Fundamental Investing Throughout the Market Cycle

Hartford Dividend and Growth Fund seeks to generate a high level of current income consistent with growth of capital by identifying undervalued companies with increasing profitability.

A Foundational Approach

Invests in companies with four pillars: consistent cash flows, undervalued leaders, attractive valuations, and healthy dividends

Uncovering Opportunity

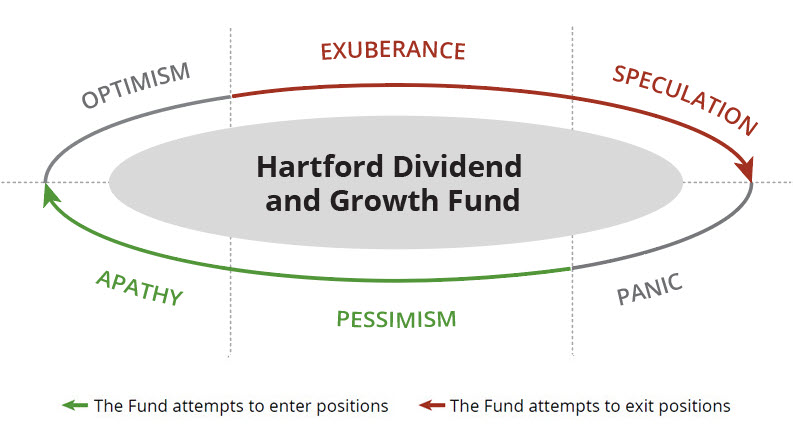

Uses capital-cycle analysis to help identify when to buy, sell, or hold companies

Sub-advised by Wellington

Wellington prioritizes independent thought and collaboration across all major asset classes

Objective: Seeks a high level of current income consistent with growth of capital.

The portfolio managers are supported by the full resources of Wellington.

Performance

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

SI = Since Inception.

Fund Inception: 07/22/1996

Share Class Inception: 8/31/06.

Class I-share performance prior to its inception date reflects Class A-share performance (excluding sales charges) and operating expenses. SI performance is calculated from 7/22/96.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Characteristics

| # of Holdings | 72 |

|---|---|

| % in Equities | 99 |

| % in Foreign Equities | 6 |

| Beta (3 year) | 0.76 |

| R Squared (3 year) | 0.73 |

| Standard Deviation | 10.32% |

| Turnover | 69% |

| Active Share | 75% |

| Dividend Frequency | Quarterly |

| FUND | S&P 500 Index | |

|---|---|---|

| Price/Earnings | 16.8x | 22.0x |

| Price/Book | 4.0x | 6.1x |

| EPS Growth Rate | 8.8% | 12.4% |

| Asset Weighted Market Cap (billions) | $577.6 | $1406.7 |

| Return on Equity | 28.4% | 40.2% |

| Median Market Cap (billions) | $105.3 | $39.7 |

| Alphabet, Inc. | 5.53 |

| Microsoft Corp. | 3.22 |

| Amazon.com, Inc. | 2.88 |

| Philip Morris International, Inc. | 2.88 |

| Cisco Systems, Inc. | 2.82 |

| Bank of America Corp. | 2.49 |

| Lockheed Martin Corp. | 2.38 |

| NXP Semiconductors NV | 2.32 |

| Merck & Co., Inc. | 2.15 |

| Unilever PLC | 2.15 |

| Total Portfolio % | 28.82 |

| 30-Day SEC Yield | 1.21 |

|

Unsubsidized 30-Day SEC Yield

|

1.21 |

| Less than $2 billion | 0 | |

| $2 billion - $5 billion | 0 | |

| $5 billion - $10 billion | 0 | |

| Greater than $10 billion | 100 | |

| Not Classified | 0 | |

|

Alpha (5 Year)

|

0.53 |

|

Down Capture (5 Year)

|

84.53 |

|

Information Ratio (5 Year)

|

-0.27 |

|

Sharpe Ratio (5 Year)

|

0.75 |

|

Up Capture (5 Year)

|

86.35 |

FUND |

BENCHMARK | UNDERWEIGHT / OVERWEIGHT | |||||

|---|---|---|---|---|---|---|---|

| 12/31/25 | 1/31/26 | 1/31/26 | -14 0 14 | ||||

| Financials | 19 | 18 | 13 | ||||

| Health Care | 14 | 13 | 9 | ||||

| Industrials | 12 | 13 | 9 | ||||

| Consumer Staples | 7 | 8 | 5 | ||||

| Energy | 6 | 6 | 3 | ||||

| Utilities | 4 | 4 | 2 | ||||

| Real Estate | 3 | 3 | 2 | ||||

| Materials | 2 | 3 | 2 | ||||

| Communication Services | 9 | 8 | 11 | ||||

| Consumer Discretionary | 6 | 7 | 10 | ||||

| Information Technology | 19 | 19 | 33 | ||||

| Distribution Date | Distribution NAV | ordinary income | short term capital gains | long term capital gains | total distribution |

|---|---|---|---|---|---|

| 12/29/2025 | 34.50 | $0.1451 | $0.0000 | $0.0000 | $0.1451 |

| 12/11/2025 | 34.53 | $0.0000 | $0.0000 | $3.9283 | $3.9283 |

| 9/26/2025 | 36.13 | $0.1045 | $0.0000 | $0.0000 | $0.1045 |

| 6/26/2025 | 34.38 | $0.1217 | $0.0000 | $0.0000 | $0.1217 |

| 3/27/2025 | 33.33 | $0.1315 | $0.0000 | $0.0000 | $0.1315 |

Insights

Resources