Just booked a long-anticipated vacation? Celebratory dance! Just enrolled in the maintenance plan for your HVAC system? That’s far less exciting. But when your AC quits in a heat wave, you’ll be dancing when the tech shows up for priority service.

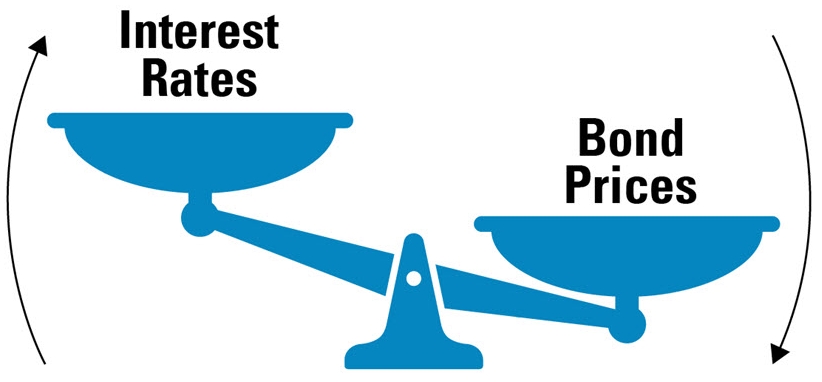

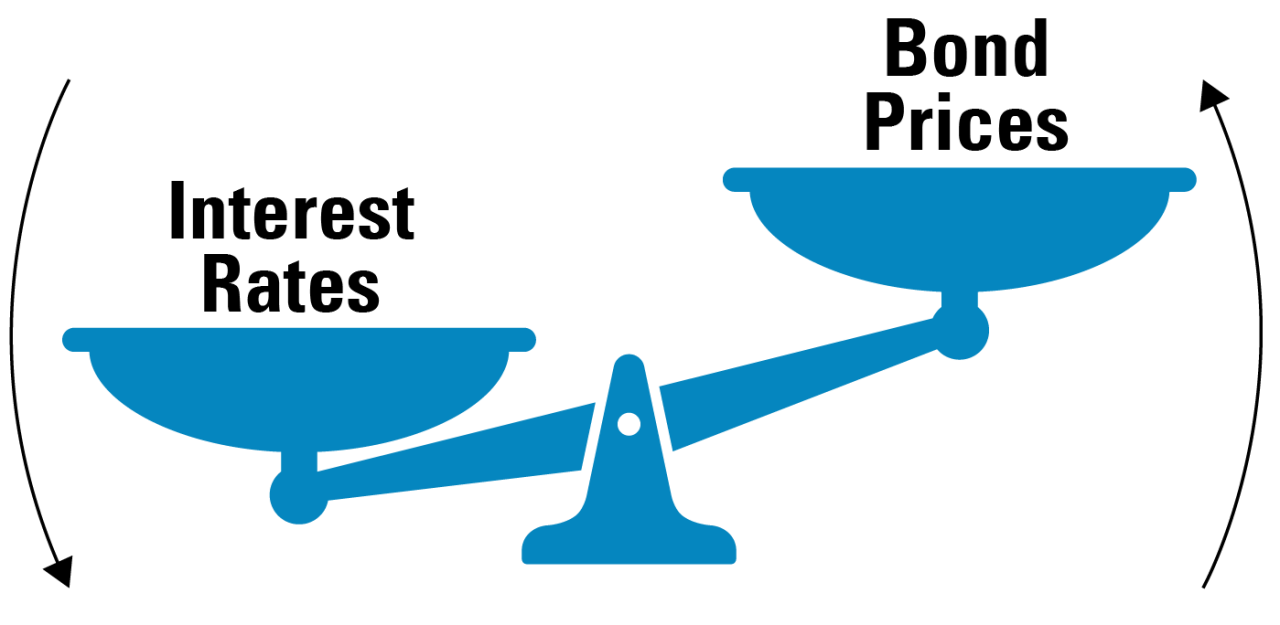

As investors, sometimes we need a reminder why we enroll in the less flashy stuff, too. In the last few years, as the Federal Reserve (Fed) has adjusted policy and shifted interest rates, fixed-income investors faced unusual volatility while equities soared.

But similar to how signing up for just-in-case maintenance can keep you cool in a pinch, bonds can help us maintain our portfolios’ cool, too. Especially today, it’s important to remember why we bother with bonds in the first place: diversification.*

Team Bonds vs. Team Stocks: It’s Not Really a Competition

There’s a give and take to diversified, balanced portfolios. There are just a handful of years on record in which both stocks and bonds both produced negative returns for the year. Generally, when stocks have been volatile, bonds have provided a welcome degree of stabilization and vice versa.

In other words, if you’re well diversified, one part of your portfolio is likely to outperform as another underperforms at any given moment. Ultimately, this balance should provide a less volatile experience overall. All the portfolios in FIGURE 1 generated significant positive returns over the time period shown, but the balanced one provided a less turbulent journey.