A growing number of families—59%—say they have a plan to pay for the full cost of college before a student enrolls, and 44% say they make the final decision about how to pay for college together.1 Has your family had this conversation?

Parental Expectations

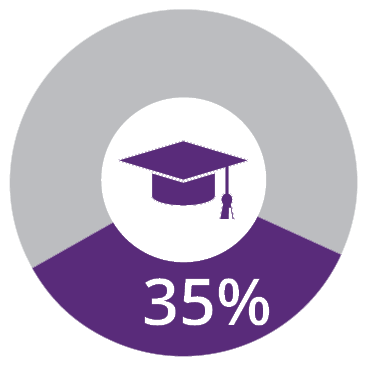

Most parents view minimizing college costs as a priority, with 74% helping to pay for their child’s education.1 On average, parents aim to save $55,342 to help cover these costs.2 In addition to the average parental savings, most expect the cost of college to be a burden shared between parents and student.

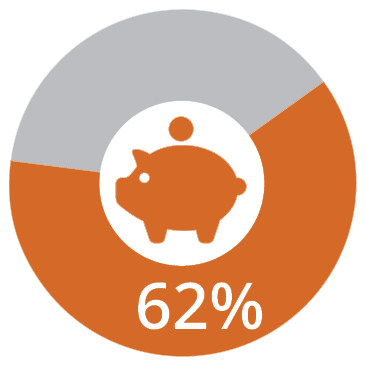

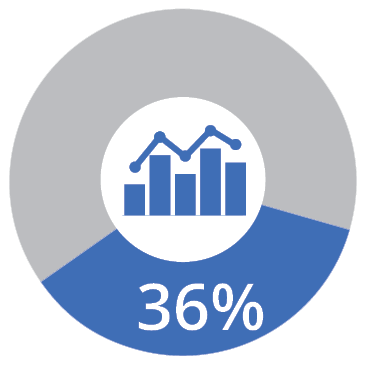

On average, parents contributed roughly 37% of the total college education costs in the 2023-24 school year.1 The remainder is funded through a combination of student income, scholarships, grants, federal student aid, loans, and gifts from family. Even though many families are saving for college, 62% of families who borrow say that was always part of their plan.1

Relaying Expectations to Children

When it comes to paying for college, closing the parent-child communication gap is important. In order to make the overwhelming task more manageable, it’s best to create a plan and be transparent with your child about that plan so you can work together.

The first step, which should be ongoing throughout your child’s primary and high school education, is to consult with your financial professional.