The 10-year Treasury hasn’t consistently yielded more than 5% since 2007—just before the Global Financial Crisis. If the yield on Treasuries hits that threshold again, investors may be concerned that stocks will underperform.

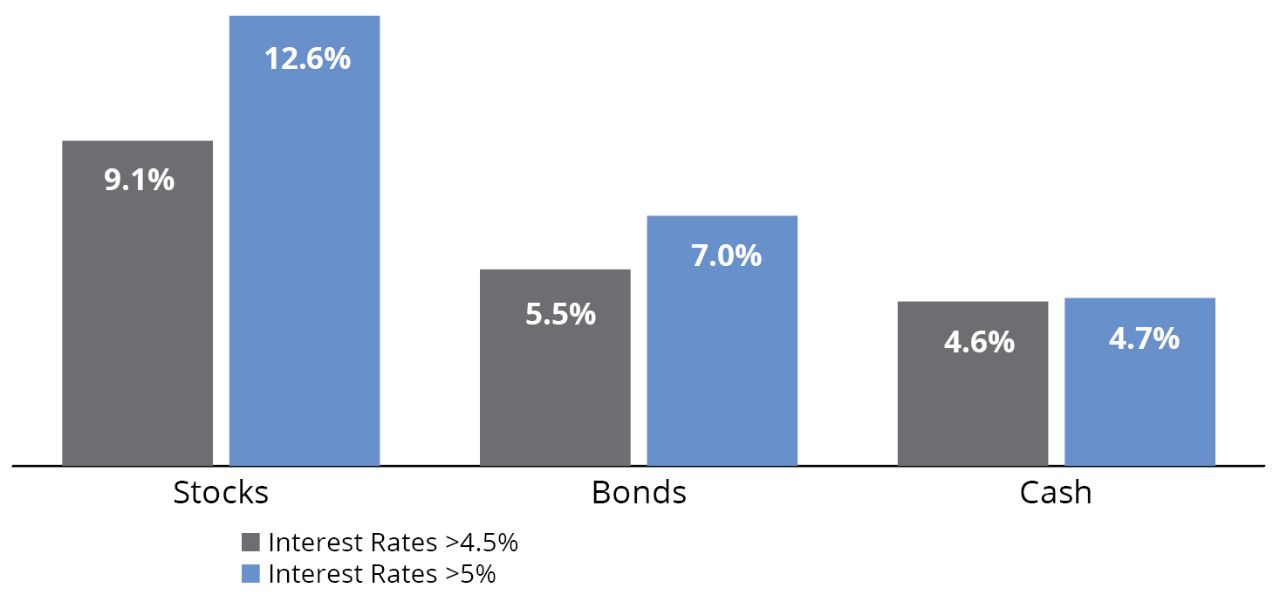

But while bonds may look especially attractive when they offer higher yields, history shows that stocks can still generate strong returns even when bond yields are high. In fact, since 1991, both stocks and bonds performed better when 10-year Treasuries yielded 5% than they did when Treasuries yielded 4.5%.

FIGURE 1

Stocks Performed Well—Even When Treasury Yields Topped 5%

Annualized Performance Since 1991 When Treasury Yields Reached 4.5% and 5%

As of 5/31/25. Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Stocks are represented by the S&P 500 Index, bonds are represented by the Bloomberg US Aggregate Bond Index, and cash is represented by the Bloomberg US Treasury Bill 1-3 Month Index. Source: Morningstar, 6/25.

Talk to your financial professional about diversifying your portfolio with the appropriate mix of stocks and bonds for your goals.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Bloomberg US Aggregate Bond Index is composed of securities that cover the US investment-grade fixed-rate bond market.

Bloomberg US Treasury Bill 1-3 Month Index is designed to measure the performance of public obligations of the US Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • U.S. Treasury securities are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. Diversification does not ensure a profit or protect against a loss in a declining market.