Each time a lottery jackpot skyrockets, ticket sales spike. Even those who aren’t regular lottery players don’t want to be left wondering if they’ve missed their big chance.

Investing, on the other hand, is less trivial. When it’s your retirement on the line, you may question whether it’s the right time to be in the market. When stocks are up, you may wonder how long the good times can last. When stocks are down, you may wonder if the bear market will ever end.

However, it’s impossible to know whether the market is entering a bear or bull market until after the fact. That’s why, historically, investors have generally been better served by simply being invested rather than waiting for a “better” time to invest.

Seeing the Forest for the Trees

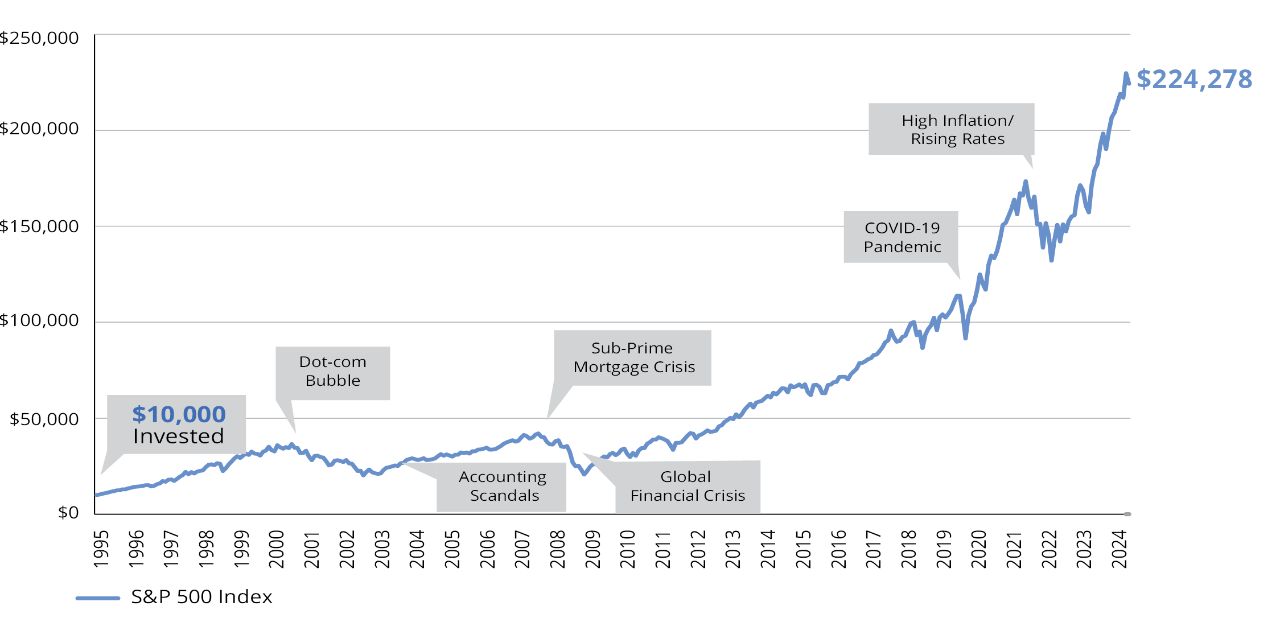

We looked at the most recent bear markets in the S&P 500 Index (defined as a 20% drop from the most recent market peak). Since 1995, the market has experienced six of them.

As FIGURE 1 shows, even if you had the worst possible timing—meaning you invested $10,000 on each of the six peak days immediately before a bear market began—your investments would have lost value initially. However, they would have recovered in time and ultimately gone on to grow your initial investment. Your hypothetical principal of $60,000 would have grown to $309,445 as of December 31, 2024.

In other words, even if you managed to invest at the worst-possible times, the amount you invested still would have more than quadrupled in time. While past performance doesn’t guarantee future results, eventually, the market has rebounded from its previous selloffs.

In short, for long-term investors who have the time horizon to weather ups and downs, the length of time you’re in the market matters far more than the point in time at which you begin investing.