Life is often about give and take. You want a specific feature, but it only comes with the super deluxe model that’s out of stock, and who has time to wait? You end up shifting your expectations.

There’s also a give and take element for investors. When market volatility looms, we look for ways to reduce risk in our portfolio, which could mean sacrificing growth potential.

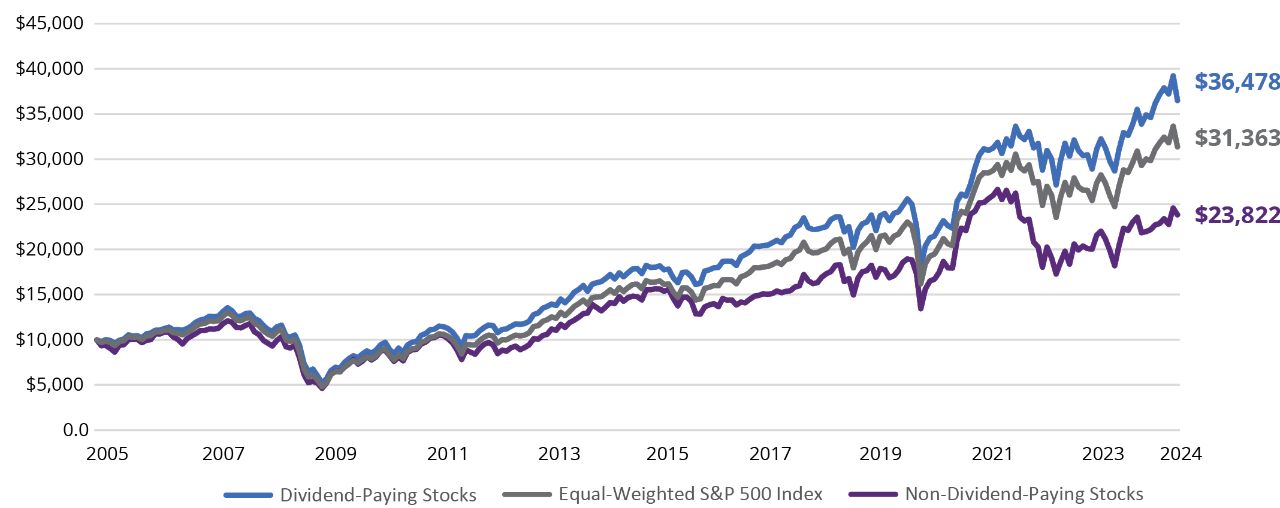

But, through dividend-paying stocks, investors may be able to have the best of both worlds. Not only do dividend-paying stocks offer growth potential, but they’ve also tended to be less volatile than the market overall—while generally providing a source of income, too.

Steady As They Go

Dividends are payments made by a company on a regular basis, often monthly or quarterly, to return some of their profits to shareholders. They’re typically offered by large companies with well-established financial footings.

Because they’re generally the stalwarts of the business world, dividend-paying stocks have historically been less volatile than both the broader market and their non dividend-paying counterparts, which has helped them noticeably outperform (FIGURE 1).

What’s more, companies are sitting on near-record high amounts of cash.1 In a world with geopolitical, economic, and overall market uncertainty, cash-rich companies could be well-positioned to provide investors with an attractive income stream.