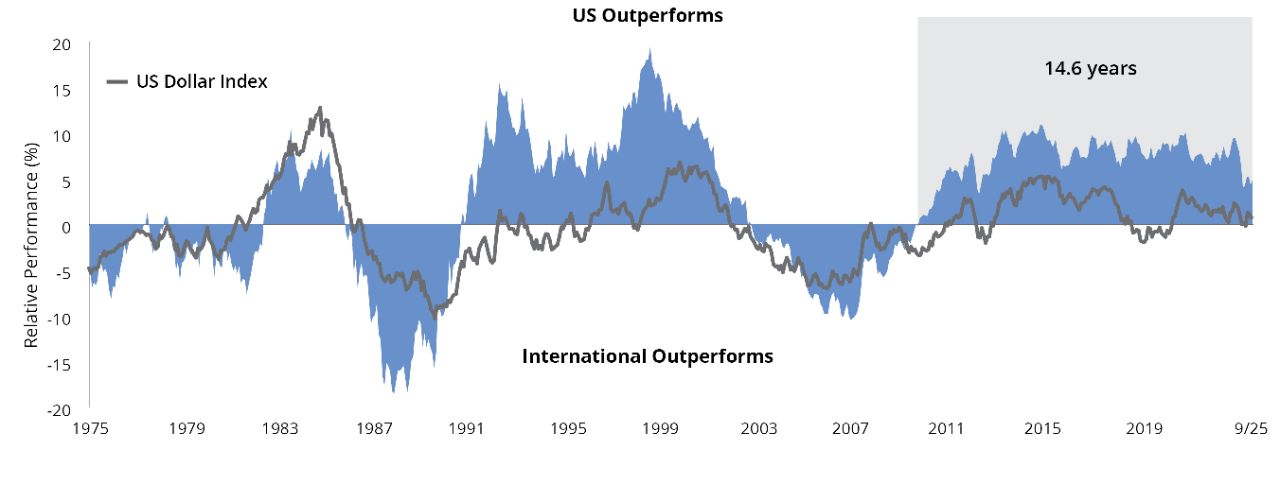

While we hope US stocks continue to perform well, history suggests that international stocks may soon have their day in the sun. Since 1975, the outperformance cycle for US vs. international stocks has lasted an average of more than eight years. We’re currently 14.6 years into the current cycle of US outperformance based on 5-year monthly rolling returns.

US Equity vs. International Equity 5-Year Monthly Rolling Returns

Chart Data: 1/31/75-9/30/25. The chart shows the values of the S&P 500 Index’s returns minus the MSCI World ex USA Index’s returns. When the line is above 0, domestic stocks outperformed international stocks. When the line is below 0, international stocks outperformed domestic stocks.

Data Sources: Morningstar, Bloomberg, and Hartford Funds, 10/25.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. The performance shown above is index performance and is not representative of any Hartford Fund’s performance.

US equity is represented by the S&P 500 Index; international equity is represented by the MSCI World ex USA Index. Please see below for representative index definitions. For illustrative purposes only.

Talk to your financial professional today about the allocation to international equities that’s right for you.

Hartford Funds Global and International Equity Funds1

Morningstar Ratings for Mutual Fund I-Shares and Exchange Traded Funds (“ETFs”)*

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

1 View the full list of Hartford Funds

* ETFs are not mutual funds. Unlike traditional open-ended mutual funds, ETF shares are bought and sold in the secondary market through a stockbroker. ETFs trade on major stock exchanges and their prices will fluctuate throughout the day. Both ETFs and mutual funds are subject to risk and volatility.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

MSCI World ex USA Index captures large and mid cap representation across developed market countries, excluding the US.

Important Risks: Investing involves risk, including the possible loss of principal. • Foreign investments may be more volatile and less liquid than US investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets.