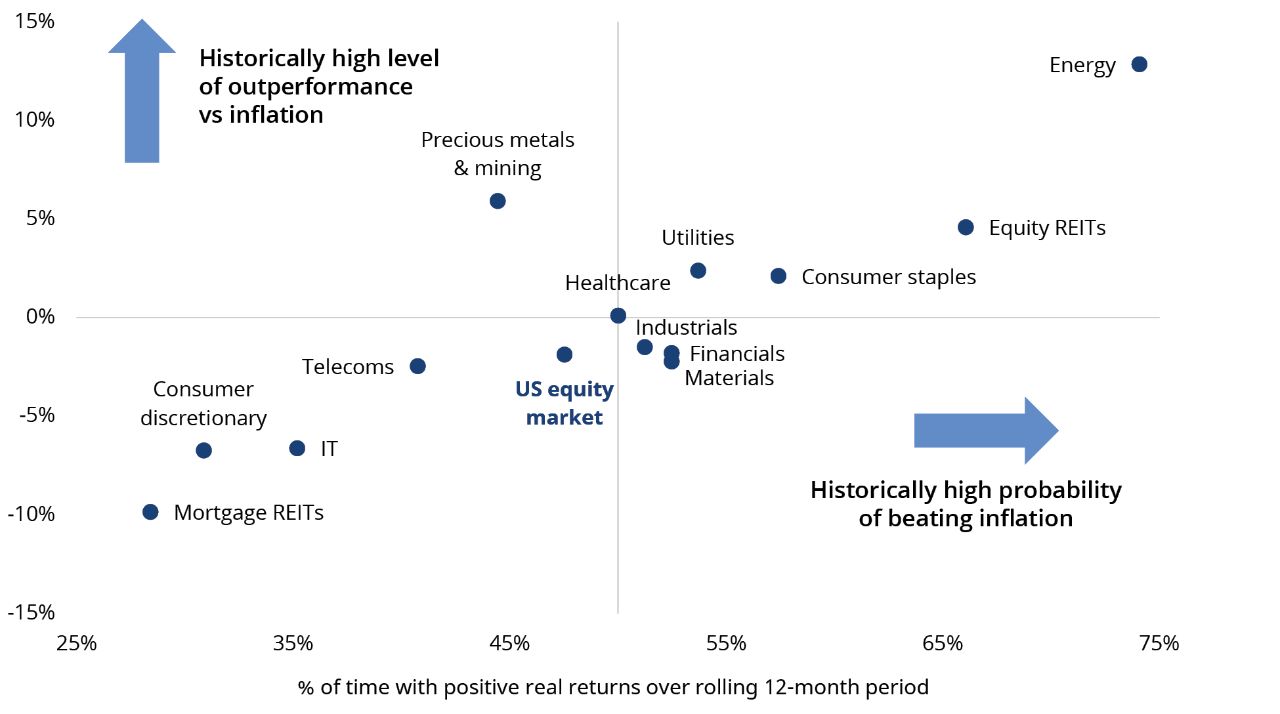

Although equities in general have performed quite poorly in high and rising inflation environments, there are potential areas that have historically performed better at the sector level. The energy sector, which includes oil and gas companies, is one of them. Such firms beat inflation 74% of the time and delivered an annual real return of 12.9% per year on average.

This is a fairly intuitive result. The revenues of energy stocks are naturally tied to energy prices, a key component of inflation indices. So by definition, they generally have performed well when inflation rises.

Equity REITs (real-estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 66% of the time and posted an average real return of 4.6%. This makes sense too. Equity REITs own real-estate assets and may provide a partial inflation hedge via the pass-through of price increases in rental contracts and property prices.

In contrast, mortgage REITs, which invest in mortgages, are among the worst-performing sectors. Just like bonds, their coupon payments generally become less valuable as inflation increases, sending their yields higher and prices lower to compensate.

The same is true of promised future growth in profits for information-technology stocks. The bulk of their cash flows are expected to arrive in the distant future, which may be worth far less in today’s money when inflation increases. Consumer staples, on the other hand, have performed comparatively better, as their cash flows tend to be concentrated in the shorter term.

But high inflation can still be especially harmful for banks because it erodes the present value of existing loans that will be paid back in the future.

Utility stocks display a somewhat disappointing success rate of only 54%. As natural monopolies, they should be able to pass on cost increases to consumers to maintain profit margins. However, in practice, regulation often prevents them from fully doing so.

What’s more, given the stable nature of their business and dividend payments, utility stocks are often traded as “bond proxies,” meaning they might be bid down relative to other sectors when inflation takes off (and bond prices fall).

Meanwhile, although gold is often touted as a hedge against fear of currency debasement, the track record for companies in the precious-metals and mining sector is mixed.

On average, such firms posted an average real return of 5.9% in high and rising inflation environments. But the likelihood of this happening was worse than a coin toss—they beat inflation only 44% of the time, considerably less than many other sectors.