| 1 | Budget for longevity – Life expectancies have increased dramatically thanks to advancements in healthcare. Consider budgeting based on a life expectancy of 90—or longer if longevity runs in your family. Include essential and discretionary spending, and factor in inflation. |

| 2 | Know your income sources – Retirement income isn’t one-size-fits-all. Identify all income sources, including Social Security, pensions, 401(k)s, IRAs, annuities, and part-time work. Then determine when each income source will begin, and estimate monthly payouts to build a clear retirement income plan that helps reduce the risk of outliving your money. |

| 3 | Plan for healthcare costs – A 65-year-old retiring in 2025 could expect to spend an average of $172,500 in healthcare and medical expenses throughout retirement.1 In addition to Medicare, consider the potential benefits of supplemental insurance, long-term care insurance, and a Health Savings Account. |

| 4 | Minimize and manage debt – Debt can drain your retirement savings. Create a payoff plan for high-interest debt before retiring. If you have a mortgage, evaluate whether downsizing or refinancing makes sense. |

| 5 | Plan for required minimum distributions (RMDs) – Starting at age 73, the IRS requires withdrawals from most retirement accounts, and not planning for this can lead to significant tax penalties. Work with a financial professional to develop a tax-efficient withdrawal strategy and consider Roth conversions if they align with your overall plan. |

| 6 | Shift from saving to spending – After decades of saving, spending can feel uncomfortable. But retirement is what you’ve been saving for! Use a withdrawal strategy such as the 4% rule or a dynamic model that adjusts based on market returns to draw down your accounts efficiently. Track your spending and adjust as needed to stay within your plan. |

| 7 | Keep your legal documents updated – Your will, power of attorney, healthcare proxy, and beneficiary designations aren’t “set it and forget it.” Review them every 3–5 years or after major life changes. Keeping them up to date ensures your wishes are honored and your loved ones are protected. |

| 8 | Consider changes to your home – Your home should support your retirement lifestyle. Explore downsizing, relocating, or modifying your space for accessibility. A smaller, more manageable home can reduce costs and improve quality of life. |

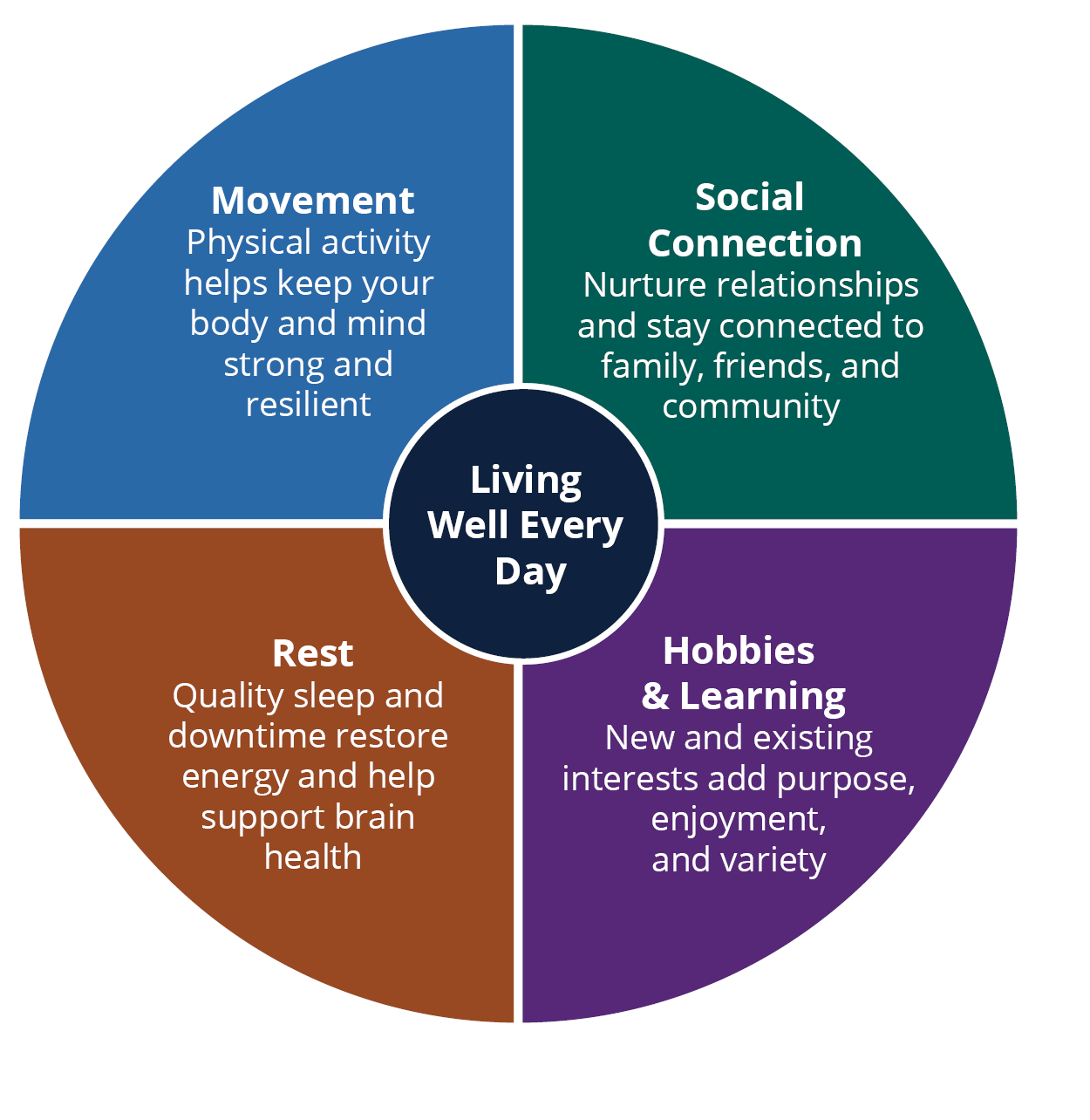

| 9 | Develop a daily routine – Retirement isn’t just a financial shift; it’s a lifestyle change. Create a daily schedule that incorporates four key dimensions: movement, social interaction, hobbies, and rest (FIGURE 1). A structured routine supports both mental and physical health, helping you stay engaged and balanced. |

| 10 | Life beyond work – Leaving the workforce can feel like losing part of your identity. Reframe retirement as a new chapter. Explore roles such as a mentor, volunteer, creator, or traveler. Find purpose in passions and community—it’s key to a fulfilling retirement. |

FIGURE 1

Four Dimensions of a Satisfying Retirement

Contact a financial professional to discuss how to achieve your financial goals.

1 Source: Fidelity Investments 2025 Retiree Health Care Cost Estimate, 7/30/25.

All information provided is for informational and educational purposes only and is not intended to provide investment, tax, accounting or legal advice. As with all matters of an investment, tax, or legal nature, you and your clients should consult with a qualified tax or legal professional regarding your or your client’s specific legal or tax situation, as applicable. The preceding is not intended to be a recommendation or advice. Tax laws and regulations are complex and subject to change.

This information does not take into account the specific investment objectives, tax and financial condition of any specific person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice.

This material is provided for educational purposes only.