| 1 | Fishing in a bigger pond – Despite the wide range of investment opportunities available in the US, a look beyond our borders can offer a much bigger playing field: There are five times more publicly traded international companies than US equities.1 |

| 2 | Which flavor do you prefer? – Developed-market equities invest in financially mature regions such as Europe and Japan, while emerging-market (EM) equities invest in developing countries and regions such as China and Africa. EM economies typically experience faster economic growth and have an added bonus of demographic tailwinds, which could potentially boost EM stocks, though they do come with increased risks. |

| 3 | More to love – Diversifying outside the US can help investors make the most of many economic environments. A portfolio that includes international equities can help investors potentially benefit from strong growth in other countries and a variety of inflation and interest-rate environments. |

| 4 | Zagging when the US is zigging – While volatility is an inevitable part of investing, foreign markets don’t always rise and fall in sync with US markets. International investing can help mitigate the risks of high market concentration in the US, which may lead to a more balanced and resilient portfolio. |

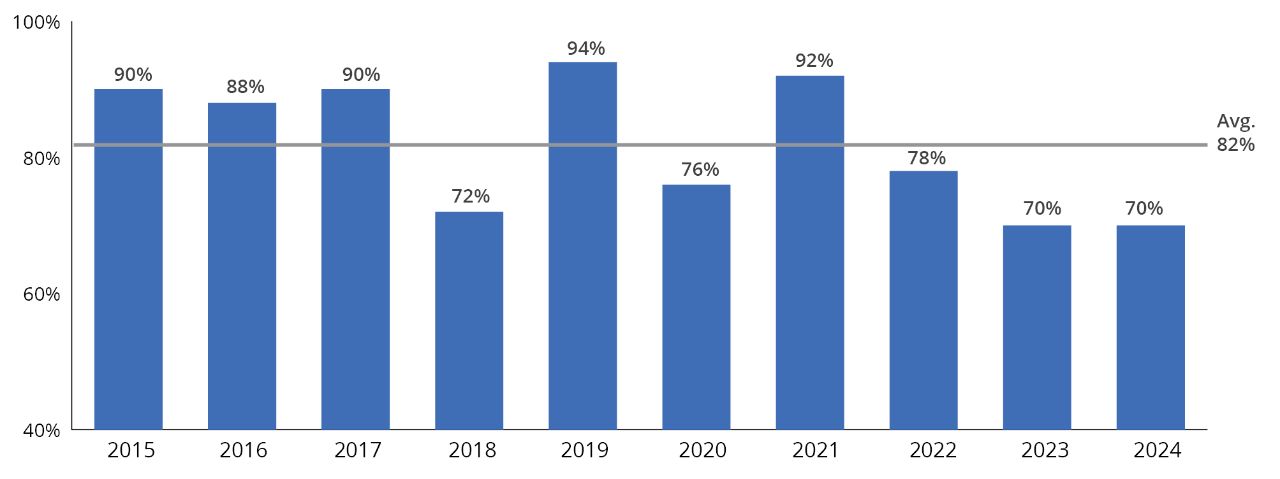

| 5 | Missing the trees for the forest – Although US stocks have had a long run of strong performance, the majority of the world’s top-performing individual stocks have consistently been international (FIGURE 1). On average, 82% of the top-50 stocks globally were from non-US companies.2 |

| 6 | A patterned past? – Since the 1970s, US and international markets have traded multi-year periods of outperformance. While domestic investors enjoyed US outperformance for more than a decade, the average outperformance cycle has lasted an average of more than eight years, which suggests the tide may be about to turn.3 |

| 7 | A lesson in value – Relative to the US, international stocks are cheaper, pay higher dividends, and have valuations below their historical average.4 These characteristics may be a draw to investors who seek to capitalize on their lower prices and potential appreciation. |

| 8 | The greenback impact – After remaining strong the last few years, the US dollar has generally been weakening. A weaker dollar tends to work in favor of international equities by making borrowing cheaper for foreign companies which, in turn, can help boost profits. |

| 9 | The more you know – Like all investments, international investing has its own set of risks. Investors may be subject to currency volatility, geopolitical disruptions, and liquidity risks that differ from investments here in the US. To help navigate these risks, it may be beneficial to access international stocks through professional active management. |

| 10 | Choose your own adventure – Investors can invest internationally by tracking a passive index, by using an actively managed fund that uses in-depth research, or through strategic-beta funds that use a rules-based methodology in an effort to outperform passive indices. |

FIGURE 1

The US Isn’t Always Best

Percentage of World’s Top-50 Stocks That Are Non-US

As of 12/31/24. Past performance does not guarantee future results. Investors cannot directly invest in indices. Based on the annual calendar-year returns of 50 highest-performing stocks of the MSCI ACWI Index. MSCI ACWI Index is a free float-adjusted market-capitalization index that measures equity-market performance in the global developed and emerging markets, consisting of developed and emerging-market country indices. For illustrative purposes only. Source: FactSet, 2/25.

To learn more about international investing, talk to your financial professional.

1 As of 12/31/24. Data Source: Bloomberg, 2/25.

2 As of 12/31/24. Data Source: FactSet, 2/25.

3 As of 12/31/24. Data Sources: Morningstar, Bloomberg, and Hartford Funds, 2/25.

4 As of 12/31/24. Data sources: FactSet and Hartford Funds, 2/25.

Important Risks: Investing involves risk, including the possible loss of principal. • Foreign investments may be more volatile and less liquid than US investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities, or to adopt any investment strategy.