As kids, we dream about eating an ice-cream-only diet forever. But as we mature, we understand the importance of a balanced diet. Flavor matters, but we learn to focus on the benefits food can provide to help enhance our overall health.

This benefit-focused mindset is also helpful for investors: Is my portfolio using the right ingredients to support my financial health?

If we think of a portfolio as a balanced meal, stocks (aka equities) generally act as the protein helping to grow your portfolio. But what about fats, which can help regulate your body, and carbohydrates, which provide energy? That’s where bonds (aka fixed income) can fill many important roles.

What Sets Fixed-Income Types Apart

While all fixed-income investments share some basic traits, they’re an investment type with many different flavors from which to choose. With so much variety, specific characteristics and roles can vary widely.

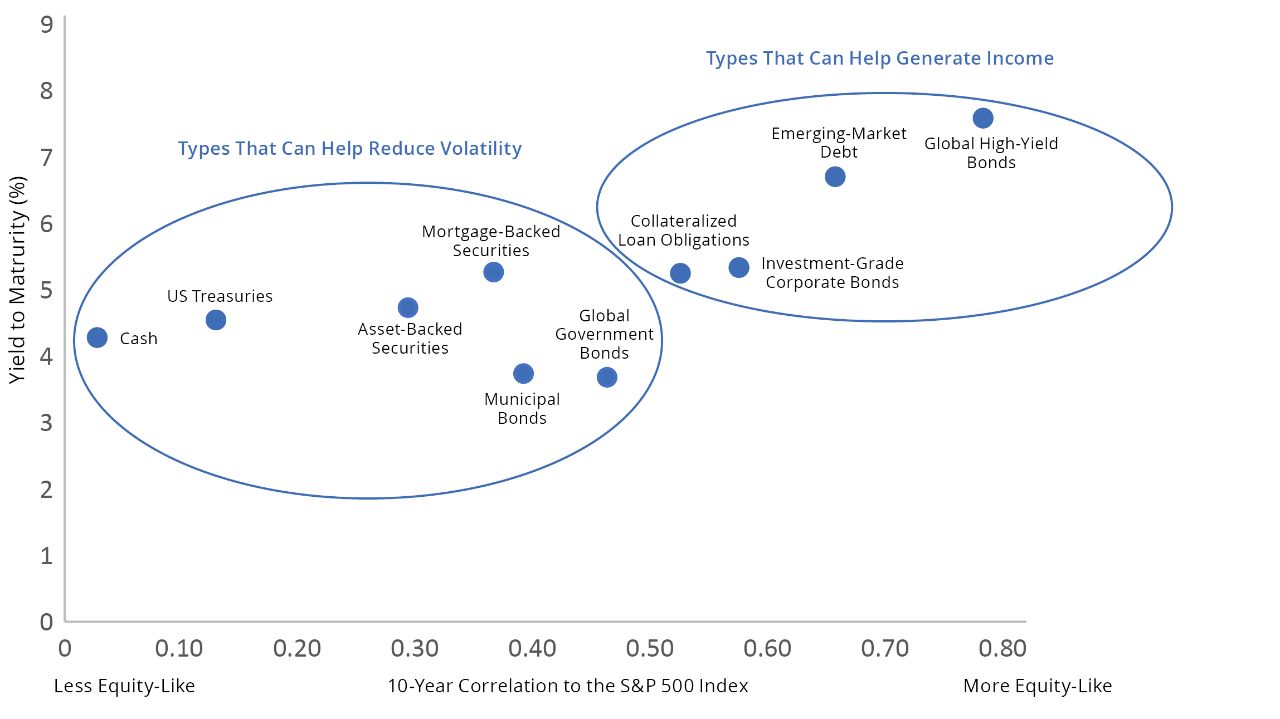

As we see it, there are two broad ways fixed income can serve investors. These include the potential to either reduce portfolio volatility (think fats) or generate income (think carbohydrates).

Potential Volatility Reducers (aka Fats)

Though dietary fats have gotten a bad rap, they’re necessary to support cell growth, help protect your organs, regulate your body temperature, and even absorb some nutrients.

In investing, you may need a cushion from equity-driven volatility. That’s a role that can be filled by high-quality bonds such as US Treasuries, municipal bonds, mortgage-backed securities, and global-government bonds.

These types of fixed income tend to behave differently than equities, which is why they can potentially offset volatility and add diversification to your portfolio. However, these types of fixed income have historically offered lower yields than equities.