When volatility rears its ugly head, our instinct is to take our money out of the market to safeguard it. However, history shows that rather than giving in to fear, staying invested and even buying stocks during volatile times can be beneficial in the long run.

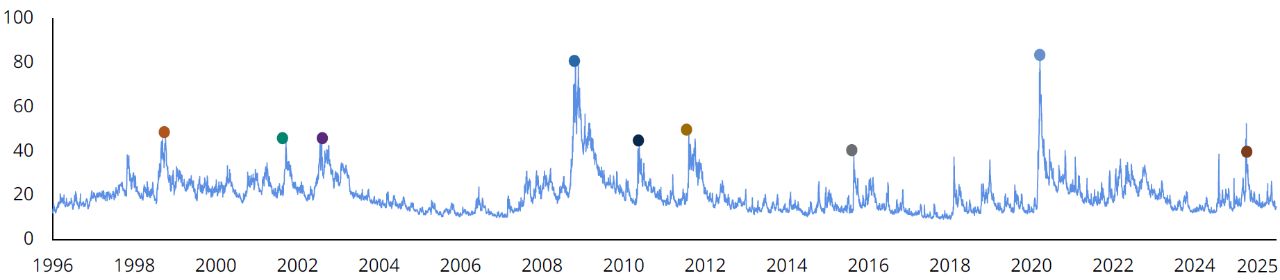

That analysis comes from examining the Cboe VIX, an index that measures volatility. It’s often referred to as the “fear index” because it gauges the market’s expectation of 30-day volatility. On average, the VIX measures around 20. But market-moving events, such as the initial outbreak of COVID-19, can quickly jolt it higher.

Fasten Your Seatbelts

If we step back and examine times when the VIX spiked above 40, indicating extremely high fear levels, there’s a trend (see below). Within three years of volatility-induced declines, the market not only recovered its losses but also produced additional positive returns in each case. Five years later, those gains continued, too.

A takeaway, then, is that while volatility can be difficult to endure, it can present opportunities for long-term investors. When fear is high, it may be time to be contrarian: consider it an opportunity to not only stay invested, but to also buy while prices are depressed.

Why stay invested? Because it’s impossible to tell when the market will resume its upward course after a bout of volatility. So sticking around means participating in the recovery as soon as it happens, rather than waiting to see improvement and missing the early days of recovery.

Easier Said Than Done

We realize it’s easy to say volatility and market dips work themselves out in time, but it’s hard to live through. That’s why it’s critical to work with a financial professional who can tailor your portfolio to your personal risk tolerances. This can help you stay confident and be the contrarian who sees the opportunity in fear.