It hasn’t just been stocks rattling nerves lately— the bond market has had its own wild ride. From tariff tensions and stagflation fears to ballooning federal deficits and an unexpected US credit downgrade, fixed-income investors have faced a barrage of unsettling headlines.

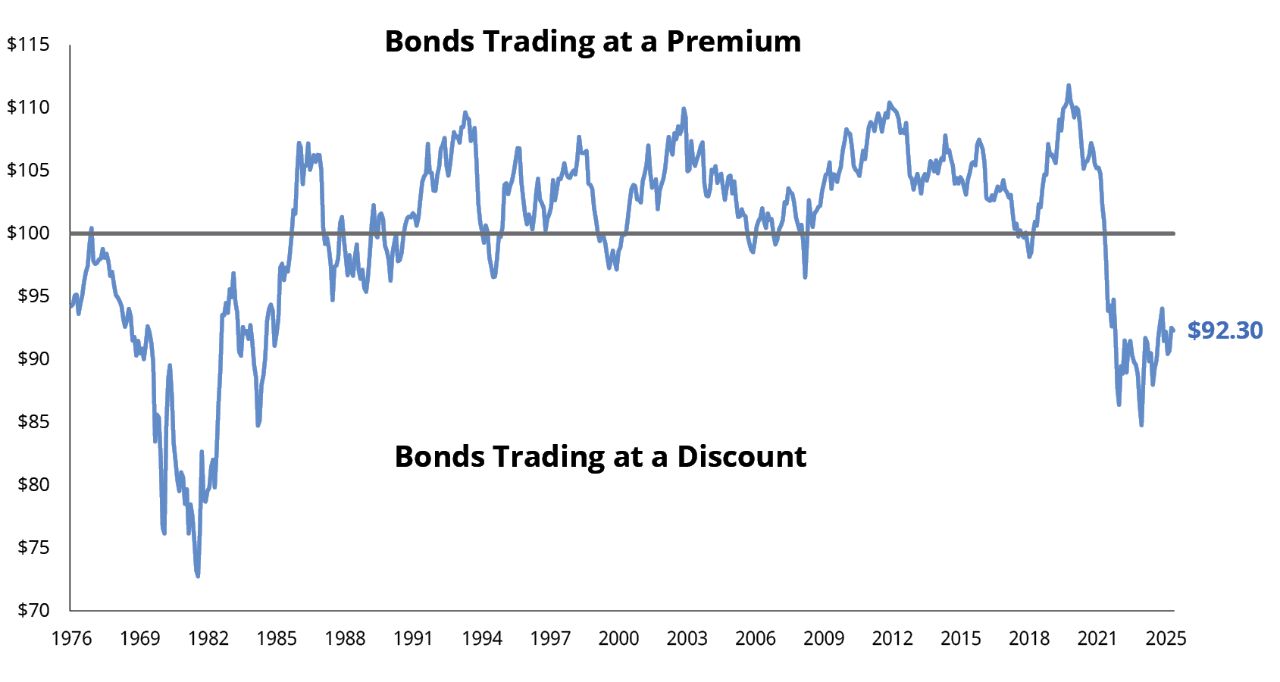

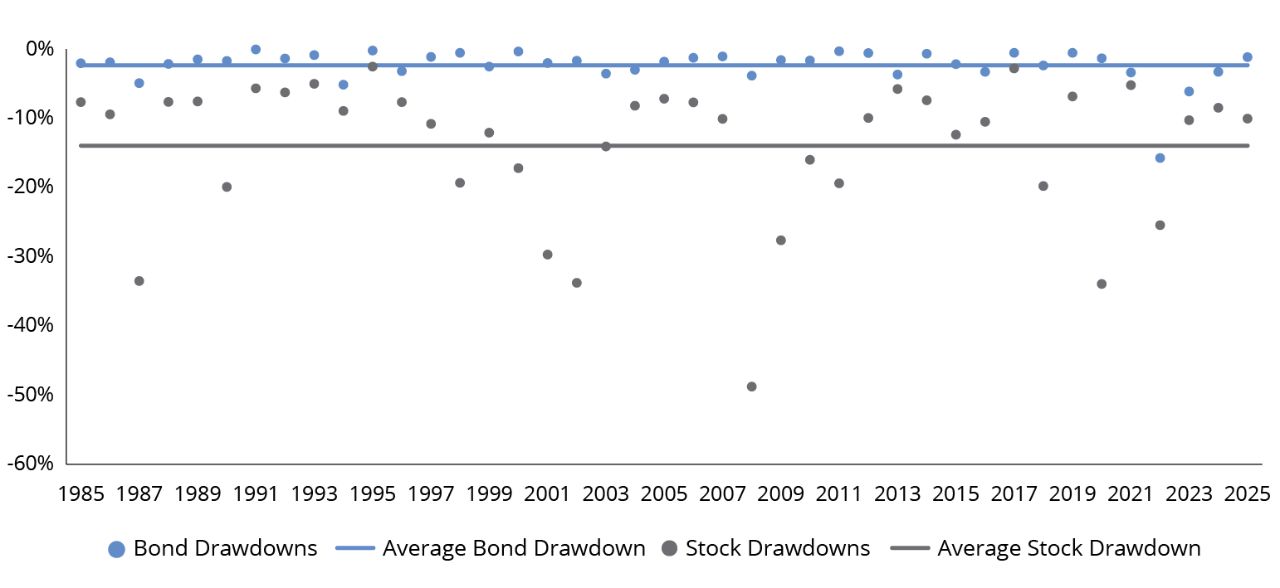

But here’s the thing: Volatility isn’t a reason to abandon fixed income—it’s a reminder of why it may belong in your portfolio. Bonds may still offer what they historically have offered: attractive valuations, smaller drawdowns compared to equities, and fewer dramatic ups and downs during times of market turbulence.

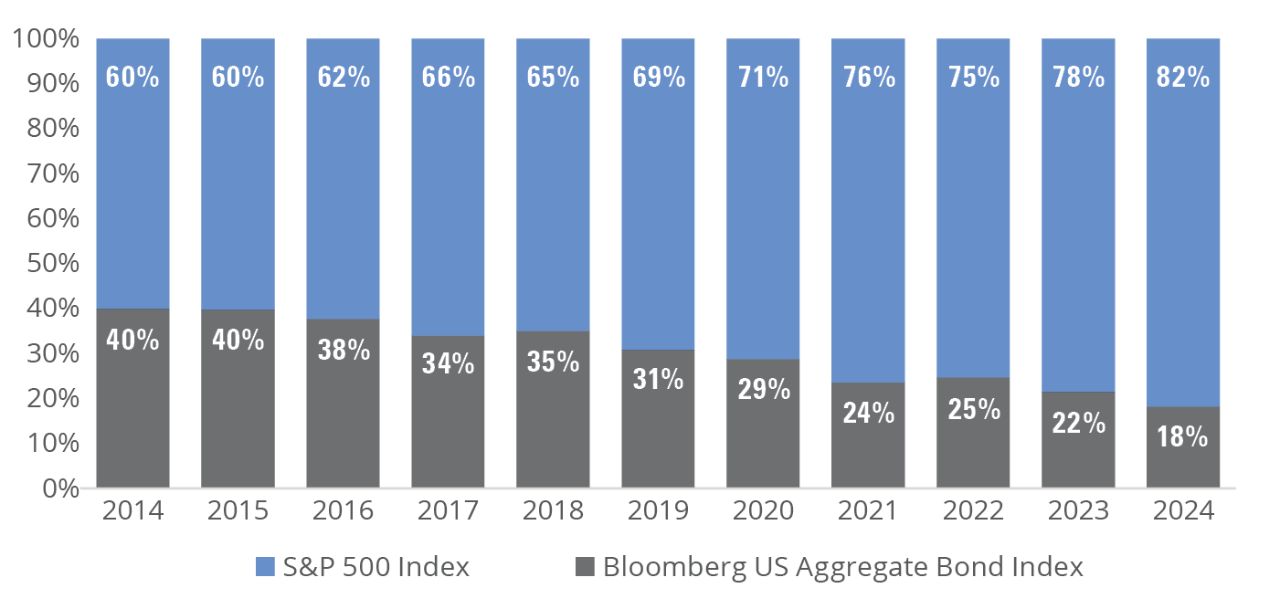

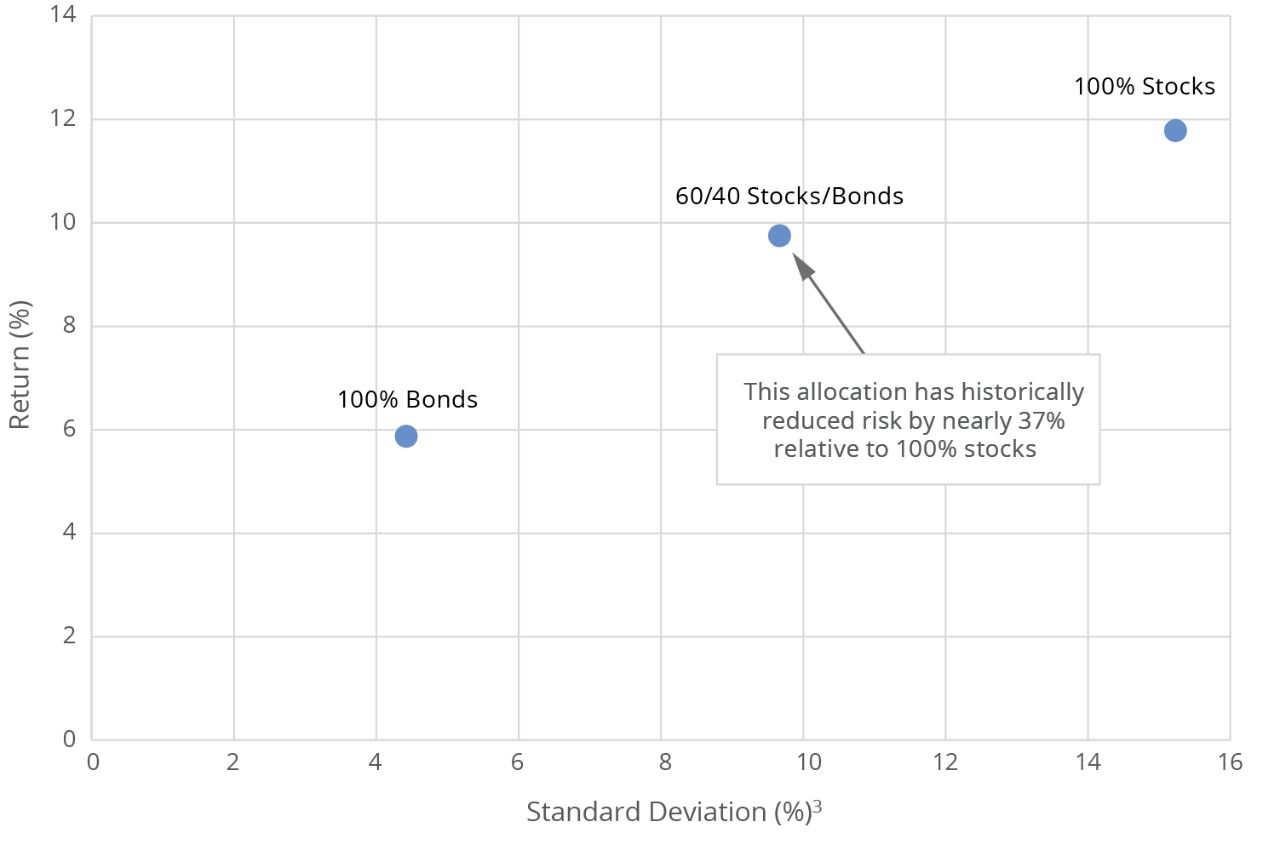

However, bonds’ positive effects can be diluted if a portfolio becomes unbalanced. FIGURE 1 shows that a failure to regularly rebalance a portfolio can also introduce excessive portfolio risk, which can render a carefully constructed allocation vulnerable to economic and geopolitical headwinds. The current period of uncertainty may be a timely opportunity to consider a strategic tilt from equities to fixed income.