It was only a few months ago that markets were all humming the same tune about US exceptionalism. The speed and magnitude of the change we’ve seen since has been stunning, with the MSCI World ex USA Index1 outperforming the MSCI USA Index2 by 15.95% year-to-date through April 28.3

After years of US equity-market dominance, some investors are understandably skeptical about the ability of international equities to outperform over a longer time frame. But I see five reasons that make me believe they can top the charts for at least the next 12 months.

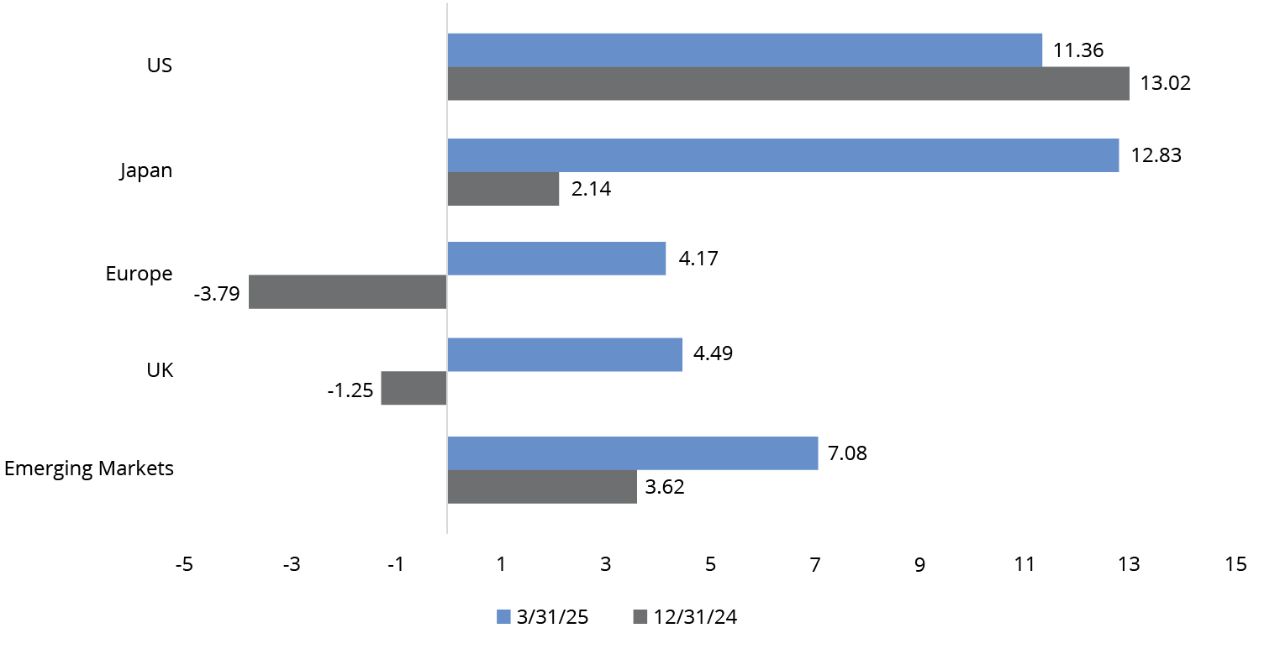

1. The fundamental outlook is weakening for the US relative to other developed markets — Economic growth and earnings forecasts have been revised down for the US and up for developed markets ex-US (FIGURE 1). This is primarily due to US tariffs, which are widely viewed as a tax on consumers and businesses that will slow consumption and investment. Furthermore, the US is expected to bear the brunt of tariff retaliation, while other countries may offset some of the effects by establishing new trading relationships.

FIGURE 1

The Earnings Outlook Has Declined in the US but Improved Elsewhere

12-Month Forward Earnings-Per-Share Growth (%)

Chart data based on daily data as of 12/31/24 and 3/31/25. Earnings-per-share growth measures how much profit a company makes per share of common stock and includes the projected growth rate in earnings per share for the next five years. Representative indices used: MSCI USA Index, MSCI Japan Index, MSCI Europe Index, MSCI United Kingdom Index, and MSCI Emerging Markets Index. Please see below for index definitions. Indices are unmanaged and not available for direct investment. Data Sources: Wellington Management and Refinitiv.

We’ve seen signs of a US tariff strategy that starts big and bold, then walks back the extreme aspects as negotiations move toward a compromise.

2. The overhang of uncertainty deserves a risk premium4 — While the state of politics remains fluid, we’ve seen signs of a US tariff strategy that starts big and bold, then walks back the extreme aspects as negotiations move toward a compromise. Markets have been an influence, especially yield spikes on the 10-year US Treasury. However, I think political uncertainty will remain a characteristic of US markets and could translate into a larger equity risk premium.

3. Fiscal stimulus is shifting — While US government spending is challenged by rising debt and deficits, Germany’s plan to make a massive €1 trillion investment in military and infrastructure has catapulted Europe into a more favorable fundamental light. I view this as a watershed moment for Germany and the broader European Union as they finally respond to the challenges they face in terms of growth, regulation, and consumption.

4. US dollar strength may be challenged — The strength of the US dollar has been a significant headwind for international-equity investors in recent years. Today, the US dollar’s primacy among reserve currencies faces several threats, including the US fiscal deficit, growth and inflation headwinds, and capital flows. I think we could see continued weakening of the dollar, which may provide an additional layer of return for investors looking outside the US.

5. Tech sector expectations are more mixed — The outlook for megacap US tech stocks is central to the rotation theme toward international equities—and it’s now much more mixed than it was a year ago. This shift is driven by concerns about these companies’ capital expenditure plans, rising competition, regulatory issues, and the more cyclical nature of some areas of their businesses. Still, at around 30% of the S&P 500 Index’s5 market cap, these companies continue to drive index returns.6

I haven’t yet mentioned valuations in my case for international equities because that argument has rung hollow in recent years, as “attractive” international-equity valuations have failed to translate into “attractive” returns. That said, as of April 28, 12-month forward price-to-earnings ratios7 for European and Japanese equities were 14.1x and 13.4x, respectively, vs. the 20.3x multiple of US equities.8 I believe there may be enough catalysts for some valuation convergence between US and international equities.

Investment Implications

- Consider seeking diversification in international equities — I think it’s time to consider diversifying portfolios that have a home bias toward US equities. US equities are facing numerous headwinds relative to international equities, including growth and inflation challenges, fiscal issues, currency fluctuations, policy changes, and concerns about megacap tech stocks, which could be catalysts to narrow the valuation gap. Diversification does not ensure a profit or protect against a loss in a declining market.

- US multinational companies may not be an optimal way to get international exposure — While US multinationals have international revenue exposure, they still generate more than 60% of their revenue in the US on average. Furthermore, I’m concerned that US brands may face headwinds from non-US consumers, governments, or institutional investors in the form of retaliation or simple preferences for non-US companies.

- Implementation is key — It’s critical to consider US exposure in investment benchmarks. For example, the MSCI World Index,9 a common benchmark for international funds, has around 70% exposure to the US.10 Therefore, benchmark-oriented active strategies may be underweight the US but still have significant US exposure. It may be better to choose a strategy with a benchmark that’s purely international, such as the MSCI EAFE Index11 or the MSCI World ex USA Index.

Talk to your financial professional about how to position your portfolio amid a changing economic landscape.

1 MSCI World ex USA Index is a free float-adjusted market capitalization index that captures large and mid-cap representation across developed markets countries excluding the United States. MSCI performance is shown net of dividend withholding tax.

2 The MSCI USA Index is a free float-adjusted market capitalization index that is designed to measure the performance of the large and mid-cap segments of the US market.

3 Sources: MSCI and Refinitiv. As of 4/28/25, the MSCI World ex USA Index returned 10.14%, while the MSCI USA Index returned -5.81%.

4 Risk premium is the investment return an asset is expected to yield in excess of the risk-free rate of return.

5 S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

6 Source: S&P Global.

7 The price-to-earnings ratio measures a company’s share price relative to its earnings-per-share and helps assess the relative value of a company’s stock.

8 Sources: Wellington Management, Refinitiv and IBES. Indices used: MSCI USA Index, MSCI Japan Index, and MSCI Europe Index.

9 MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

10 Source: MSCI, as of 3/31/25.

11 MSCI EAFE Index is a free float-adjusted capitalization index that is designed to measure developed market equity performance and excludes the US and Canada.

MSCI Emerging Markets Index captures large and mid-cap representation across 25 emerging-market countries, covering approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Europe Index is a free-float adjusted market-capitalization-weighted index designed to measure the equity market performance of the developed markets in Europe.

MSCI Japan Index is a free-float adjusted market-capitalization index designed to measure large- and mid-cap Japanese equity market performance.

MSCI United Kingdom Index is designed to measure the performance of the large and mid-cap segments of the UK market. It covers approximately 85% of the free float-adjusted market capitalization in the UK.

Important Risks: Investing involves risk, including the possible loss of principal. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets or if focused in a particular geographic region or country. • Small- and mid-cap securities can have greater risks and volatility than large-cap securities. • Investments focused in specific sectors may be subject to increased volatility and risk of loss if adverse developments occur. • Different investment styles may go in and out of favor, which may cause underperformance versus the broader stock market.

The views expressed here are those of the authors and Wellington Management’s Investment Strategy team. They are based on available information and are subject to change without notice. This information should not be considered as investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specific investment objectives, tax and financial condition of any specific person. Portfolio positioning is at the discretion of the individual portfolio management teams; individual portfolio management teams and different fund sub-advisers may hold different views and may make different investment decisions for different clients or portfolios. This material and/or its contents are current as of the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management or Hartford Funds.