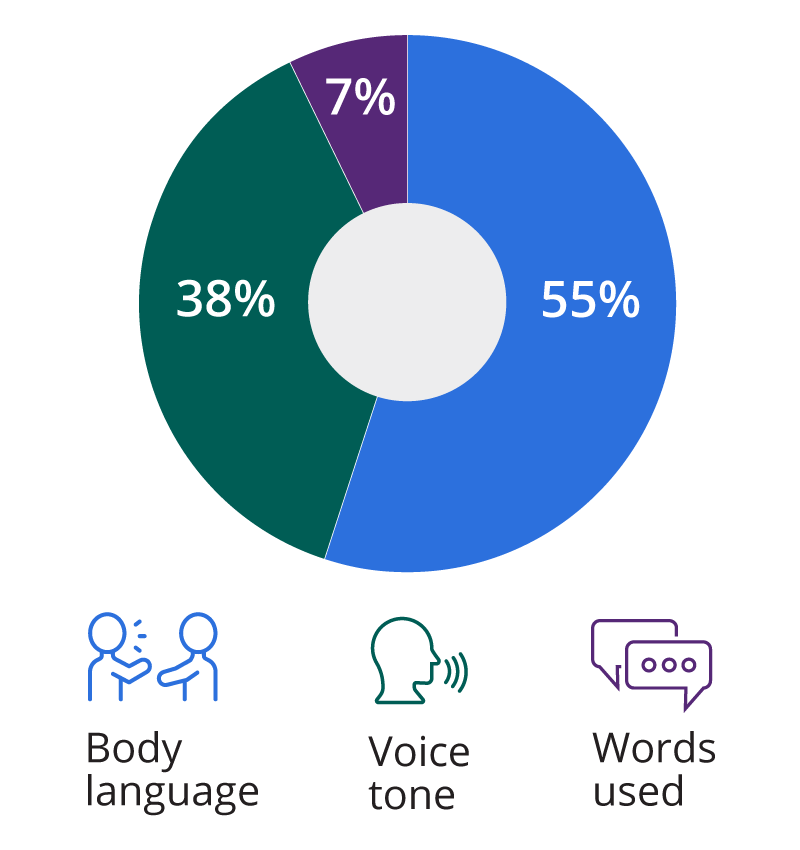

How Communication Is Likely To Be Interpreted If Visual, Vocal, And Verbal Cues Don’t Match

You can provide excellent guidance about how clients should think long term during a crisis, but if your body language, words, and voice tone aren’t in sync, clients may assume you’re not fully confident in the advice you’re providing.

Source: How to Practice Active Listening, Duke Today, 6/18/19

The Great Recession. Brexit. Politics. A pandemic. Inflation. There are always reasons for clients to be concerned. In challenging times, there is one thing we can be fairly certain of: It won’t be our last challenging time. How can you communicate in a way that shows your confidence and conviction that things will ultimately be okay?

At times like this, successful financial professionals speak to their clients more frequently—to reassure them, to help them keep a long-term perspective, and to help dissuade them from making any regrettable investment decisions. But as the adage goes, “It’s not just what you say—it’s how you say it.” You may have truly great insights that provide clients perspective and encourage patience, but here’s the challenge: If you aren’t able to deliver that information with confidence, clients might not be convinced enough to heed your recommendations.

First, It’s Not Just What You Say—It’s How You Say It

Perhaps you’ve heard the rule of thumb that “93% of all communication is nonverbal.” While that’s an oversimplification of the research from which the statistic’s derived, it’s still useful to understand the basic premise.1 Here’s the gist: Sometimes when we communicate with another person, we send mixed messages. For example, imagine that you’re mad about something. If someone were to ask what’s wrong and you said, “Nothing,” but you did so with an angry tone, crossed arms, and clenched teeth, you’d be sending a mixed message.

So how can someone tell which part of a mixed message is accurate? When it seems the messages we send through our body language, tone of voice, and word selection don’t match, one type is perceived as being most accurate.1

As the chart on the page shows, it’s our body language. That’s followed by our tone of voice; then, the actual words we use.

Let’s apply this to our current situation. Imagine you said to a client, “I’m confident this recommendation is your best option.” If you nervously tap your fingers on the desk and your voice wavers while you utter this, it’s very possible your clients may assume you’re not fully confident in the advice you’re providing—or worse, that you’re not being truthful.

So our goal should be to communicate with congruence—that is, our words, tone of voice and body language should all send the same message. How can we ensure that’s the case? By being more aware and intentional about the messages we’re sending.

Second, Tips for Communicating With Confidence

At times like this, financial professionals and clients alike can feel anxious or upset. But many clients count on their financial professionals to comfort them and guide them through challenging times with poise. In these situations, it’s not enough that our messages are merely congruent—they also need to be confident.

In each of the sections below, the column on the left shows things that could reflect a lack of confidence on your part—which could affect your clients’ confidence in you. The column on the right shows tips that can help you project more confidence. These tips can be used to communicate confidently at any time, though they are especially helpful during challenging situations.

There are many tips listed but don’t be overwhelmed. Pick a few things from the charts that you think might be the best opportunity for refinement and start there. You can always revisit this piece once you’ve practiced those to decide where to focus next.