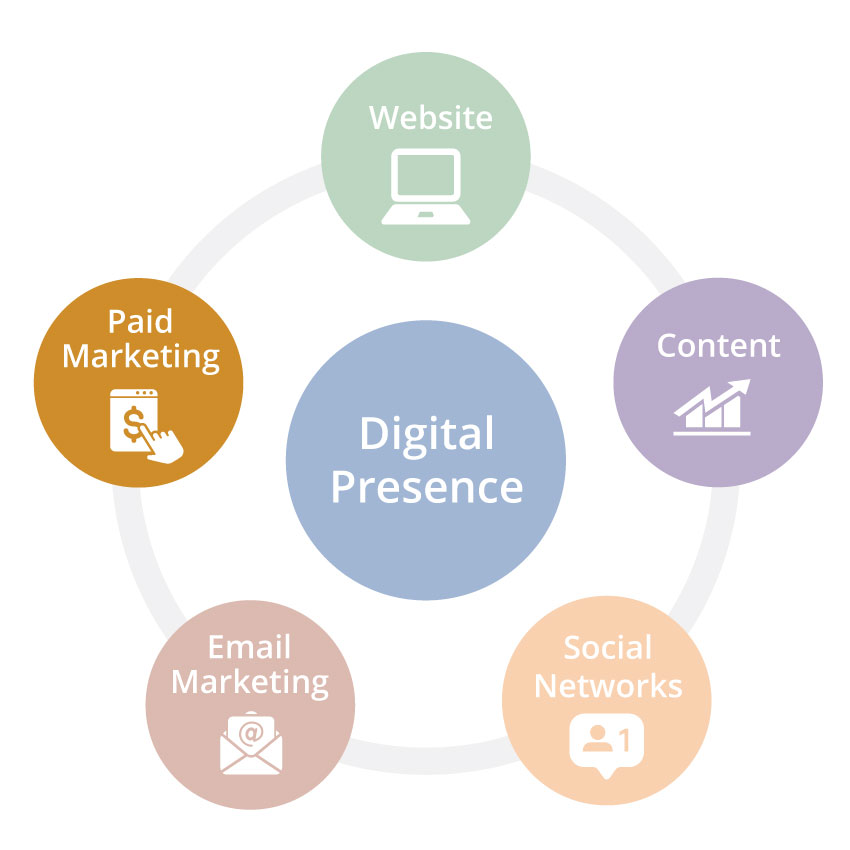

In this workbook, we’ll discuss the basics of “Paid Marketing.” It can help you reach more prospects with your digital presence.

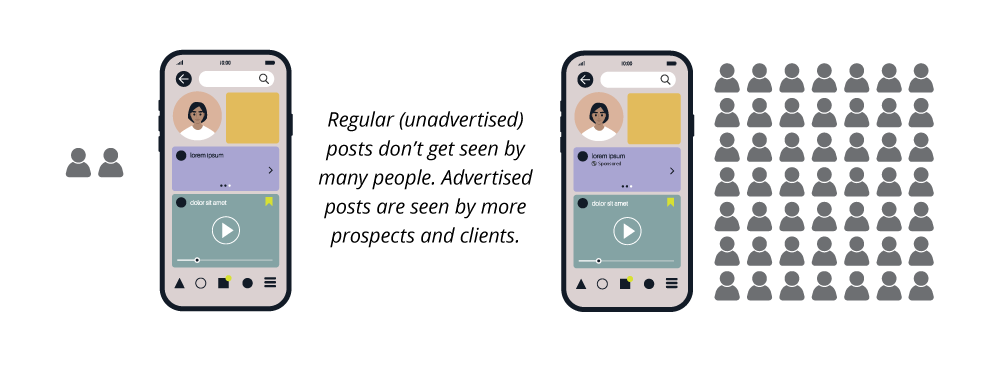

For many, the goal of having a digital presence is to attract and engage website visitors with useful, relevant content and then convert those visitors into prospects and clients. However, to attract and engage visitors, they must see your content. We could have great web content and post it consistently on social media and yet very few of the people we’re trying to reach will ever see it.

Why?

Because of the way social media algorithms work, advertised social media posts are prioritized over non-advertised posts. Advertised posts are more likely to appear prominently in users’ news feeds, which increases visibility.

The average view percentage of a non-advertised post is only 5.2%. That means roughly one in every 19 of your social media followers sees your non-advertised post. Plus, advertising a post can boost its visibility beyond your existing followers.

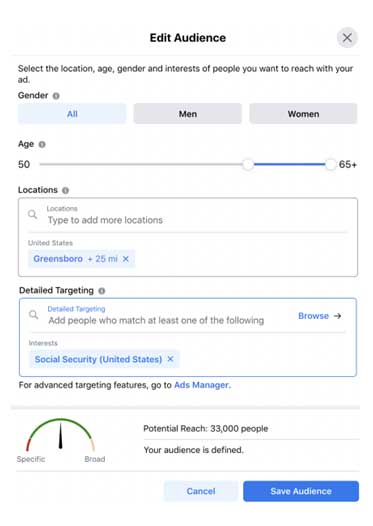

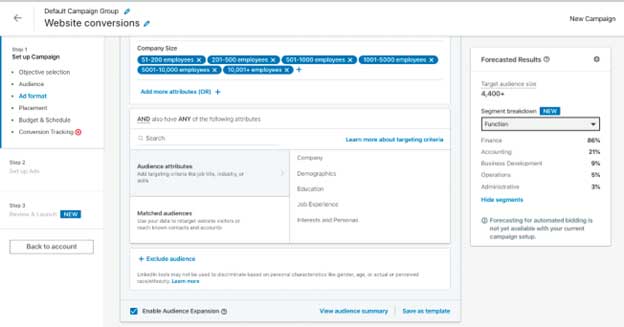

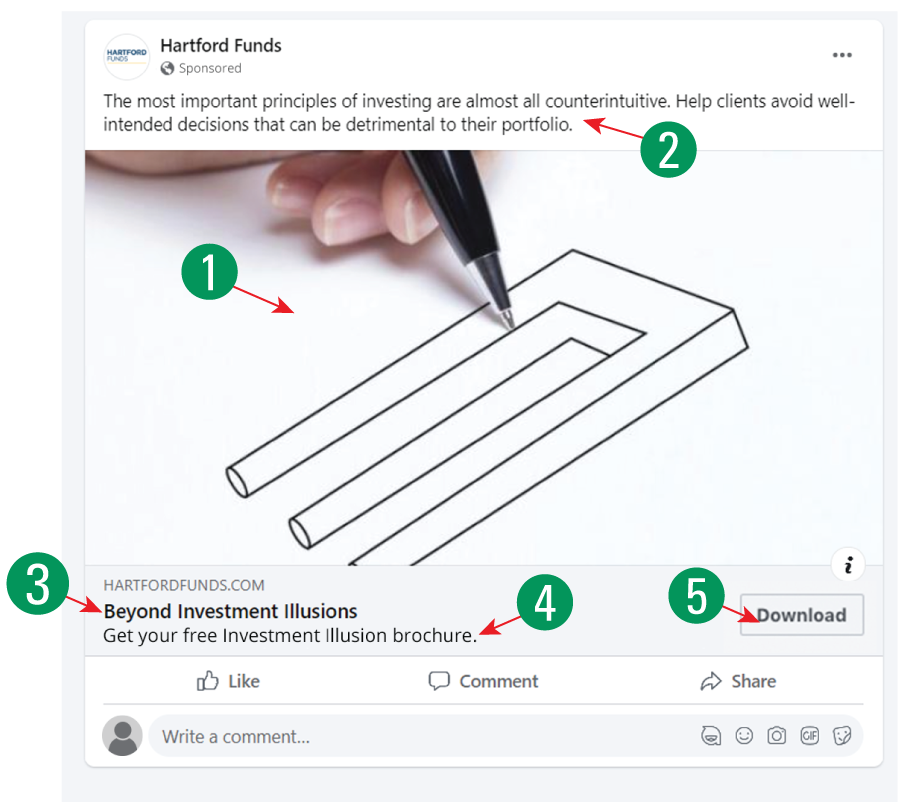

“Reach” is the number of views something gets on digital networks, such as Facebook, LinkedIn, or Google. The higher the reach, the more people see it, and the greater your chances of reaching prospects and turning them into clients. This workbook will teach you ways to get more reach.