Our Multi-Asset Views

| Asset Class | View | Change |

| Global equities | Moderately OW | — |

| DM government bonds | Neutral | — |

| Credit spreads | Moderately OW | — |

| Commodities | Neutral | — |

| Cash | Moderately UW | — |

| Within Asset Classes | ||

| Global Equities | ||

| US | Moderately UW | |

| Europe | Neutral | — |

| Asian DMs | Moderately OW | |

| EMs | Neutral | — |

| DM Government Bonds | ||

| US government | Neutral | — |

| Eurozone government | Moderately UW | |

| UK government | Moderately OW | |

| Japan government | Moderately UW | |

| Credit Spreads | ||

| Global investment-grade credit | Neutral | — |

| Global high yield | Moderately OW | — |

| EM debt | Neutral | — |

OW = overweight, UW = underweight

Views have a 6–12-month horizon and are those of the authors and Wellington’s Investment Strategy Team. Views are as of 6/30/25, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may make different investment decisions for different clients. This is not to be construed as investment advice or a recommendation to buy or sell any specific security.

Against this backdrop, we have a slightly pro-risk stance on equities and credit, assuming a base case of slower growth and sticky inflation. Our caution stems primarily from policy uncertainty, which is weighing on economic activity, but also from the less-discussed impact of immigration restrictions that have shrunk the labor force, a reversal relative to the past few years. We see better value in regional plays in equities and credit and are particularly focused on these relative opportunities. With a nod to the TV series Severance, we’re on the lookout for markets with “innies and outies”—that is, disconnects between the economy and markets.

For example, recent narrow gains in US equities, on the back of better-than-expected mega-cap tech earnings, have returned valuations to “priced for perfection” levels. As a result, we have an underweight view on the US relative to other regions where we expect the valuation gap to narrow. While Europe has enjoyed the best performance among developed markets (DM) year-to-date, we think it may be Japan’s turn to rise, with substantial fiscal stimulus already enacted and more good news on corporate governance. We’re also more open to the potential for EM equities to outperform the US, driven partly by improvements in China. Technology innovation and investments in green industries are shifting China’s growth engine away from real estate, while fiscal stimulus appears to be boosting consumer spending.

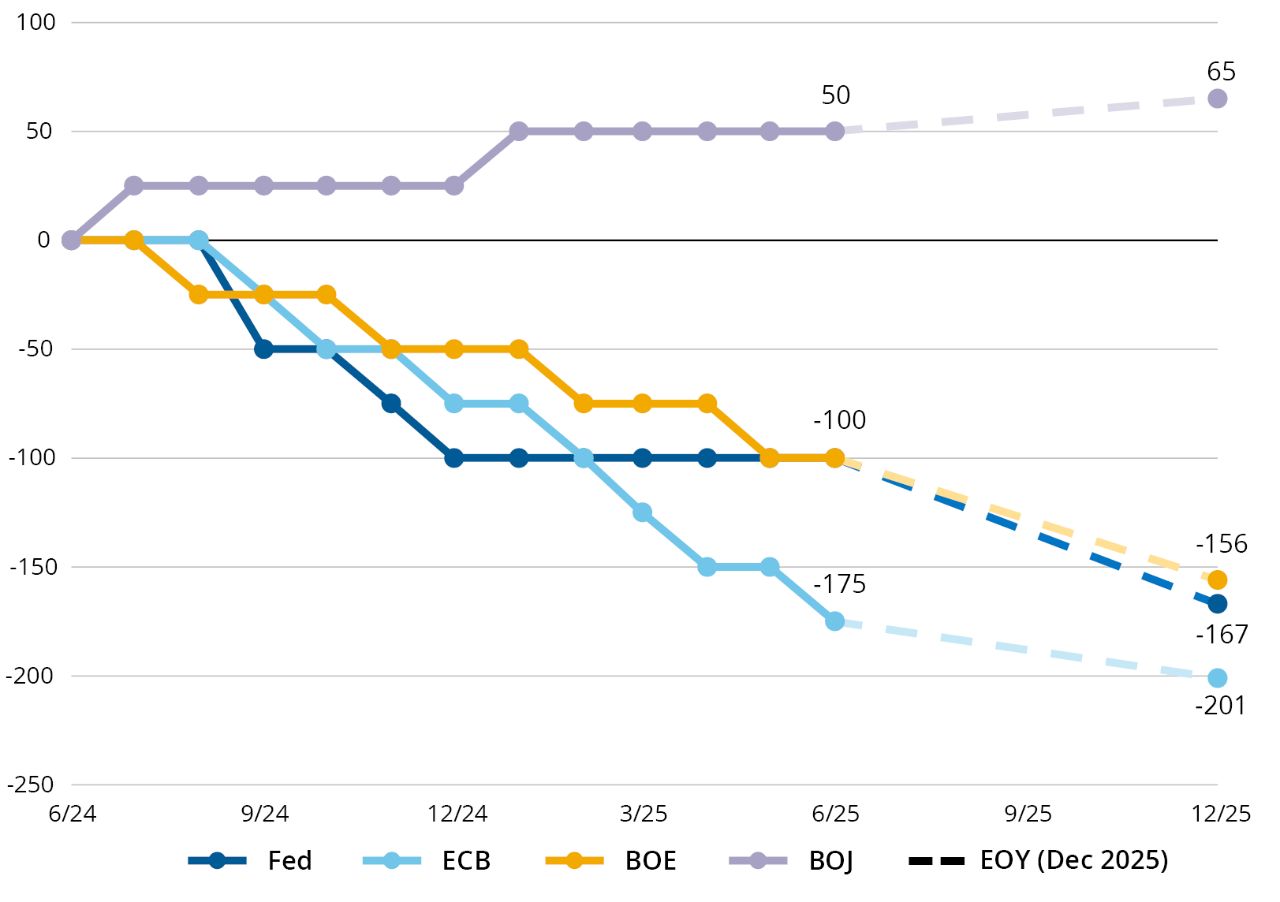

Turning to government bonds, we’re most interested in the disparate stances of central banks, as each region’s domestic economy is being affected differently by tariffs. We think the market is overly bearish on the UK’s fiscal situation, and favor duration there relative to Europe, where the European Central Bank (ECB) has already delivered 175 basis points (bps)6 of rate cuts over the past year, yet markets expect even more. We prefer a short-duration stance in Japan, where we think the Bank of Japan (BOJ) will finally deliver rate hikes in response to higher inflation, even as more fiscal stimulus could add to inflationary pressure. Despite tight spreads, we maintain our overweight view on high yield, which is supported by continued low default rates, higher-quality names, and limited supply.

Equities: It’s All Relative

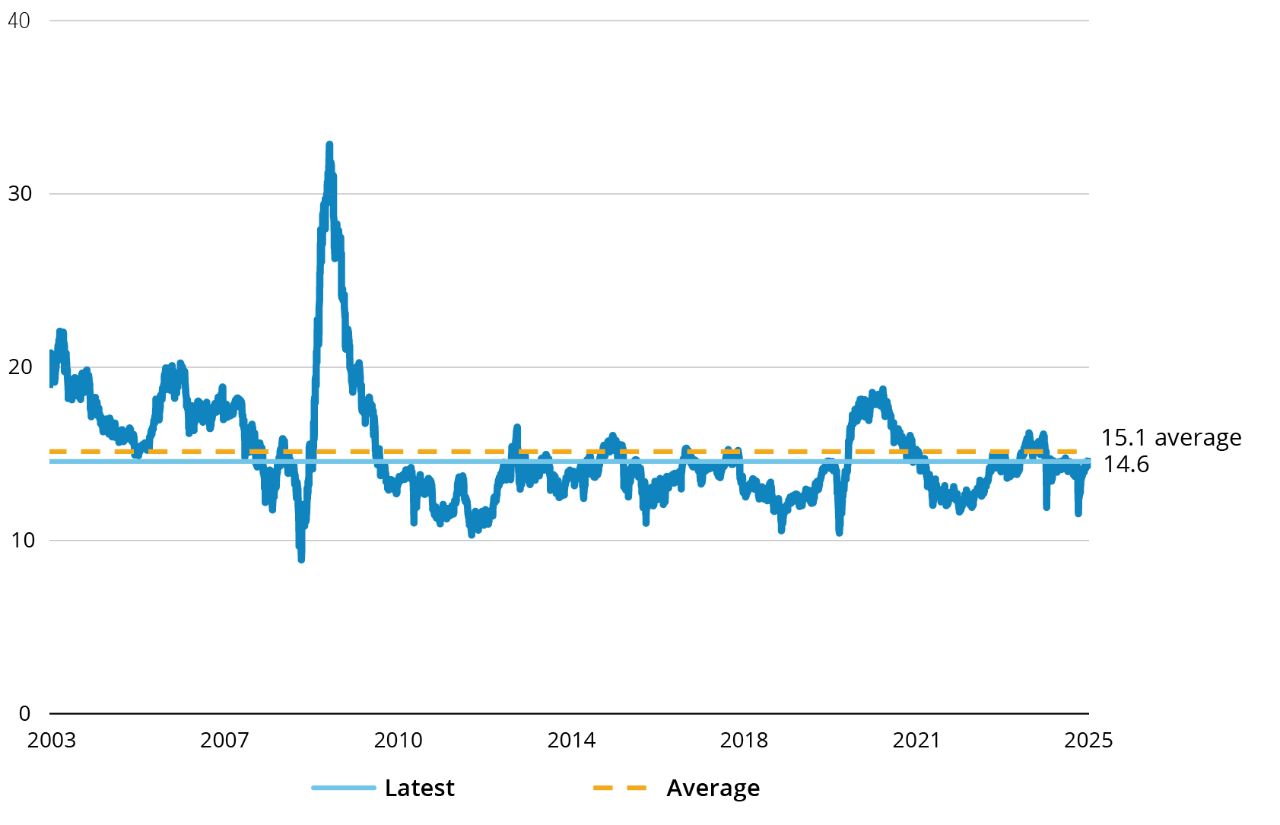

We retain our slight overweight view on global equities. We still expect positive earnings growth across all major regions and believe downward earnings revisions may have bottomed out, but we’re cautious on valuations. The current tight equity risk premium suggests excessive optimism, in our view, and implies that tail risks are underpriced. While there are reasons for optimism, as noted earlier, the market seems to assume that tariffs and other policies will avoid causing any economic damage, and it’s incorporating little geopolitical risk premium.

We maintain an overweight view on Japan relative to the US, thanks in part to the valuation gap between the two. Governance reforms in Japan are gaining momentum, boosting both return on equity (ROE) and corporate balance sheets. Japan has historically lagged in ROE compared to global peers, but this is changing and strengthening the argument for higher price-to-earnings multiples (FIGURE 1). Along with Europe, Japan has one of the highest levels of cash return to shareholders, through both dividends and buybacks. Policy—and specifically the potential for yen strength—could be a headwind, however, preventing us from taking a larger overweight stance against the US.