In the late 19th century, economist and philosopher Vilfredo Pareto observed that 80% of Italy’s land belonged to just 20% of its population. Then he realized 80% of its healthy pea pods came from 20% of its pea plants. Obsessed with this ratio, he investigated industries and found that the principle stuck: Generally, 80% of output is generated by 20% of input.

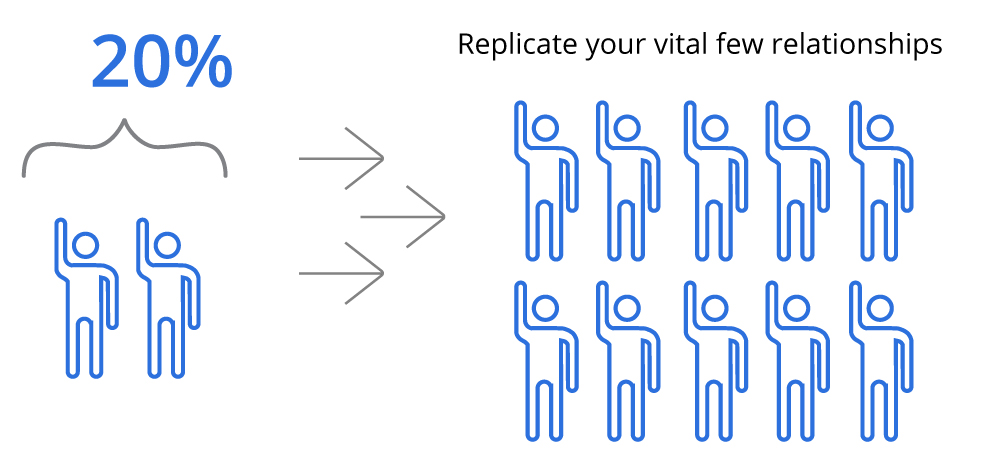

In your practice, 80% of your revenue likely comes from 20% of your clients. In other words, a vital few of your clients drive a disproportionate amount of your business. Let’s discuss how you can use the Pareto Principle to retain and replicate top clients.

First, Apply the 80/20 Ratio to Your Practice

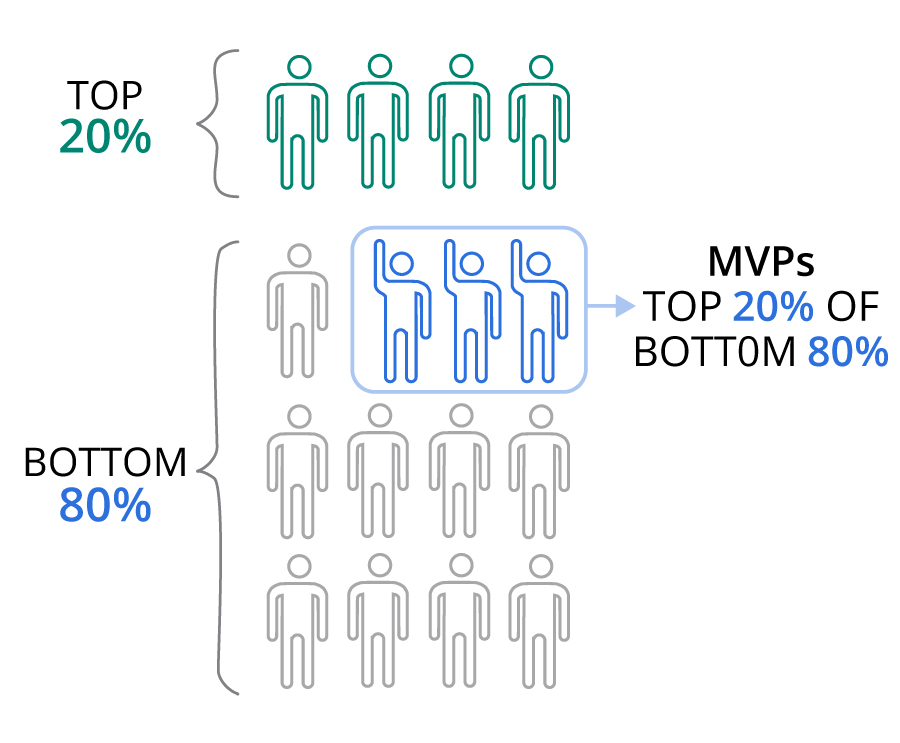

While many financial professionals are aware of this ratio, most haven’t applied it to their practices. Use your firm’s internal tools, filters, or even Excel to sort your households according to assets, from highest to lowest. Working your way down, determine how many clients account for the top 80% of your revenue.

Next, subtract that number from your total number of clients to see how many account for the remaining 20% of your revenue.

Does the 80/20 rule hold true in the context of your practice?

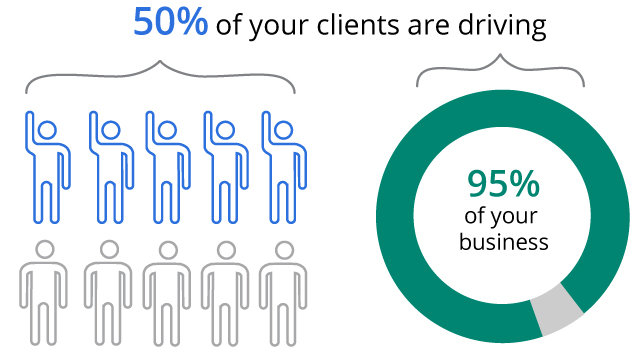

If you already applied the 80/20 rule to your practice, you may not have gone to the second iteration—the 95/5 Rule.

If you apply the 95/5 rule, you’ll likely notice that the top 50% of your clients account for 95% of your revenue, while the bottom 50% of your clients account for 5% of your revenue. Furthermore, your top one to three relationships will likely account for the top 5% of your overall revenue.

Did you notice a pattern? Regardless of the ratios you use, your top clients are driving most of your revenue. That’s good to know, but what should we do about it? We’ll discuss that next.