As a young professional, you’re faced with conflicting financial priorities. Retirement is farthest away, so it’s tempting to delay saving for it until you feel more established. However, this goes against a main tenet of investing: Time in the market matters more than how much you invest.

Consider this: Growing your retirement nest egg isn’t unlike growing a veggie garden. You plant small seeds and in a few months have healthy plants and produce. If you plant them late, you can’t just make up that lost time with extra water—they need time to mature.

Time Is (Literally) Money

The power of compounding—a concept Albert Einstein once dubbed “the eighth wonder of the world”1—has a similar effect on your investments. Compound interest can help grow money faster because it’s the interest earned on your initial principal and any previously accumulated gains and interest. That’s why starting early, even with a smaller initial amount, can be far more beneficial than investing more later in life.

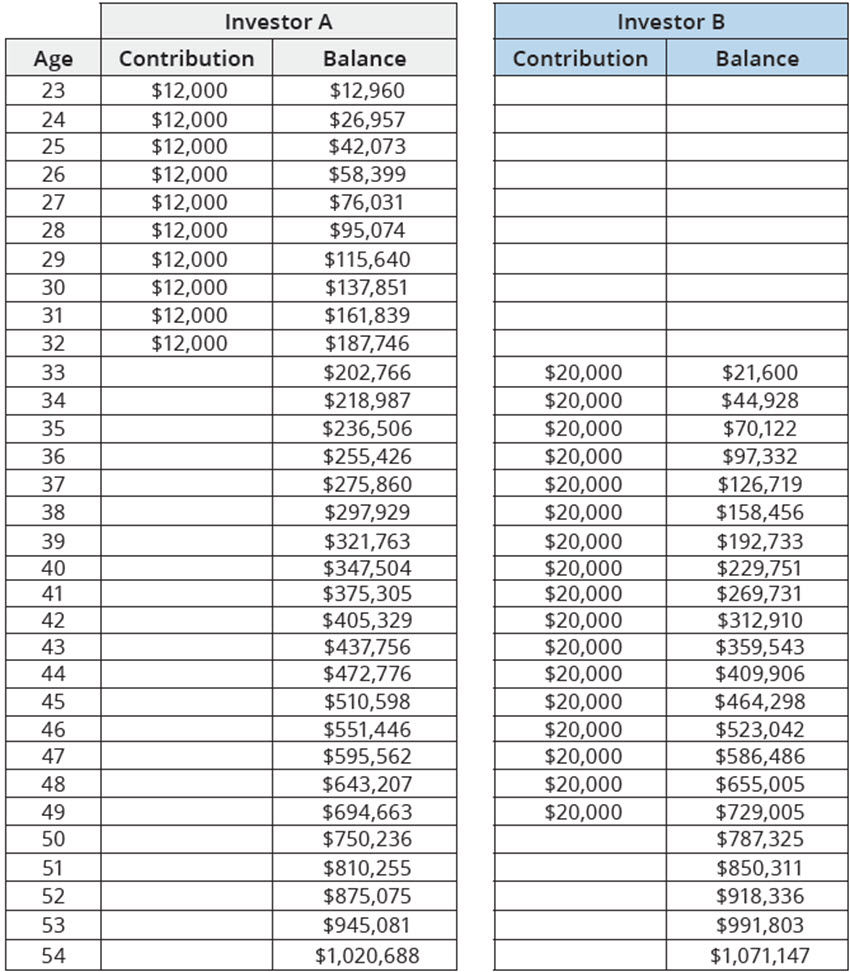

For example, as the left side of FIGURE 1 on page 2 shows, a 23-year-old professional (Investor A) who starts by consistently investing $12,000 for 10 consecutive years, then allows the accumulated balance to earn interest for each of the following 22 years without making any additional contributions, could be a millionaire by age 54. This hypothetical example assumes an annual return of 8%.

By contrast, the right side of FIGURE 1 shows a 33-year-old professional (Investor B) who also wants to become a millionaire by age 54 but must play catch-up by socking away $20,000 a year for 17 years. This investor would grow wealth significantly, too, but would have to invest about 3x the principal of the early starter ($340,000 vs. $120,000).