Representative Indices for Figure 4:

Australia is represented by the S&P/ASX 200 Index, which tracks the performance of the 200 largest companies on the Australian Securities Exchange, serving as Australia’s leading stock-market indicator.

Canada is represented by the S&P/TSX Composite Index, which is Canada’s main benchmark, tracking roughly 250 of the largest companies on the Toronto Stock Exchange to reflect the broader Canadian economy.

China is represented by the MSCI China Index, which captures the performance of large and mid-cap Chinese companies—including mainland and overseas listings—covering about 85% of the total investable Chinese market.

France is represented by the CAC 40 Index, which represents the 40 largest and most actively traded companies on Euronext Paris, serving as the flagship French stock market indicator

Germany is represented by the DAX Index, which tracks the performance of the 40 largest and most liquid German companies listed on the Frankfurt Stock Exchange.

India is represented by the Sensex Index, which is a benchmark of 30 of the most valuable and actively traded stocks on the Bombay Stock Exchange, representing India’s economy.

Japan is represented by the MSCI Japan Index, which tracks the performance of large and mid-sized publicly traded Japanese companies, representing about 85% of Japanese stock market value

Korea is represented by the KOSPI Index, which measures the performance of all common shares listed on the Korea Exchange, weighted by their market values.

Switzerland is represented by the Swiss Market Index, which reflects how the 20 largest and most actively traded Swiss companies perform on the SIX Swiss Exchange.

Taiwan is represented by the Taiwan Taiex Index, which measures the price movement of all (non-preferred) stocks listed on the Taiwan Stock Exchange, weighted by their market value.

UK is represented by the MSCI UK Index, which measures the performance of large and mid-sized publicly traded UK companies, covering roughly 85% of the country’s stock market.

US is represented by the S&P 500 Index.

1 Diversification does not ensure a profit or protect against a loss in a declining market.

2 S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

3 Correlation is a statistical measure of how two investments move in relation to each other. A correlation of 1.0 indicates the investments have historically moved in the same direction; a correlation of -1.0 means the investments have historically moved in opposite directions; and a correlation of 0 indicates no historical relationship in the movement of the investments.

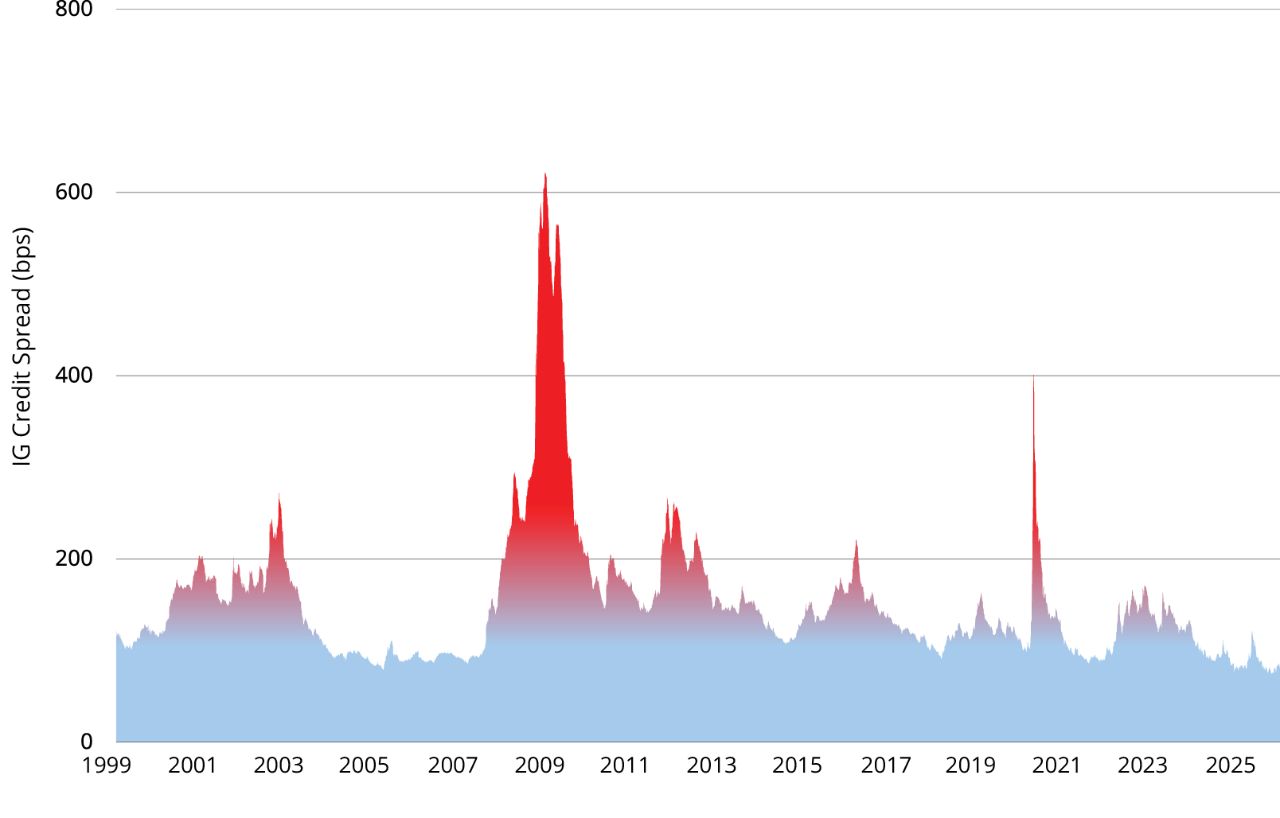

4 Spreads are the difference in yields between two fixed-income securities with the same maturity but originating from different investment sectors.

5 A basis point is a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security.

6 Alpha measures an investment’s excess return relative to a benchmark index.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets or in a particular geographic region or country. • Small- and mid-cap securities can have greater risks and volatility than large-cap securities. Focusing on one or more sectors may increase volatility and risk of loss if adverse developments occur.

The views expressed herein are those of Schroders Investment Management, are for informational purposes only, and are subject to change based on prevailing market, economic, and other conditions. The views expressed may not reflect the opinions of Hartford Funds or any other sub-adviser to our funds. They should not be construed as research or investment advice nor should they be considered an offer or solicitation to buy or sell any security. This information is current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Schroders Investment Management or Hartford Funds.