As election season heats up, you’re going to hear lots of dire predictions about what will happen if Vice President Kamala Harris or former President Donald Trump is elected. If history is any guide, the US economy and the stock market may be fine in the long run no matter who’s in office.

|

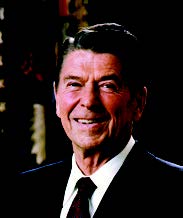

Ronald Wilson Reagan 40th US President 1981-1989 |

|

| In 1980 His Critics Said: | Average US GDP Growth* | S&P 500 Index Average Annual Return* |

|

3.5% | 14.2% |

|

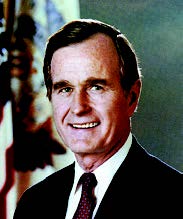

George Herbert Walker Bush 41st US President 1989-1993 |

|

| In 1988 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

2.2% | 15.7% |

|

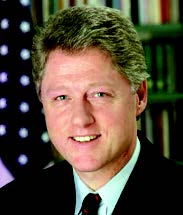

William Jefferson Clinton 42nd US President 1993-2001 |

|

| In 1992 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

3.9% | 17.2% |

|

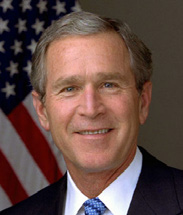

George Walker Bush 43rd US President 2001-2009 |

|

| In 2000 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

2.2% | -2.9% |

|

Barack Hussein Obama 44th US President 2009-2017 |

|

| In 2008 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

1.7% | 14.5% |

|

Donald John Trump 45th US President 2017-2021 |

|

| In 2016 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

1.4% | 16.0% |

|

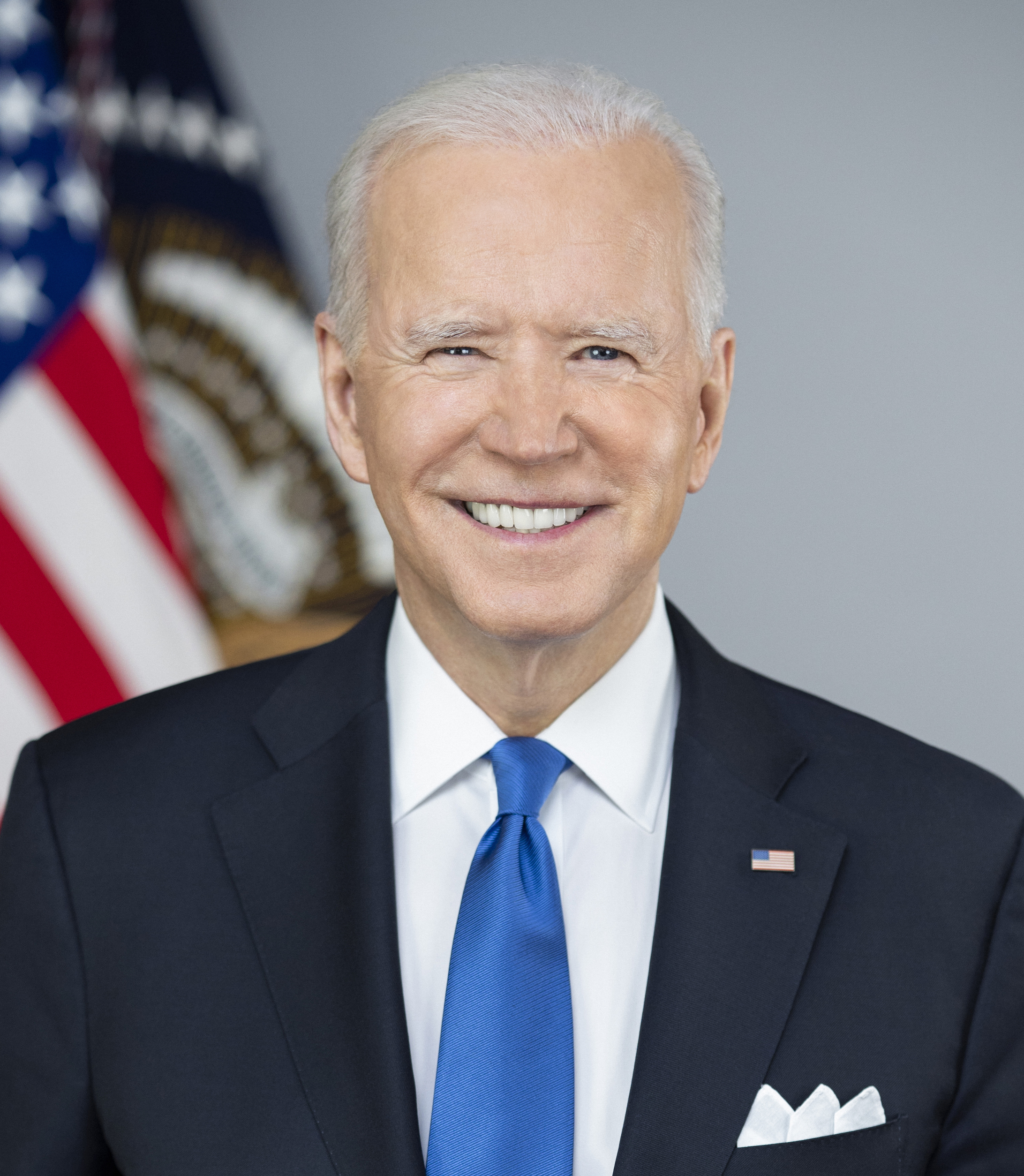

Joseph Robinette Biden, Jr. 46th US President 2021-Present |

|

| In 2020 His Critics Said: | Average US GDP Growth | S&P 500 Index Average Annual Return |

|

3.3% | 13.1% |

Don’t fret if your preferred candidate doesn’t get elected in November! The US economy and stock market have generally marched higher through Democratic and Republican administrations alike. Dramatic events such as 9/11, the Global Financial Crisis, and the COVID-19 pandemic can cause sharp market selloffs—but our economy and stock market have historically been resilient to these types of shocks.

Your financial professional can help you stay focused on your long-term goals regardless of who’s in the White House.

* GDP is calculated beginning on January 1 of the year a president is elected; S&P 500 Index returns are calculated beginning on Inauguration Day. For President Biden, GDP is as of 6/30/24 (most recent data available), and S&P 500 Index returns are as of 7/31/24. Data Sources: US Bureau of Economic Analysis and IMF via FactSet, Morningstar, and Hartford Funds, 8/24.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Past performance does not guarantee future results. The index is unmanaged and not available for direct investment. For illustrative purposes only.

Investing involves risk, including the possible loss of principal.

This material is provided for educational purposes only.