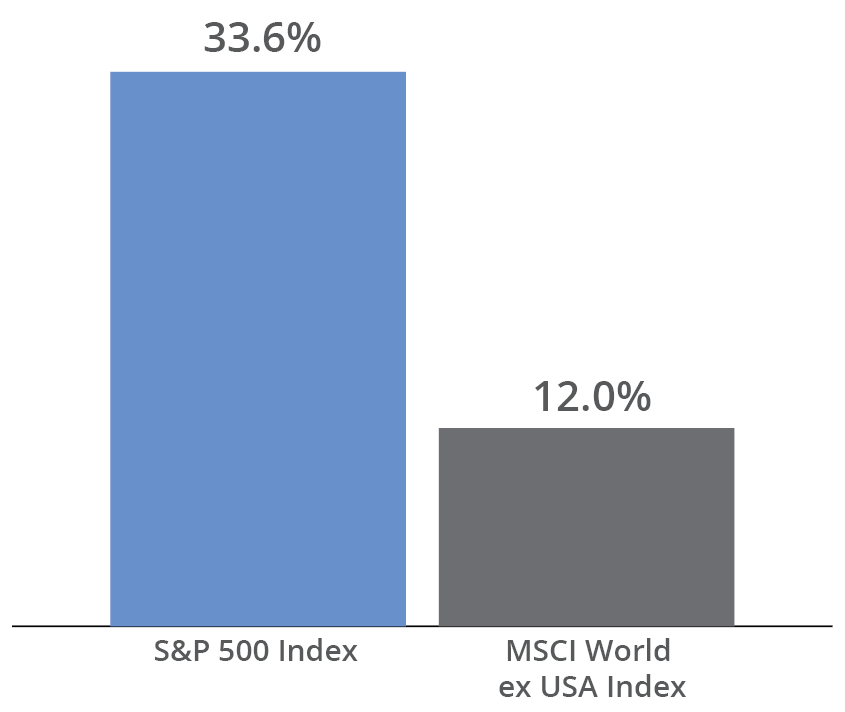

US equities, as measured by the S&P 500 Index, compounded at a remarkable average annual rate of 13.5% from 2009 to 2024.1 Investors who eschewed diversification in favor of US equities saw their portfolios handily outperform more diversified portfolios—until now.

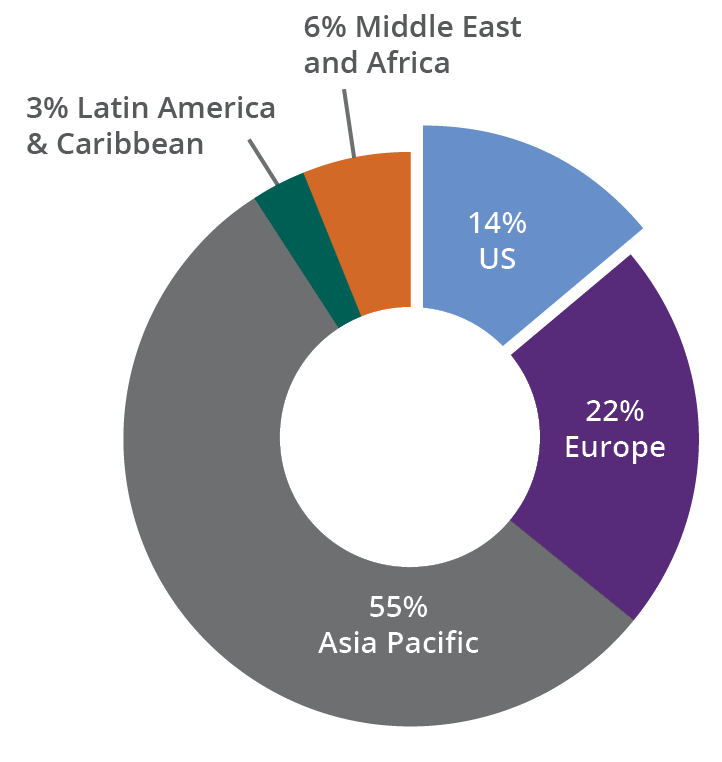

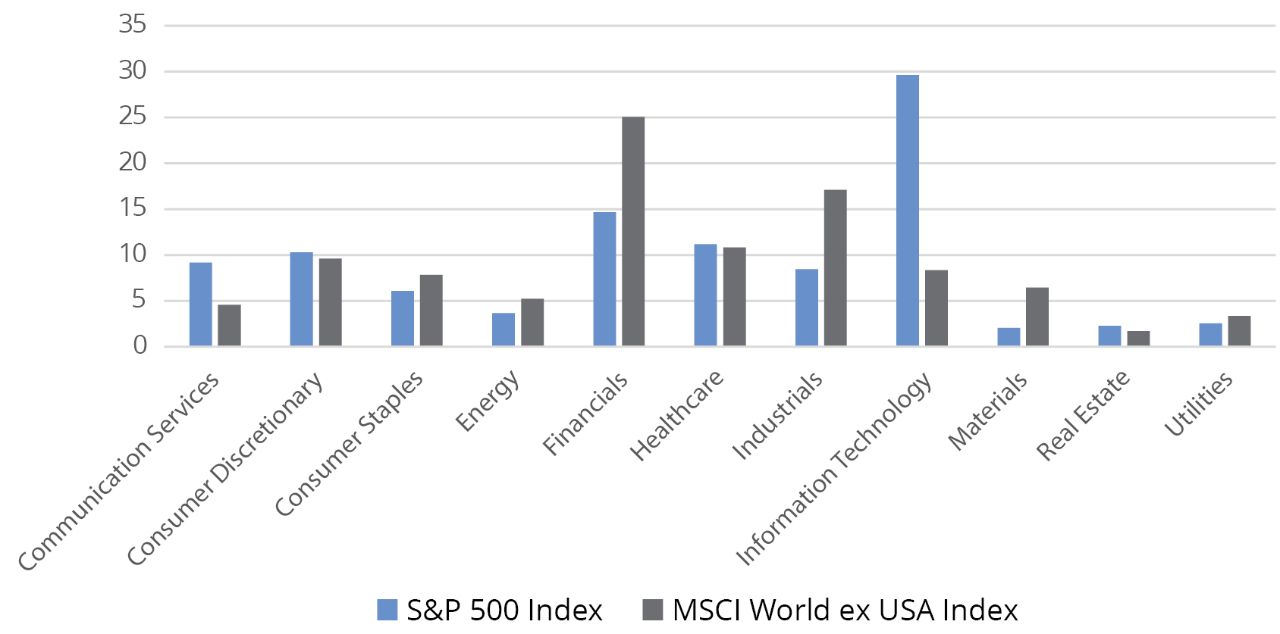

The long-awaited broadening of returns beyond US large-cap equities began before President Donald Trump’s historic tariff announcement on April 2 sparked a significant uptick in volatility, and there are compelling reasons why this trend could continue going forward.

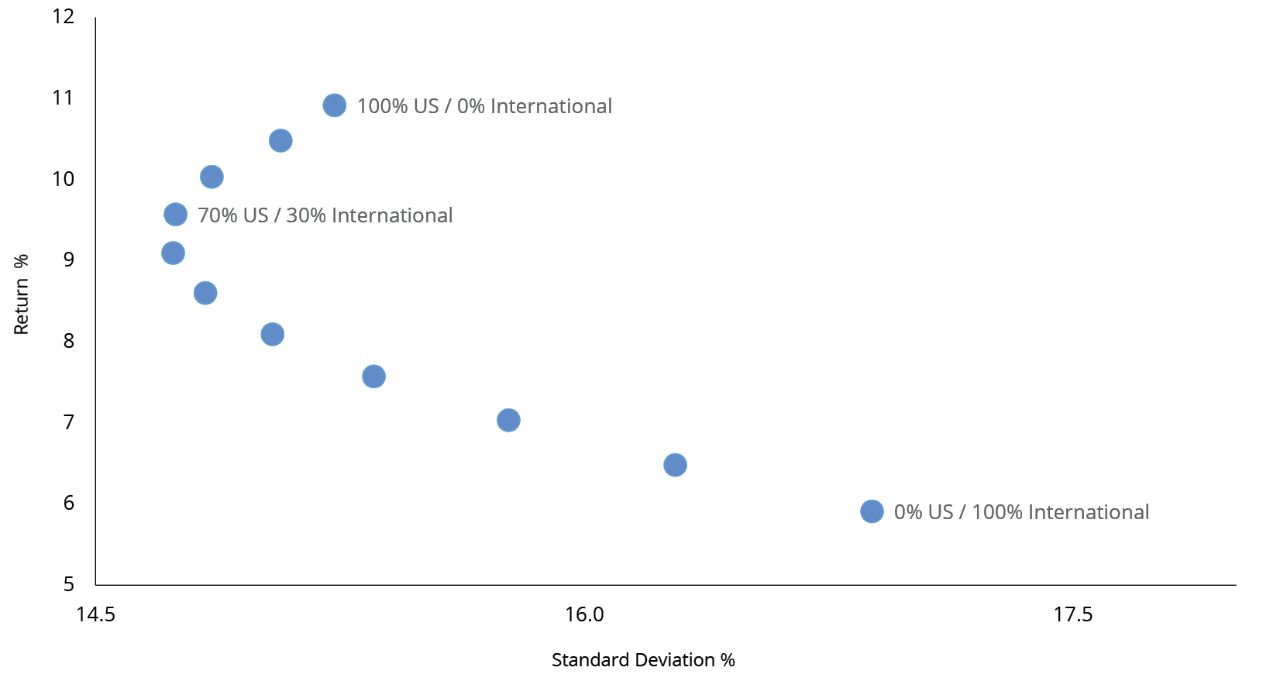

Risk-conscious investors may want to consider three strategies: diversifying with fixed income, reallocating to international equities, and incorporating dividend-paying stocks.

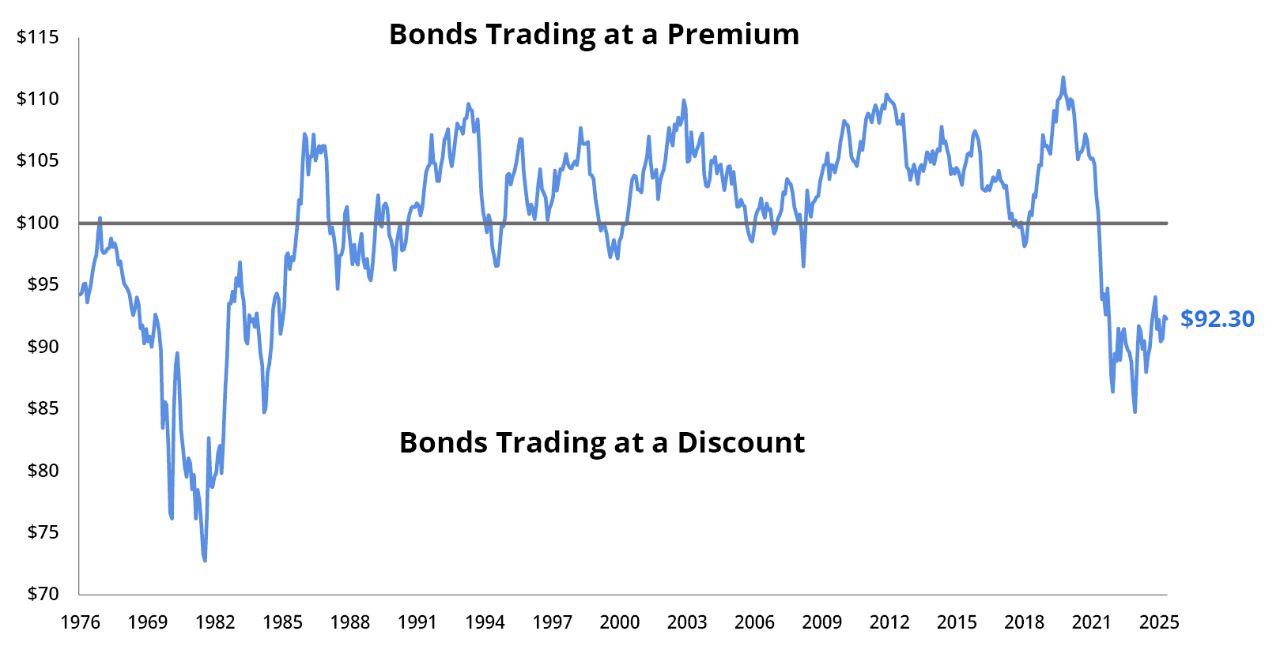

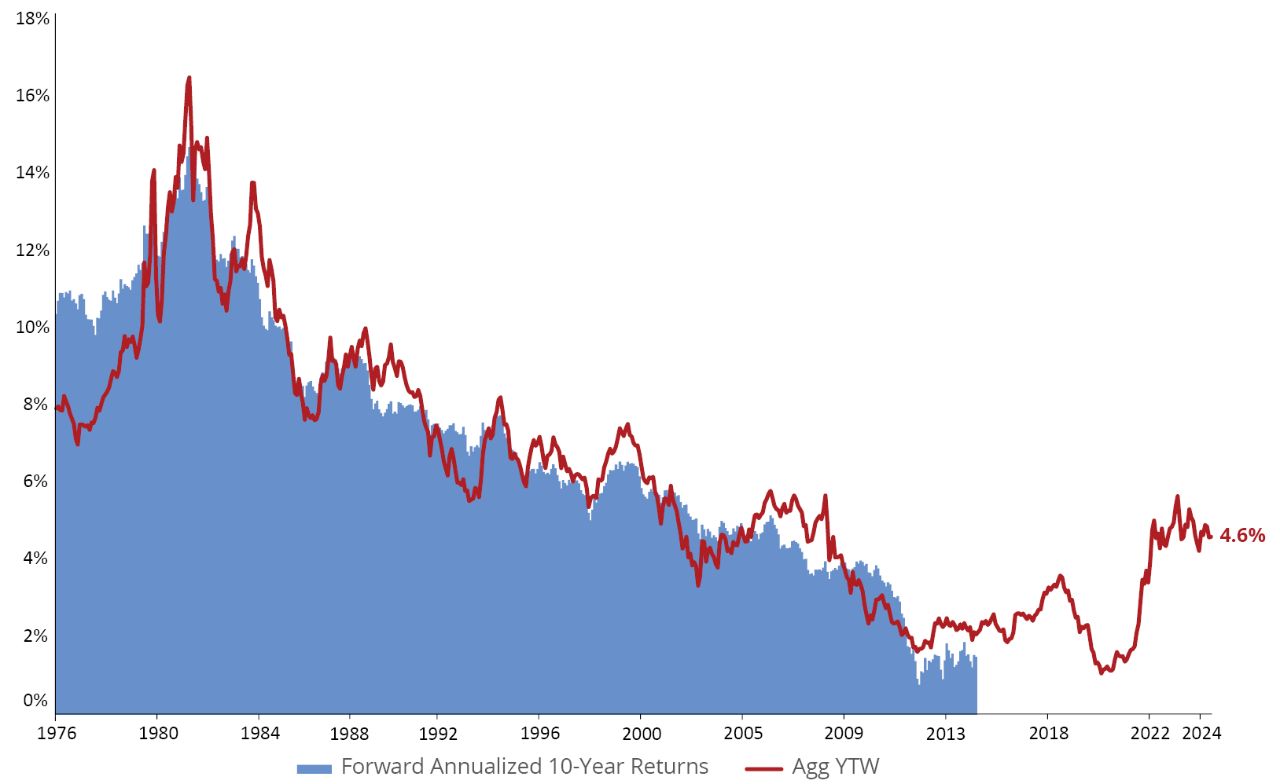

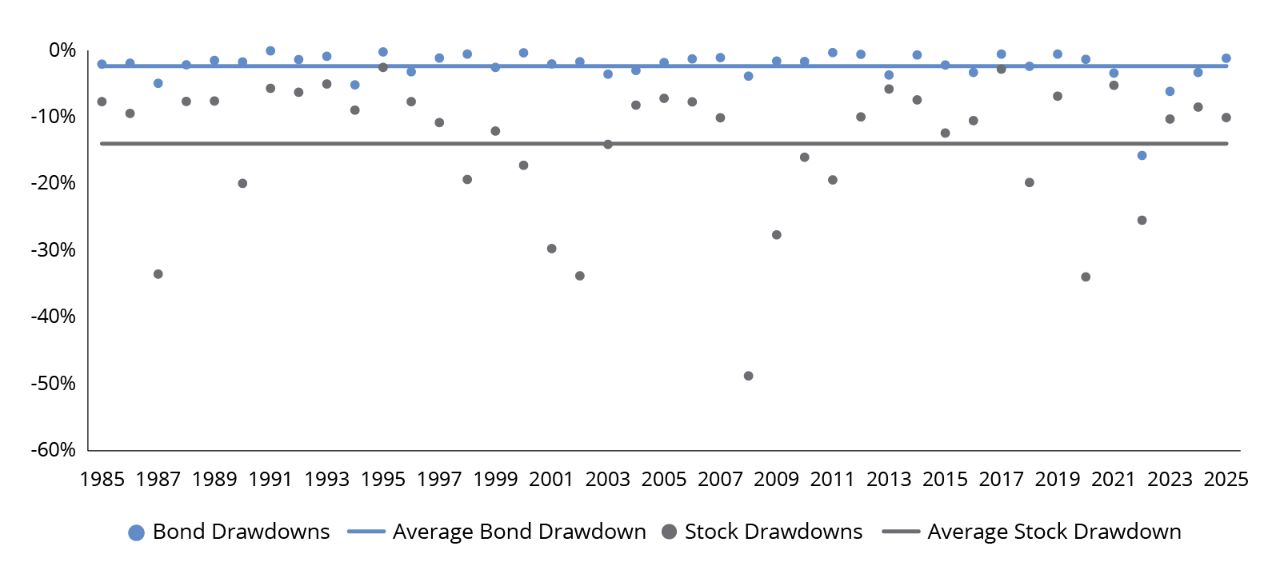

1. Diversifying With Fixed Income

Even after the dramatic sell-off in the wake of Trump’s tariff announcement, US equities are still trading at a premium valuation on a forward-looking basis.2 Valuations have fallen, but still seem to be pricing in a swift resolution of trade disputes and continued optimism about artificial intelligence.

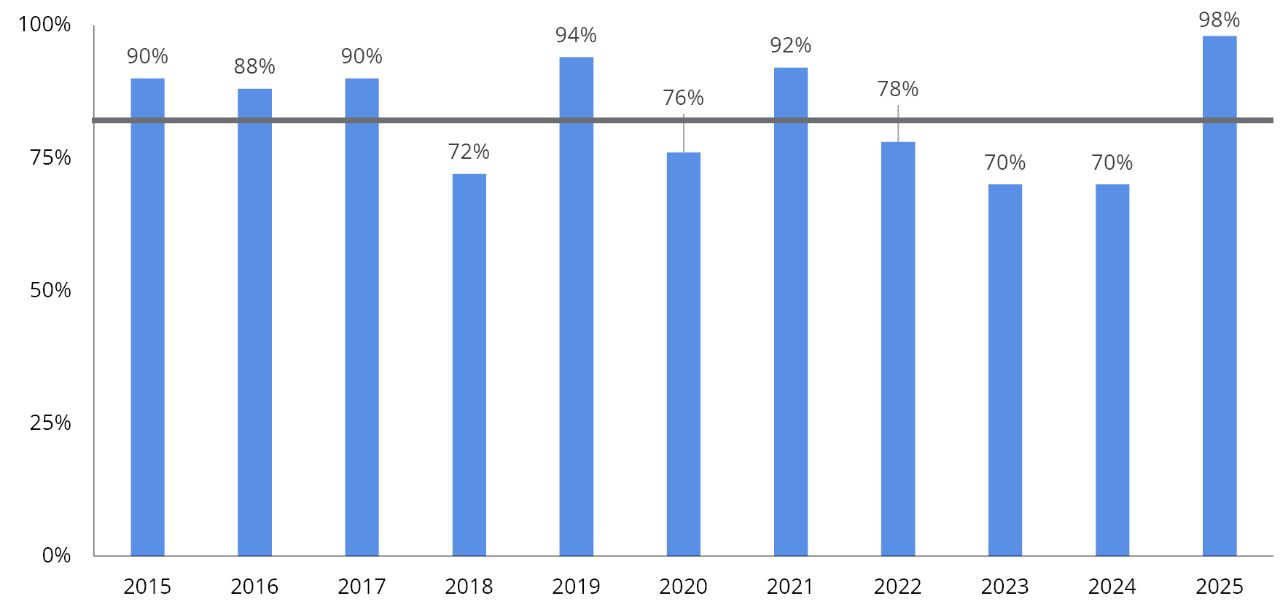

One way to measure the relative value of stocks vs. bonds is with the earnings yield, which measures the S&P 500 Index’s most recent 12-month earnings divided by its current market price. The yield on the 10-year US Treasury recently surpassed the S&P 500 Index’s earnings yield (FIGURE 1). This may indicate that bonds are currently a better value than stocks.