Make Saving Automatic

It’s easy to prioritize today’s needs and wants over saving for the future. Life gets busy, and immediate gratification—or just keeping up with friends and influencers—can quickly derail your budget goals. That’s where automation comes in: By making saving automatic, you remove the need to make a conscious decision every month.

Start by setting up automatic transfers from your checking account to savings or investment accounts right after payday, so you’re saving before you spend. You can also automate contributions to different accounts for specific goals, or use apps that round up purchases and invest the spare change. Keep in mind that continuous or periodic investment plans don’t guarantee profits or protect against losses. Since these programs invest continuously regardless of price changes, you should carefully consider your financial ability to continue investing during periods of market fluctuation.

As your income grows (through raises, bonuses, or tax refunds), consider increasing your automated savings. Many apps and platforms make it easy to adjust your contribution amount, so you can scale your investments over time without extra effort.

Take Full Advantage of Employer Benefits

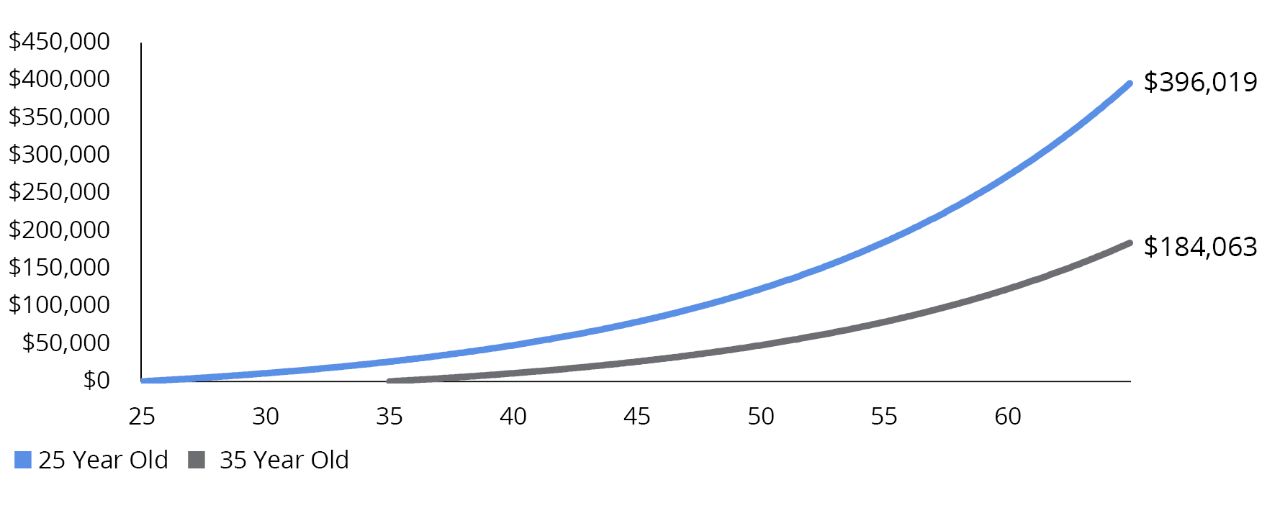

Employer-sponsored benefits can be a powerful tool for your financial future. If your employer offers a retirement plan with matching contributions, aim to contribute at least enough to get the full match—otherwise, you’re leaving part of your compensation on the table. As your paycheck increases, consider gradually increasing your contribution rate. A good long-term goal is to save around 17% of your income for retirement, a benchmark often associated with individuals who become millionaires through consistent investing in their 401(k).

Beyond retirement plans, many employers offer additional benefits such as stock purchase programs, health savings accounts (HSAs), and financial-wellness tools. These options are often overlooked, but they can add significant value and help you reach your financial goals faster. Take time to explore what’s available to you, and consider how each benefit can fit into your overall strategy.

Build Your Financial Knowledge

Understanding how money works is just as important as saving it. Building your financial knowledge helps you make informed decisions, avoid common mistakes, and feel more confident about your future.

There are plenty of beginner-friendly resources—books, podcasts, online courses, and financial blogs. Start with the basics: how investing works, the benefits of different types of accounts, and how to manage risk. Learning by doing (e.g., opening an account or trying a budgeting app) can be just as valuable as reading or listening.

Financial education is a lifelong process, and it’s normal to make mistakes along the way. The key is to stay curious, seek out reputable sources, and keep building your knowledge over time.

Get Started Now

Investing isn’t just about building wealth—it’s about creating more freedom and opportunity in your life. Making the decision to take action today may help put you in a better position in the future. You don’t need to be perfect or have all the answers; just get started, keep learning, and celebrate progress along the way.