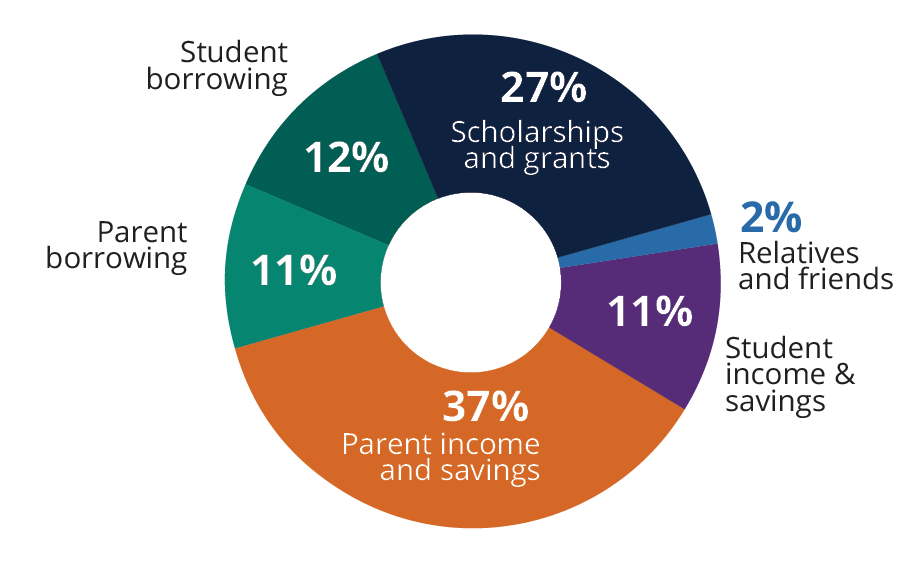

| 1 | The whole hog? – Saving for college is a huge undertaking, but your goal doesn’t have to be covering the entire bill. Parental income and savings paid for the largest portion of costs for the 2023-24 academic year, but that only accounted for 37% of total costs.1 The rest was filled out by gifts, scholarships and grants, and loans (FIGURE 1). |

| 2 | More than one way to save – There are additional strategies that can help reduce borrowing costs. For example, making use of a 529 savings account, earning college credits through AP classes in high school, completing general-education classes at a local community college, and taking advantage of federal student aid through the Free Application for Federal Student Aid (FAFSA). |

| 3 | Not all aid is created equal – There are four main types of financial aid: grants, scholarships, work-study programs, and loans. Grants and scholarships are essentially free money that doesn’t have to be repaid. Grants are need-based, and students are automatically considered when they submit their FAFSA. Scholarships are merit-based, and students have to apply for them on an individual basis. Federal work-study programs are need-based, part-time employment opportunities awarded through the FAFSA. |

| 4 | Late bloomers – Even with a later start, a 529 is still a valuable college savings tool—any amount squirreled away is money that doesn’t have to be borrowed and can still take advantage of compound interest. Investment returns aren’t guaranteed, and you could lose money by investing in a 529 plan. |

| 5 | Now and later – Saving for college and retirement doesn’t have to be an either-or situation, but retirement should be a priority. Ideally, families will strike a balance that works for them, but while there are quite a few options to fund education, borrowing for retirement isn’t an option. Sacrificing saving for later years could be detrimental to your future quality of life. |

| 6 | With a little help from my friends – Relatives and friends contributed an average of $662 toward tuition in 2023-24.1 While helpful, a similar contribution to a 529 plan when a child is young could grow to substantially more through compounding. Many 529 accounts even provide a gifting link that can easily be shared. |

| 7 | Wiggle room – Today’s 529 savings accounts are more flexible than ever. Qualified tuition expenses include not only colleges and universities, but also two-year colleges, trade and vocational schools, apprenticeship programs,2 and private or religious K-12 programs.3 |

| 8 | A full 180 – If your student has a change of heart and decides to forego higher-ed altogether, 529 account holders aren’t completely out of luck. 529 plans never “expire,” beneficiaries can be changed, and funds can be rolled over to relatives of the beneficiary or saved for future grandchildren. |

| 9 | Are we there yet? – Once a student heads off to school, there are still benefits to contributing to a 529 account. Tucking away a little extra money to help pay for those years of school allows savers to take advantage of potential short-term growth, and withdrawals to cover qualified education costs are still tax-free.4 |

| 10 | Game of loans – For borrowers, repayment won’t begin until six months after graduation or after dropping below half-time enrollment; funds in a 529 plan can be used to repay up to $10,000 of qualified student loans.5 To help further whittle away at their balance, grads may want to consider making additional payments, setting up automatic payments, or refinancing. In addition, most federal-loan providers offer income-driven repayment plans, some employers offer student-loan assistance benefits, and loan-forgiveness programs may apply to certain occupations. |

FIGURE 1

How a Typical Family Pays for College

Sources: Sallie Mae and The College Board, 2024.

Talk to your financial professional for more strategies to help your family save for college.

1 Sallie Mae, “How America Pays for College,” 2024.

2 529 plans can be used for apprenticeship programs registered and certified with the Secretary of Labor under the National Apprenticeship Act.

3 If using a 529 plan for K–12, it can only be used for tuition up to $10,000 per year.

4 Non-qualified withdrawals are taxable as ordinary income to the extent of earnings and may also be subject to a 10% federal income-tax penalty. Such withdrawals may have state income-tax implications.

5 Can be used for student-loan repayment for a maximum lifetime limit of up to $10,000.

State tax treatment may vary from federal tax treatment when using withdrawals from a 529 account for K-12 tuition, apprenticeship costs, or student loan repayment. Consult with a qualified tax or legal professional to learn more.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice.