By diversifying your investments across bond sectors, you may reduce risk in your portfolio and potentially enhance your returns as markets change.

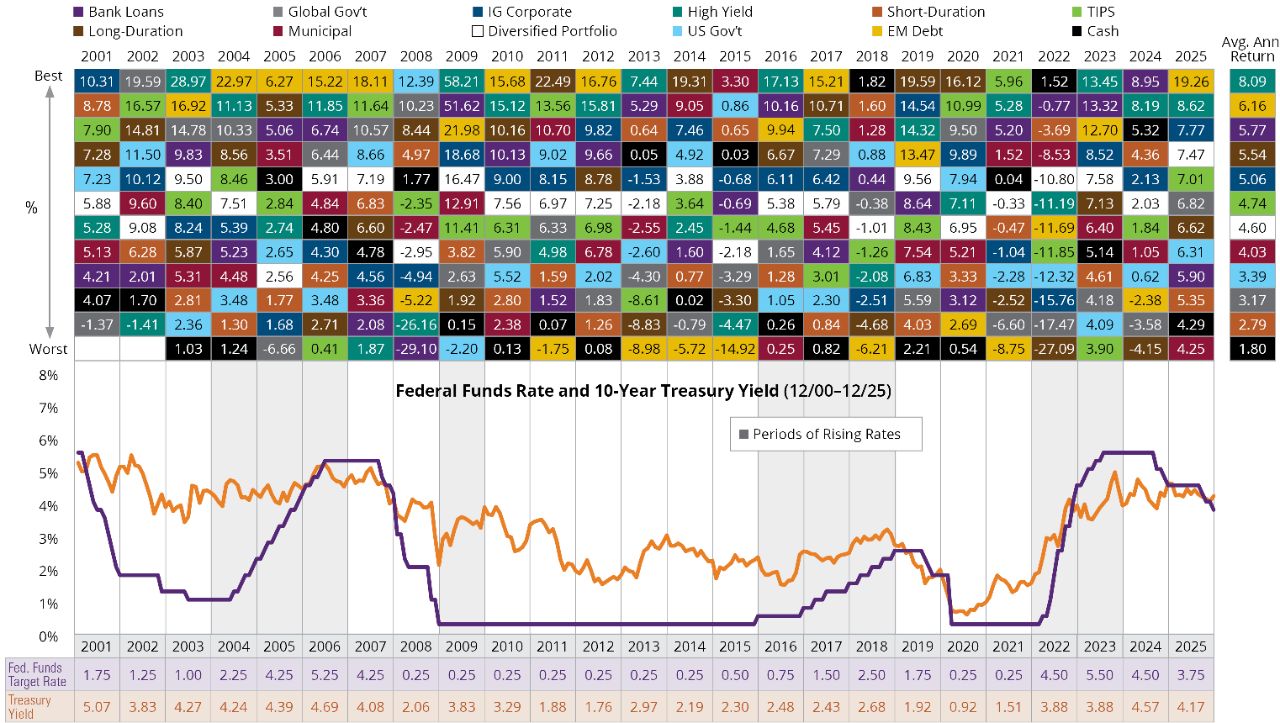

Annual Returns of Fixed-Income Asset Classes Represented by Indices (as of 12/31/25)

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment, and do not represent the performance of any Hartford Fund. See below for representative index definitions. Data Sources: Morningstar and FactSet, 1/26.

Talk to your financial professional today about managing risk in your fixed-income portfolio.

High Yield Bonds are represented by the Bloomberg Corporate High Yield Index, which covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

Short-Duration Bonds are represented by the Bloomberg 1-3 Year Gov’t/Credit Index, which is comprised of the US Gov’t/Credit component of the US Aggregate Bond Index.

Municipal Bonds are represented by the Bloomberg Municipal Index, which is considered representative of the broad market for investment grade, tax-exempt bonds with a maturity of at least one year.

Long-Duration Bonds are represented by the Bloomberg US Long Gov’t/Credit Bond Index, which measures the non-securitized component of the US Aggregate Bond Index with 10 or more years to maturity. The index includes investment grade, US dollar-denominated, fixed-rate treasuries, government-related, and corporate securities.

Investment Grade Corporate Bonds are represented by the Bloomberg US Corporate Bond Index, which measures the investment-grade, fixed-rate, taxable corporate bond market. The index includes US dollar-denominated securities that are publicly issued by industrial, utility, and financial issuers.

US Government Bonds are represented by the Bloomberg US Government Bond Index, which is comprised of the US Treasury and US Agency Indices. The Index includes US dollar-denominated, fixed-rate, nominal US Treasuries, and US agency debentures TIPS (Treasury Inflation Protected Securities) are represented by the Bloomberg US TIPS Index, which consists of Treasury inflation-protected securities issued by the US Treasury with a remaining maturity of one year or more.

Global Government Bonds are represented by the FTSE World Government Bond Index, a market-capitalization-weighted index consisting of government bond markets that have a remaining maturity of at least one year.

Bank Loans are represented the Morningstar LSTA Leveraged Loan Index, which is a market-value-weighted index that is designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads, and interest payments.

Cash Investments are represented by the Bloomberg 1-3 Month US Treasury Bill Index tracks the market for treasury bills with 1 to 2.9999 months to maturity issued by the US government.

EM Debt is represented by the JP Morgan GBI Emerging Markets Global Diversified Index, which is a comprehensive global, local emerging-markets index, and consists of liquid, fixed-rate, domestic-currency government bonds.

Diversified Portfolio is represented by an equal portion (10% each from 2000-2002, 9.1% each from 2003-2025) of the previously listed indices.

Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall. • Municipal securities may be adversely impacted by state/local, political, economic, or market conditions. Investors may be subject to the federal alternative minimum tax as well as state and local income taxes. Capital gains, if any, are taxable. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. U.S. Treasury securities are backed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. Diversification does not ensure a profit or protect against a loss in a declining market.