telephones |

| Drug/Alcohol Addiction Treatments | Television |

| Drugs | Transplants |

| Eye Exams | Transportation |

| Eyeglasses | Tuition |

| Eye Surgery | Vasectomy |

| Fertility Enhancement | Vision Correction Surgery |

| Guide Dog or Other Service Animal | Weight-Loss Program |

| Hearing Aids | Wheelchair |

| Home Care | Wig |

| Home Modifications | X-rays |

Follow this link for a full list of Qualified Medical Expenses: IRS Publication 502 Section 213(d)

Talk to your financial professional to learn more about how to make the most of an HSA.

1 Source: IRS

2 Source: Bureau of Labor Statistics, most recent data available.

3 Source: IRS Publication 969: “Health Savings Accounts and Other Tax-Favored Plans.”

4 Source: IRS.gov

This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax and financial condition of any specific person. The information is not intended to be either tax or legal advice. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice. This material is provided for educational purposes only.

Links from this article to a non-Hartford Funds site are provided for users’ convenience only. Hartford Funds does not control or review these sites nor does the provision of any link imply an endorsement or association of such non-Hartford Fund sites. Hartford Funds is not responsible for and makes no representation or warranty regarding the contents, completeness or accuracy or security of any materials on such sites. If you decide to access such non-Hartford Funds sites, you do so at your own risk.

Investing involves risk, including the possible loss of principal.