A historical perspective of the market shows us a pattern of bull and bear markets that may be tempting to investors. Why not try to time the market and avoid those short-lived bear markets? Wouldn’t that be more lucrative? Unfortunately, it’s impossible and could be a costly mistake.

Market Cycles: Hypothetical Growth of $10,000 Invested in the S&P 500 Index (1950-2024)

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data Sources: Morningstar and Hartford Funds, 2/25.

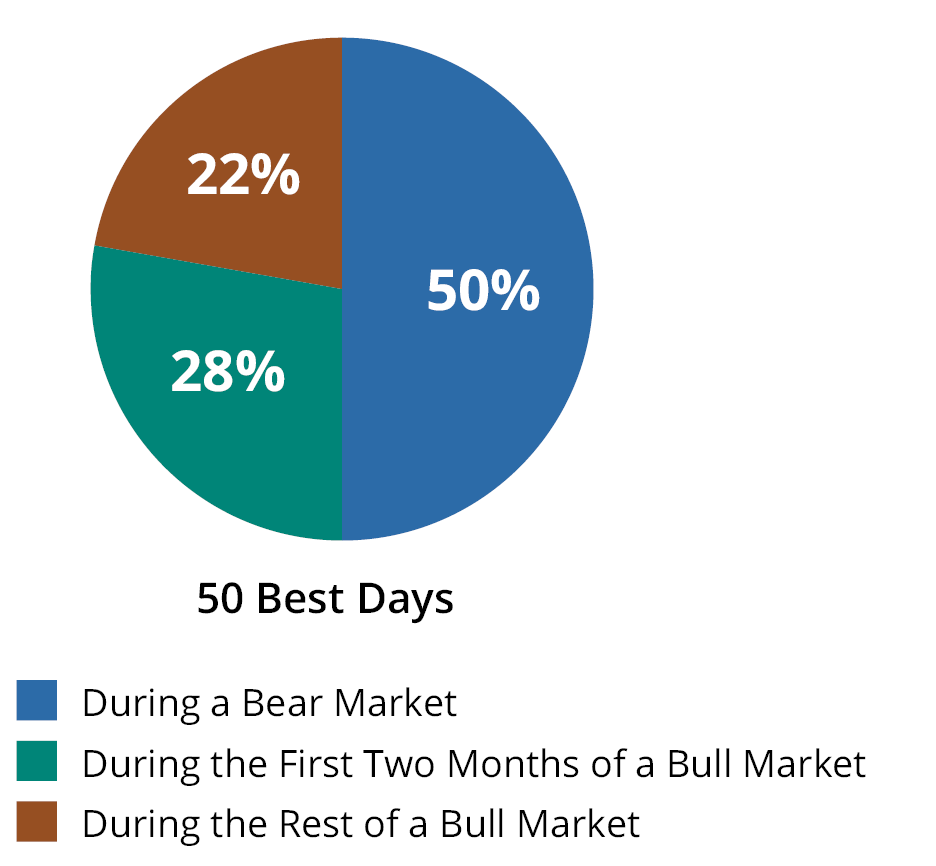

Avoiding the market’s downs may mean missing out on the ups as well. Seventy-eight percent of the stock market’s best days have occurred during a bear market or during the first two months of a bull market. If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%.

Good Days Happen in Bad Markets

S&P 500 Index Best Days: 1995–2024

Missing the Market’s Best Days Has Been Costly

S&P 500 Index Average Annual Total Returns: 1995–2024

Past performance does not guarantee future results. For illustrative purposes only. Data Sources: Ned Davis Research, Morningstar, and Hartford Funds, 1/25.

Talk to your financial professional so you can feel confident investing in bull and bear markets alike.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Important Risks: Investing involves risk, including the possible loss of principal.