Interest rates are important to people who put their money into savings accounts or rely on their investments for income. Twelve-month rates on certificates of deposit (CDs) were below 3% from 2008 to 2022, but have increased recently. When you factor in taxes and inflation, 12-month CDs have provided negative real returns in 15 out of the last 20 years.

Inflation and Taxes Have Had a Significantly Negative Effect on CD Returns

| Year | 12-Month CD Yield (%)1 |

Taxes (%)2 | Inflation (%) | Real Return After Taxes & Inflation (%) |

|---|---|---|---|---|

| 2006 | 4.91 | 25 | 2.52 | 1.16 |

| 2007 | 4.43 | 25 | 4.11 | -0.79 |

| 2008 | 2.65 | 25 | -0.02 | 2.01 |

| 2009 | 1.44 | 25 | 2.81 | -1.73 |

| 2010 | 0.96 | 25 | 1.44 | -0.72 |

| 2011 | 0.77 | 25 | 3.06 | -2.48 |

| 2012 | 0.69 | 25 | 1.76 | -1.24 |

| 2013 | 0.67 | 25 | 1.51 | -1.01 |

| 2014 | 0.70 | 25 | 0.65 | -0.13 |

| 2015 | 0.62 | 25 | 0.64 | -0.18 |

| 2016 | 0.59 | 25 | 2.05 | -1.61 |

| 2017 | 0.80 | 25 | 2.10 | -1.50 |

| 2018 | 1.29 | 22 | 1.92 | -0.91 |

| 2019 | 1.14 | 22 | 2.26 | -1.37 |

| 2020 | 0.39 | 22 | 1.28 | -0.98 |

| 2021 | 0.28 | 22 | 7.10 | -6.88 |

| 2022 | 2.35 | 22 | 6.42 | -4.59 |

| 2023 | 5.32 | 22 | 3.40 | 0.75 |

| 2024 | 4.42 | 22 | 2.90 | 0.55 |

| 2025 | 4.01 | 22 | 2.65 | 0.48 |

Past performance does not guarantee future results. Data Sources: Bloomberg, FactSet, and Hartford Funds, 1/26.

CDs are short-term investments that pay fixed principal and interest, are insured by the FDIC up to $250,000, and are subject to changing renewal rates and early withdrawal penalties. The chart uses the highest marginal federal income tax rate based on $100,000 of taxable income for a married couple filing jointly for each calendar year. The tax rate is not representative of the experience of every investor. A lower tax rate would have a favorable effect on the real return.

Are CDs the Right Choice for You?

Although there are benefits to investing in CDs, there are also risks. Because of the inherent safety and short-term nature of CDs, the interest rate is usually lower than investments with higher risk. In addition, CDs sold prior to maturity may be subject to early withdrawal penalties. Investors should also consider the impact of inflation on CD returns. CD income in the illustration below is calculated using the 12-month annualized average monthly CD rate.1

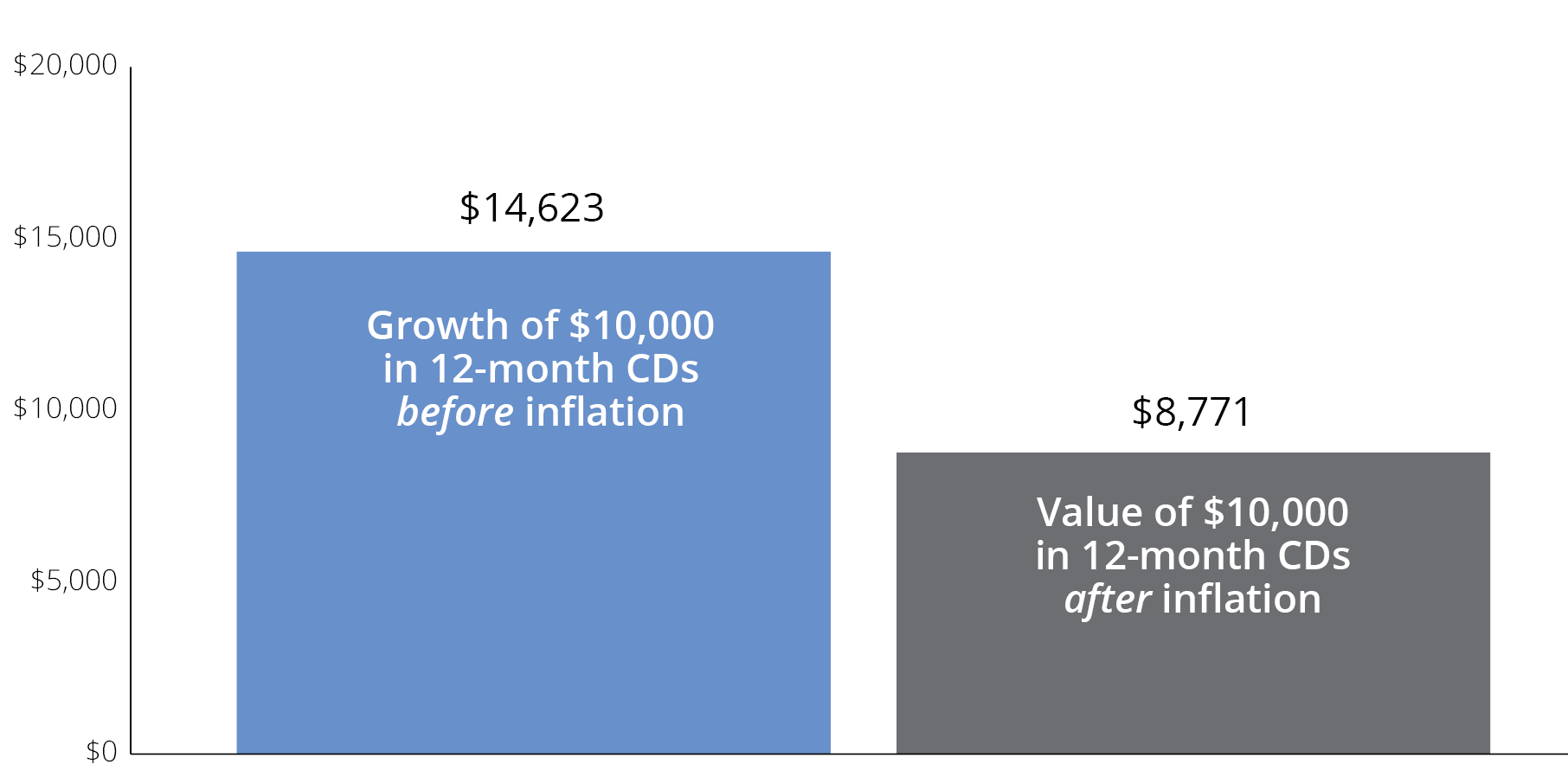

Inflation Eroded the Entire Return of CDs Over the Past 20 Years

This chart illustrates the growth of a hypothetical $10,000 investment in 12-month CDs before and after inflation from 2006–2025. Inflation, as measured by the Consumer Price Index (CPI), consumed the entire return of CDs over this period and caused investors to lose money.

The average annual return for 12-month CDs was 1.92%; the average annual return for inflation (as measured by the CPI, a measure of change in consumer prices as determined by the US Bureau of Labor Statistics) was 2.53%. Data Sources: Bloomberg, FactSet, and Hartford Funds, 1/26.

Talk to your financial professional today about investments with the potential to outpace taxes and inflation.

1 CD rates are proxied by Bankrate’s 12-month CD national average.

2 Tax Policy Center, 12/24.

Investing involves risk, including the possible loss of principal.